Navigating the world of options trading can be perplexing, but understanding its intricacies unveils lucrative opportunities. Embark on this journey with me as I narrate a case study that illuminates valuable lessons, equipping you for informed investment decisions.

Image: www.adigitalblogger.com

Options Trading: Defining the Landscape

Options contracts confer the right, not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. These versatile instruments can amplify returns, mitigate risks, and provide flexibility in investment strategies.

Call and Put Options: A Closer Look

Call options grant the buyer the right to purchase an underlying asset, while put options confer the right to sell. These options are typically exercised when the market price is favorable to the option holder. Understanding the dynamics of call and put options is foundational in options trading.

Strategies for Success: Enhancing Profitability

Mastering options trading involves employing strategic approaches tailored to specific market conditions. Popular techniques encompass covered calls, cash-secured puts, protective puts, and spreads. These strategies empower traders to optimize returns while managing risks effectively.

Covered calls involve selling a call option when holding the corresponding underlying asset to potentially generate premium income while limiting the upside potential of the asset. Cash-secured puts entail selling a put option with sufficient cash in the account to cover the potential obligation to purchase the underlying asset.

Protective puts mitigate downside risks by purchasing a put option that gives the trader the right to sell the underlying asset at a predetermined price. Spreads, involving the simultaneous buying and selling of options at different strike prices or expiration dates, offer flexibility and nuanced risk-reward profiles.

Image: thebrownreport.com

Expert Insights and Actionable Tips

- Diligently research: Thoroughly examine the underlying asset, industry dynamics, and historical performance before venturing into options trading.

- Embrace risk management: Options trading entails inherent risks; establish clear risk parameters and adhere to them strictly.

Moreover, seek guidance from experienced traders or certified financial advisors to refine your understanding and decision-making. Additionally, capitalize on educational resources, webinars, and online forums to augment your knowledge.

Frequently Asked Questions: Demystifying Options Trading

Q1: Can options trading yield substantial returns?

Yes, options trading has the potential to generate significant returns, although it also exposes traders to substantial risks. Informed decision-making is paramount to mitigate potential losses.

Q2: Is options trading suitable for all investors?

No, options trading is not appropriate for every investor. It necessitates a comprehensive understanding of market dynamics and risk tolerance. Beginner investors should proceed with caution and seek expert guidance.

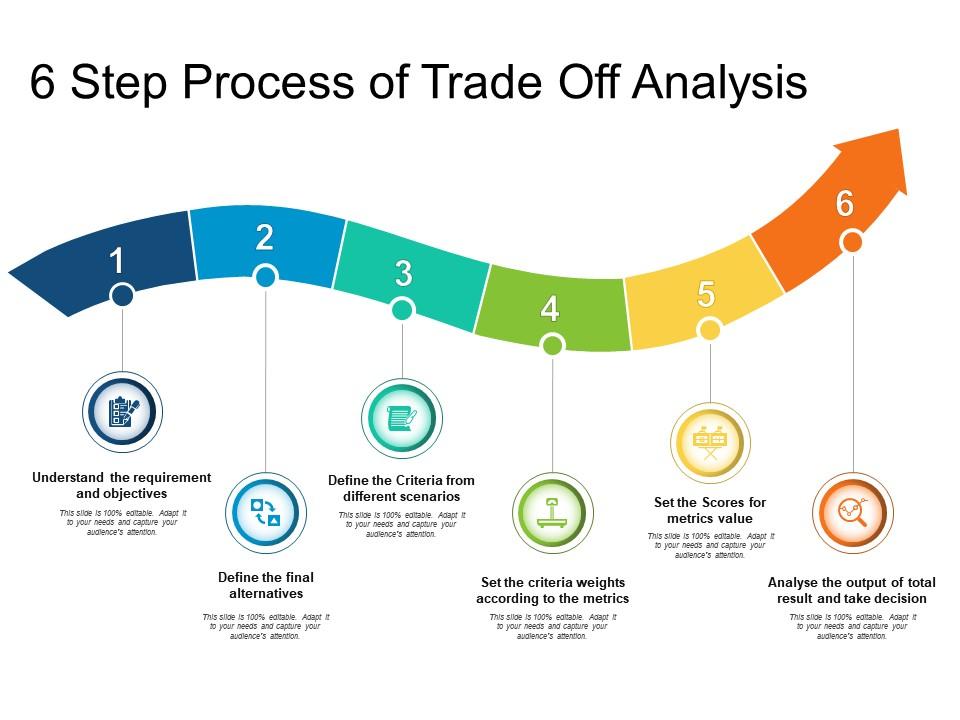

Option Trading Case Study

Image: www.slideteam.net

Conclusion: Unlocking the Power of Informed Decisions

Embracing options trading can unleash a multitude of investment opportunities. By leveraging knowledge, experience, and strategic approaches, investors can navigate the intricate world of options with confidence. Whether you are a seasoned trader or embarking on this journey, continuous learning and informed decision-making remain cornerstones of successful options trading.

Are you enthusiastic about delving into the exciting realm of options trading? Share your thoughts and experiences in the comments below, let us engage in a vibrant exchange of ideas, and collectively enhance our financial literacy.