Image: in.pinterest.com

In the bustling world of finance, options trading stands out as a sophisticated tool that enables investors to navigate market uncertainty. At the heart of options trading lies a lexicon of Greek letters—the Option Greeks—that serve as essential measures for assessing risk and potential returns. Join us as we delve into the fascinating realm of Option Greeks, deciphering their significance and empowering you to make informed trading decisions.

Unveiling the Option Greeks:

Options, unlike stocks or bonds, offer a unique ability to control risk and tailor strategies to specific market scenarios. However, understanding the intricacies of options trading requires a firm grasp of the Option Greeks, which quantify different aspects of an option’s sensitivity to underlying factors such as price, volatility, and time. The most prominent Option Greeks include Delta, Gamma, Vega, Theta, and Rho.

1. Delta: The Price Sensitivity Coefficient

Delta measures an option’s sensitivity to changes in the underlying asset’s price. It represents the change in an option’s price for every $1 change in the underlying. A Delta close to 1 indicates that the option’s value moves almost in tandem with the underlying asset, while a Delta near 0 suggests a less responsive relationship.

2. Gamma: The Delta’s Sensitivity

Gamma quantifies the rate at which Delta changes with respect to the underlying’s price. A positive Gamma implies that the Delta becomes more responsive to price fluctuations as the option approaches expiration. On the other hand, a negative Gamma suggests the opposite, with the Delta becoming less responsive over time.

3. Vega: The Volatility Sensitivity Coefficient

Vega measures an option’s sensitivity to changes in implied volatility (IV), which gauges market expectations for future price swings. A high Vega indicates that the option’s value is highly sensitive to changes in IV, making it more speculative and potentially profitable in high-volatility environments.

4. Theta: The Time Decay Coefficient

Theta captures the decline in an option’s value as time passes. Since options have a finite lifespan, their value erodes gradually towards expiration. Theta becomes more influential as an option gets closer to its maturity date.

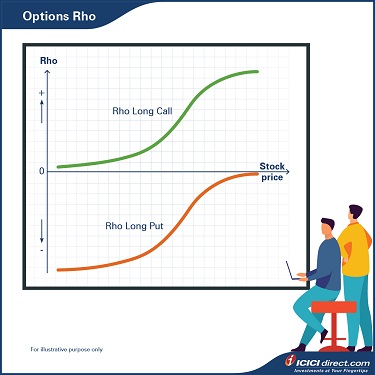

5. Rho: The Interest Rate Sensitivity Coefficient

Rho measures the sensitivity of an option’s value to changes in the prevailing interest rates. It indicates the change in the option’s price for every basis point (0.01%) shift in the risk-free interest rate. Rho is particularly relevant for long-term options and plays a key role in trading strategies that involve interest rate expectations.

Harnessing the Greek Advantage:

By understanding the intricacies of Option Greeks, traders can gain a deeper insight into option behavior, identify potential risks and rewards, and tailor their strategies accordingly. For instance, investors seeking to maximize their potential returns in a rising market might prefer options with high Deltas. Conversely, those aiming to hedge against potential downside might opt for options with negative Deltas.

Furthermore, Option Greeks allow traders to fine-tune their strategies based on prevailing market conditions. Gamma and Vega provide insights into the impact of implied volatility on option pricing, helping traders adjust their positions in anticipation of future volatility fluctuations. Theta and Rho enable investors to manage the effects of time decay and interest rate changes, ensuring their strategies are both timely and profitable.

Conclusion:

The realm of Option Greeks may initially seem complex, but their importance in options trading cannot be overstated. By decoding the alphabet of options, traders can unearth valuable insights that empower them to make informed decisions, navigate market uncertainties, and maximize their trading potential. Embrace the Option Greeks as you embark on your journey towards mastering the art of options trading.

Image: www.icicidirect.com

Option Trading Stocls Greeks

Image: www.investingcube.com