Image: purepowerpicks.com

In the ever-evolving realm of financial markets, the allure of options trading captivates investors with its potential for lucrative returns. Among the various option strategies, put options stand out as a versatile tool to hedge against market uncertainty and generate income. This comprehensive guide will delve into the intricacies of put options, unraveling their history, mechanisms, and strategic applications.

What are Put Options?

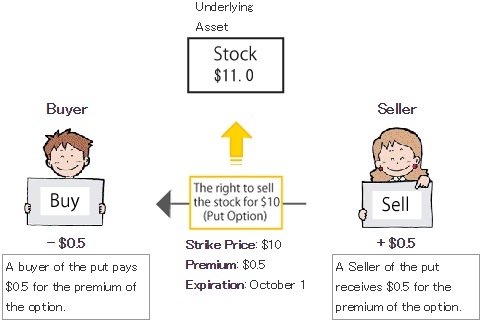

An option, in its simplest form, represents a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). A put option, specifically, conveys to the buyer the right to sell a certain quantity of an underlying asset at a fixed price, irrespective of the market’s direction.

Understanding Put Option Mechanics

At the core of put option trading lies the concept of time decay. With each passing day, the option’s value diminishes, a phenomenon primarily driven by the reduction in time to exercise the option. This decline in value is particularly pronounced for short-term options, making precise timing crucial for successful put option strategies.

When the underlying asset’s price falls below the strike price, the put option gains intrinsic value. Intrinsic value represents the profit an investor could realize by exercising the option to sell the asset at the strike price in the current market. If, on the other hand, the underlying asset’s price remains above the strike price at expiration, the put option expires worthless.

Applications of Put Options

Put options offer investors a diverse range of strategic possibilities. They can serve as a hedge against potential losses in an existing portfolio or as a standalone strategy to capitalize on market declines. Some prominent applications include:

-

Downside Protection: Investors can utilize put options to mitigate the risk of owning an asset in a declining market. By purchasing a put option with a strike price below the current asset price, they effectively create a ‘floor’ below which their potential losses are limited.

-

Income Generation: Put options can generate income through premium collection. By selling a put option with a strike price higher than the current asset price, the seller receives a premium from the buyer. If the asset price remains above the strike price at expiration, the seller retains the premium as profit.

-

Market Hedging: Institutional investors and financial institutions often use put options to hedge their portfolios against overall market downturns. By purchasing put options on a widely diversified index or sector, they can partially offset losses incurred by underlying asset holdings.

Recent Trends and Future Outlook

The put options market has witnessed significant advancements in recent years. The proliferation of exchange-traded funds (ETFs) and options on futures (FOFs) has expanded the range of investable put option products. These instruments offer increased liquidity and risk management capabilities compared to traditional put options.

Moreover, the rise of algorithmic trading has introduced greater efficiency into the pricing and execution of put option orders. Advanced trading platforms and machine learning techniques have enabled investors to identify and execute complex put option strategies with increased precision.

As the financial markets continue to evolve, the significance of put options will only grow. The ability to hedge risk and generate income makes put options an essential tool in the arsenals of both sophisticated and novice investors.

Conclusion

Put options offer a potent combination of downside protection, income generation, and market hedging capabilities. Understanding the mechanics and strategic applications of put options empowers investors to navigate market uncertainties with confidence. Whether you’re a seasoned trader or just starting your options journey, the knowledge contained in this comprehensive guide will serve as an invaluable resource.

Image: www.myespresso.com

Option Trading Put Options

Image: www.option-dojo.com