In the intricate tapestry of financial markets, equity options emerge as a versatile tool that has revolutionized the way investors navigate the ebb and flow of the stock market. These multifaceted financial instruments offer a unique blend of flexibility and leverage, enabling traders to mitigate risk, enhance their returns, and craft personalized strategies tailored to their individual risk appetite and financial goals.

Image: www.optiontradingtips.com

Options trading, while seemingly esoteric to the uninitiated, has its genesis in a tale as old as commerce itself. Imagine a merchant preparing for a long sea voyage, unsure of the market conditions he will encounter upon arrival at his destination. To safeguard himself from potential losses, he could purchase a contract from a ship captain, granting him the exclusive right to purchase (or sell) a certain quantity of a specific commodity at a predetermined price. This pioneering form of option trading provided a valuable safety net against the uncertainties of distant markets.

Decoding Equity Options

Equity options are financial derivatives that derive their value from the underlying equity or stock they represent. They empower traders with the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specific number of shares at a predetermined price known as the strike price before a specified expiration date.

The charm of options lies in their versatility. They can be employed for a wide range of purposes, including:

- Hedging risks: Options can serve as a protective layer, safeguarding investors against potential losses in their underlying stock positions.

- Enhancing returns: Options can amplify the profit potential of investors with a positive outlook on the underlying stock.

- Speculating on market movements: Options can provide an avenue for traders to speculate on the future price direction of stocks, utilizing leverage to magnify their gains.

Understanding the Intricacies of Equity Options

Navigating the labyrinth of equity options trading requires a solid grasp of key concepts, including:

- Premium: The price paid to acquire an option contract, which reflects the option’s intrinsic value and extrinsic value.

- Strike price: The predetermined price at which the underlying stock can be bought (for call options) or sold (for put options).

- Expiration date: The date on which the option contract expires, rendering it worthless if unexercised.

- Exercise: The act of converting an option contract into a binding agreement to buy or sell the underlying stock.

The interplay between these factors determines the value and potential profitability of equity options. By comprehending these concepts and meticulously analyzing market conditions, investors can craft strategic options trades that meet their unique financial aspirations.

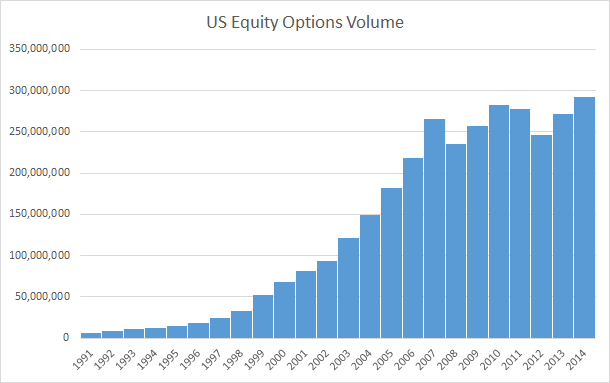

Exploring the Latest Trends and Developments

The equity options market is constantly evolving, with new strategies and products emerging to cater to the ever-changing needs of investors. Some of the latest trends include:

- The proliferation of exchange-traded options: Exchange-traded options (ETOs) are standardized options contracts traded on exchanges, offering greater transparency and liquidity compared to their over-the-counter (OTC) counterparts.

- The rise of binary options: Binary options are a type of all-or-nothing option that pays a fixed return if the underlying stock meets a specific condition at expiration.

Image: www.youtube.com

Tips and Expert Advice for Savvy Trading

For those seeking to harness the power of equity options, the following tips can prove invaluable:

- Understand your risk tolerance: Options trading carries inherent risks, so it’s crucial to carefully assess your risk tolerance before venturing into this arena.

- Thoroughly research the underlying stock: Obtain a deep understanding of the company’s financial health, industry dynamics, and market sentiment before making any options trades.

- Employ proper risk management techniques: Utilize stop-loss orders, position sizing, and hedging strategies to mitigate potential losses.

- Seek professional guidance if needed: If you’re a novice trader or lack confidence in your abilities, consider consulting a qualified financial advisor for expert advice.

By adhering to these principles, you can navigate the complexities of equity options trading with greater confidence and enhance your chances of realizing your financial objectives.

Frequently Asked Questions (FAQs)

Q: What are the main types of equity options?

A: There are two primary types of equity options: call options, which grant the buyer the right to purchase the underlying stock, and put options, which grant the buyer the right to sell the underlying stock.

Q: Can I lose money trading options?

A: Yes, it’s possible to lose money trading options. The value of options contracts is influenced by various factors, including the underlying stock price, time to expiration, and market volatility. Unfavorable market conditions or incorrect trading strategies can result in losses.

Q: Are options suitable for beginner investors?

A: While options offer the potential for substantial gains, they are generally not recommended for novice investors due to their inherent complexity and risks. It’s advisable to gain a thorough understanding of financial markets and the nuances of options trading before venturing into this arena.

Equity Options Trading

https://youtube.com/watch?v=vbImgOg0jiw

Conclusion

Equity options trading empowers investors with a versatile tool that can unlock a world of opportunities. By leveraging their flexibility, managing risks effectively, and incorporating expert advice, you can harness the power of options to enhance your returns, protect against market volatility, and achieve your financial goals.

If the allure of equity options trading has piqued your interest, I invite you to continue your exploration of this fascinating topic. Delve into the intricacies of options strategies, track market trends, and engage with financial gurus. By embracing a spirit of continuous learning and prudent trading practices, you can unlock the potential of equity options trading and empower yourself in the realm of financial markets.