Introduction

Delve into the dynamic realm of cash flow option trading, a sophisticated trading strategy that empowers investors to capitalize on the subtle shifts in cash flows. Cash flow refers to the movement of funds into and out of a company or organization, reflecting the financial health and operational efficiency of the entity. By analyzing and trading options on cash flow-related variables, traders can unlock a new dimension of profit potential and mitigate risks effectively.

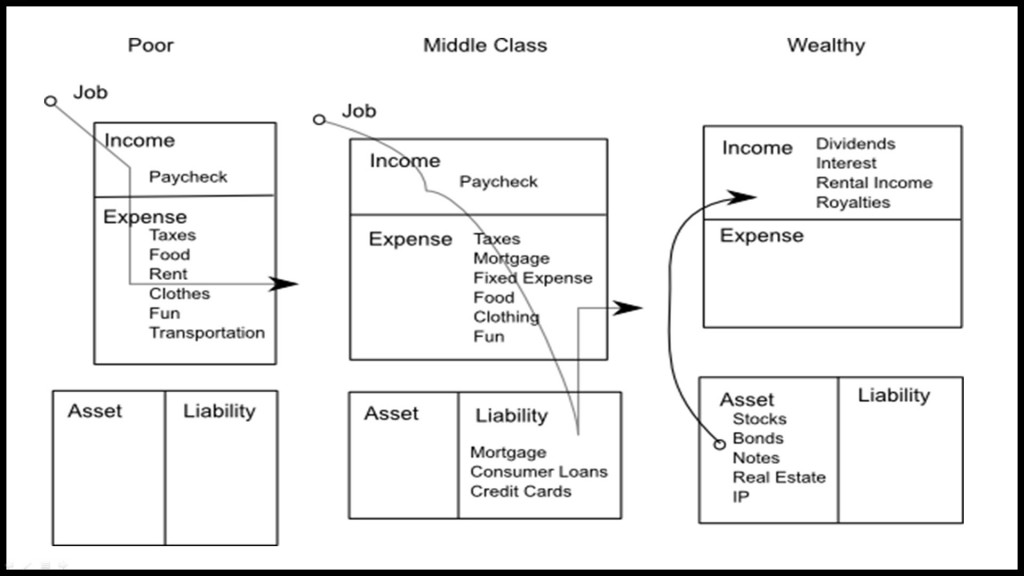

Image: www.us-analytics.com

This article will elucidate the fundamentals of cash flow option trading, from its inception to its intricate applications. Armed with real-world examples and the latest industry insights, we will explore the nuances and potential rewards of this specialized trading technique.

Historical Roots and Evolution

The concept of cash flow option trading has its origins in the early days of financial trading. In the 1970s, the pioneering work of economists Fisher Black and Myron Scholes laid the groundwork for option pricing theory, revolutionizing the way investors value and trade options. As the financial markets evolved and the sophistication of trading instruments increased, cash flow option trading emerged as a distinct and lucrative strategy.

Core Concepts Behind Cash Flow Option Trading

At its core, cash flow option trading involves speculating on the future direction of a company’s or organization’s cash flows, using various financial instruments such as cash flow swaps and options on cash flow indexes. Traders assess a range of factors that influence cash flows, including revenue, expenses, capital expenditures, and operational efficiency. By accurately predicting the trajectory of these cash flows, traders can position themselves to profit from favorable market conditions.

Cash Flow Swaps: These contracts allow traders to exchange cash flows with a counterparty based on a predetermined benchmark. Traders can enter into a cash flow swap to hedge their exposure to cash flow fluctuations or to speculate on the future direction of cash flows.

Options on Cash Flow Indexes: These options provide traders with the right, but not the obligation, to buy or sell a specific cash flow index at a predetermined price on a future date. They offer traders flexibility and leverage in speculating on the overall trend of cash flows within a particular industry or sector.

Practical Applications in the Real World

Cash flow option trading finds wide application in various real-world scenarios, providing investors with opportunities to enhance their portfolios and manage risk effectively:

Speculation on Future Cash Flows: Traders can bet on the direction of future cash flows using cash flow options. For instance, if they anticipate an increase in a company’s cash flows due to a new product launch or cost-cutting measures, they can purchase call options on the cash flow index related to that company.

Hedging against Cash Flow Volatility: Businesses and investors can mitigate risks associated with cash flow fluctuations by using cash flow swaps. They can enter into contracts that offset potential cash flow shortfalls or lock in favorable cash flow rates.

Cross-Border Cash Flow Management: Cash flow option trading facilitates efficient management of cash flows across different currencies and jurisdictions. Traders can use currency options to hedge against fluctuations in exchange rates that may impact their cash flows.

Image: lesboucans.com

Market Landscape and Recent Developments

The cash flow option trading market has experienced significant growth and innovation in recent years, driven by technological advancements and the increasing sophistication of financial instruments:

Electronic Trading Platforms: Electronic trading platforms have revolutionized the way cash flow options are traded, providing traders with real-time access to market data and execution capabilities. This has increased liquidity and transparency in the market.

Structured Products: Banks and financial institutions offer structured products that combine cash flow options with other financial instruments, such as bonds or structured notes. These products provide investors with customized solutions that meet their specific risk and return objectives.

Artificial Intelligence and Machine Learning: AI and machine learning algorithms are playing an increasingly important role in cash flow option trading. They assist in analyzing vast amounts of data and identifying trading opportunities, enhancing the accuracy and efficiency of trading decisions.

Cash Flow Option Trading

Image: ohovovygozah.web.fc2.com

Conclusion

Cash flow option trading opens up a world of possibilities for investors and risk managers seeking to navigate the dynamic financial markets. By understanding the underlying concepts, real-world applications, and latest developments in this specialized trading technique, individuals can equip themselves with the knowledge and tools to capitalize on cash flow-related market opportunities and enhance their investment strategies. As the financial landscape continues to evolve, cash flow option trading will remain an important and lucrative strategy for savvy market participants.

Embrace the complexities of cash flow option trading, delve into the latest market insights, and unlock the potential of this powerful trading tool. The journey to financial freedom and risk mitigation starts with the first step towards understanding and mastering cash flow option trading.