In the vibrant realm of cryptocurrency, option trading stands as a powerful instrument, offering traders a myriad of strategies to harness the market’s volatility. Unlike traditional stock market options, cryptocurrency options introduce unique characteristics that cater specifically to the decentralized nature of digital assets. Embarking on this exploration, we will delve into the intricacies of option trading in cryptocurrency, unlocking its potential for astute investors.

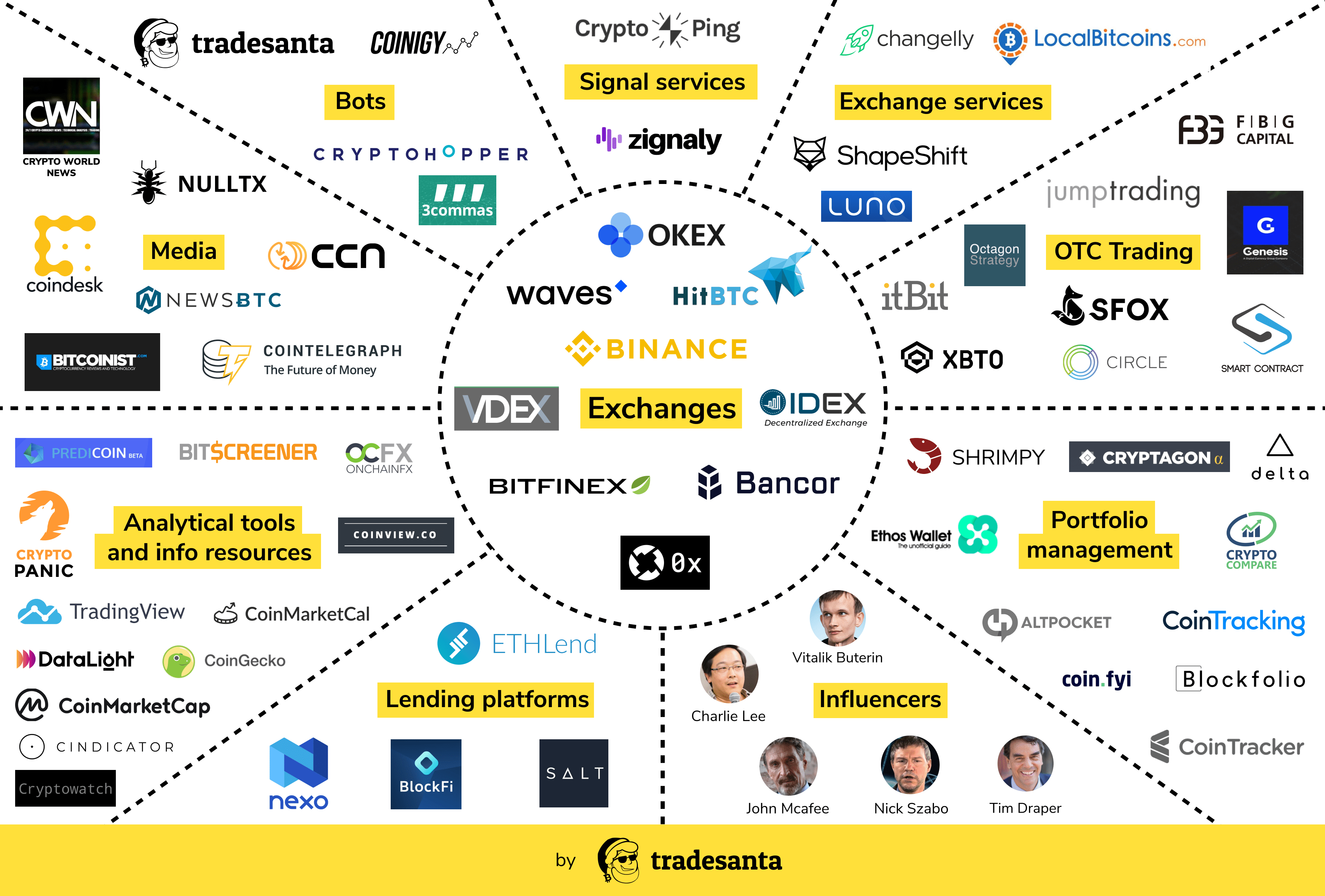

Image: tradesanta.com

Defining Option Trading in Cryptocurrency

Option trading involves contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a predetermined price on or before a specific date. This flexibility empowers traders to capitalize on price fluctuations while mitigating potential risks. By understanding the underlying principles and nuances of option trading in cryptocurrency, traders can navigate market dynamics and enhance their profitability.

Embracing the Advantages of Option Trading

-

Amplified Potential Return: Option trading offers the potential for exponential returns, particularly during periods of high market volatility. Investors can leverage options contracts to magnify their gains while limiting their losses.

-

Precise Risk Management: Unlike spot trading, where losses are potentially unbounded, options trading allows traders to precisely define their risk exposure. Traders can carefully calibrate their positions to match their risk appetite.

-

Hedging against Market Volatility: Option trading enables investors to hedge against adverse price movements. By purchasing protective put options, traders can reduce their portfolio’s vulnerability to sudden market downturns.

Navigating the Nuances of Cryptocurrency Options

-

Choose Reputable Exchanges: Not all cryptocurrency exchanges offer options trading. Conduct thorough research to identify trustworthy platforms with competitive fees and a proven track record.

-

Understand Exercise Prices and Expiration Dates: Exercise price refers to the predetermined price at which the buyer can exercise the option. Expiration date defines the last day on which the option can be exercised. Both factors significantly impact option pricing.

-

Interpreting Greeks: Greeks are metrics that measure an option’s sensitivity to underlying factors such as price and volatility. Understanding and analyzing Greeks is crucial for effective option trading.

Image: finance.yahoo.com

Strategies for Option Trading in Cryptocurrency

-

Covered Calls: This strategy involves selling a call option while simultaneously holding the underlying cryptocurrency. It generates premium income while limiting the upside potential.

-

Protective Puts: This strategy consists of purchasing a put option to protect against potential losses. It acts as an insurance policy for holders of the underlying cryptocurrency.

-

Iron Condors: This neutral strategy involves selling both a call and a put option at different strike prices while buying both a call and a put option at even higher and lower strike prices. It aims to profit from a stable or range-bound market.

Option Trading In Cryptocurrency

Image: www.daytrading.com

Conclusion

Option trading in cryptocurrency opens up a horizon of opportunities for savvy investors seeking to harness market volatility. By mastering the intricacies of option contracts, investors can mitigate risks, enhance returns, and navigate the dynamic cryptocurrency landscape. Whether you are an experienced trader or a curious newcomer, the world of option trading beckons with its allure of profitability. Embrace knowledge, strategize wisely, and unlock the potential of option trading in cryptocurrency.