If you’re venturing into the ever-evolving world of options trading, grasping the concept of “per item” is paramount. This fundamental term plays a pivotal role in determining your position and potential profit or loss. In this article, we embark on a comprehensive journey into the realm of per item, unraveling its significance and providing actionable insights.

Image: voxt.ru

Defining “Per Item” in Options Trading

Per item, in the context of options trading, refers to the unit of measure used to calculate the premium, the price you pay to acquire an option contract. This unit may vary depending on the underlying asset traded but commonly represents a share of stock, a barrel of oil, or a unit of a particular commodity.

Understanding per item is essential because it directly affects the total premium you pay and, consequently, your potential profit or loss. By carefully considering the per-item value, you can make informed decisions about the number of contracts to buy or sell.

Calculating Premium and Potential Profit/Loss

The premium for an option contract is calculated by multiplying the number of contracts purchased or sold by the per-item price. For instance, if you buy 10 call options with a per-item value of $10 and a strike price of $50, the total premium payable would be 10 x $10 = $100.

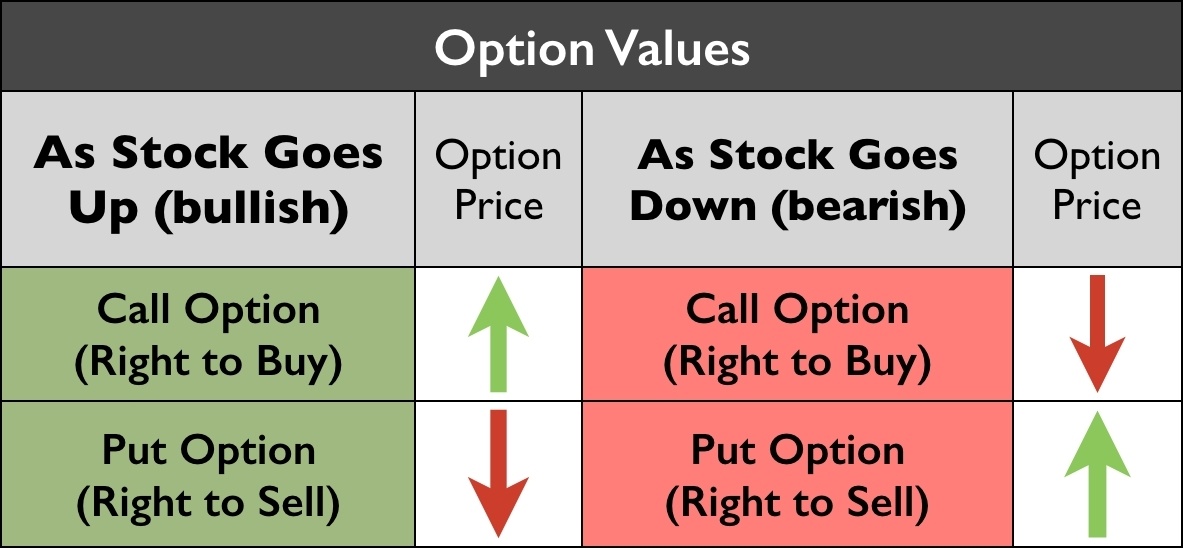

The potential profit or loss from an options trade is also determined based on the per-item value. If the underlying asset moves in the direction of your option position, you stand to gain profit. For example, if the stock price rises above the strike price for a call option, you will make a positive return per item for each contract held.

Practical Applications and Considerations

Comprehensively understanding per item empowers you to optimize your options trading strategy in several ways:

-

Calculating position size: Determine the total premium based on the number of contracts and per-item value, ensuring it aligns with your risk tolerance.

-

Risk management: Spread your risk by trading options with varying per-item values. Higher per-item values may offer greater potential returns but can also amplify losses.

-

Understanding underlying asset price: Consider the per-item value and the underlying asset’s price to make informed decisions about strike prices and expiration dates.

Image: tradesmartu.com

Expert Insights and Actionable Tips

“Per item is a fundamental element in options trading, providing the basis for premium calculation and potential profit or loss,” explains Elisa Lee, a seasoned trader and market strategist. “Balancing per-item values and position size is crucial for effective risk management and maximizing potential returns.”

Here’s an actionable tip to apply this knowledge: Diversify your options portfolio by buying or selling a mix of options with varying per-item values. This strategy helps mitigate risk while potentially enhancing overall returns.

What Does Per Item Mean In Options Trading

Image: www.youtube.com

Conclusion:

In the vibrant realm of options trading, understanding “per item” is a non-negotiable. By demystifying this concept and equipping you with actionable insights, this comprehensive guide empowers you to confidently navigate the terrain of options trading. Remember, thorough research, informed decision-making, and risk management are the keys to unlocking successful outcomes in this ever-evolving marketplace.