Introduction

In the fast-paced world of finance, option trading has emerged as a captivating discipline, attracting traders from all walks of life. As the popularity of options continues to soar, it’s essential to delve into the intricacies of this dynamic instrument and explore the reasons behind its growing appeal. In this comprehensive guide, we unravel the multifaceted world of option trading, outlining its history, key concepts, and real-world applications.

Image: club.ino.com

What is Option Trading?

In essence, an option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Unlike futures contracts, options do not convey any obligation to exercise the underlying instrument. This flexibility makes options appealing to traders seeking various investment strategies, from hedging and income generation to speculation and portfolio diversification.

A Brief History of Options

The roots of option trading trace back to ancient Greece, where philosophers employed derivatives to wager on the price of olive harvests. In the modern era, options first gained prominence in the 1970s with the development of the Black-Scholes pricing model, which revolutionized the understanding of options and their valuation. Since then, option trading has evolved exponentially, transforming into a sophisticated and widely accessible market.

Key Concepts in Option Trading

To navigate the world of option trading effectively, it’s crucial to grasp several fundamental concepts:

- Call and Put Options: Call options give the buyer the right to purchase the underlying asset, while put options provide the right to sell the underlying asset.

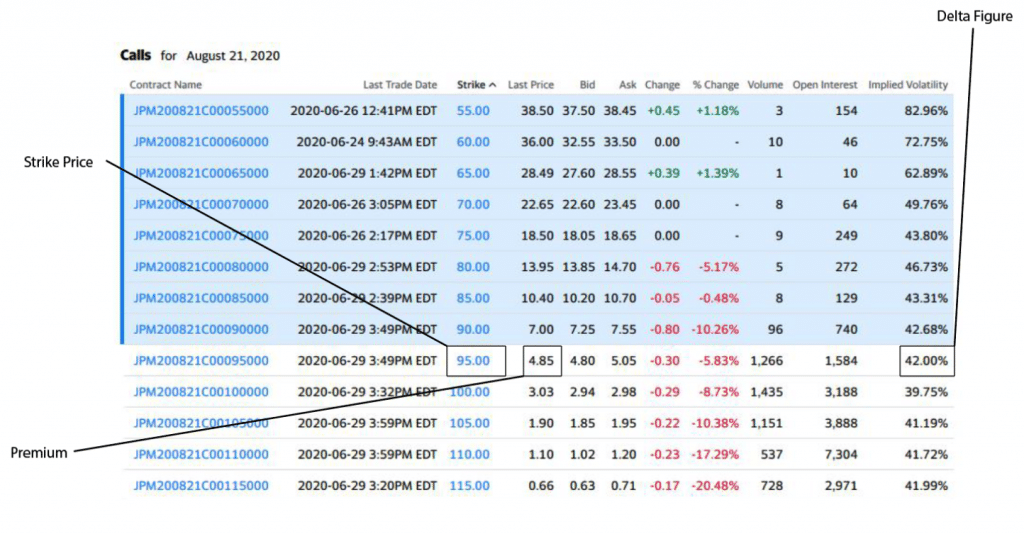

- Strike Price: The predetermined price at which the buyer can buy or sell the underlying asset.

- Expiration Date: The specified date on which the option contract expires, after which it becomes worthless.

- Premium: The price paid to acquire an option contract, representing the market’s assessment of its value.

- Volatility: A measure of the fluctuations in the underlying asset’s price, which can significantly impact option values.

Image: medium.com

Understanding Option Trading Strategies

The versatility of options allows traders to employ a wide range of strategies tailored to their risk tolerance and investment goals. Some common strategies include:

- Bullish Strategies: Geared towards profiting from rising asset prices, such as call options and bullish spreads.

- Bearish Strategies: Designed to capitalize on falling asset prices, such as put options and bearish spreads.

- Neutral Strategies: Seek to profit from fluctuations in volatility or the passage of time, such as straddles, strangles, and iron butterflies.

Option Trading in the Real World

Option trading finds diverse applications in the financial realm:

- Hedging: Options can be employed by investors to offset the risk exposure of their existing portfolio.

- Income Generation: Selling options can yield income, often used as a strategy in low-volatility markets.

- Speculation: Traders can speculate on the future direction of asset prices using options, aiming for significant returns.

- Portfolio Diversification:** Options can enhance portfolio diversification by providing non-correlation to traditional investments.

The Rise in Popularity of Option Trading

The growing popularity of option trading can be attributed to several factors:

- Increased Accessibility: Online platforms and mobile trading apps have made option trading more accessible to retail investors.

- Technological Advancements:** Algorithmic trading and sophisticated options trading strategies have made execution faster and more efficient.

- Market Volatility: Heightened market uncertainty in recent times has fueled demand for options as a tool to manage risk and capitalize on volatility.

- Education and Awareness: Educational initiatives and online resources have contributed to a surge in investor knowledge and understanding of options trading.

Option Trading Getting More Popular

Image: www.tradethetechnicals.com

Conclusion

As option trading continues to permeate financial markets, it’s crucial for investors to engage in thorough research, familiarize themselves with the complexities of this instrument, and proceed with caution. By embracing the opportunities and managing the inherent risks, option trading can empower traders to navigate market dynamics and achieve their financial objectives within the ever-evolving landscape of the financial world.