Introduction

In the fast-paced world of financial markets, understanding the intricate dance of options expiration dates is crucial for traders seeking to maximize their potential profits and mitigate risks. Option trading involves the buying and selling of contracts that grant the holder the right to buy or sell an underlying asset at a predetermined price before a specific date. These contracts come with varying expiration dates, each marking a pivotal moment when the option’s value either persists or vanishes. This article will serve as a comprehensive guide to option trading calendars, deciphering their enigmatic workings and empowering traders to navigate the financial landscape with precision and confidence.

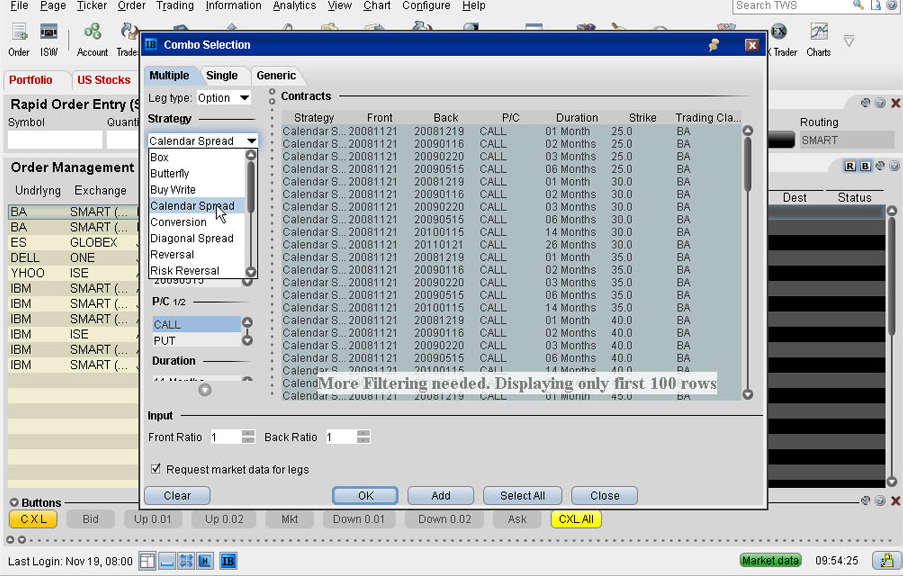

Image: topbinaryoptionsbrokers.logdown.com

Decoding the Option Expiration Calendar

The option trading calendar is the roadmap that guides traders through the labyrinthine maze of expiration dates. It meticulously lists the dates on which various option contracts expire, providing a clear understanding of the time-sensitive nature of these instruments. These dates are typically drawn from standard monthly cycles, commonly known as monthly expiration cycles. Each monthly cycle aligns with the third Friday of every month, creating a rhythmic cadence that governs option trading activities.

Exhaustive Coverage of Expiration Cycles

Option trading calendars meticulously track the expiration dates for a wide range of options, including stock options, index options, commodity options, and currency options. This exhaustive coverage empowers traders with the ability to monitor multiple markets simultaneously, identifying potential trading opportunities and managing risk across various asset classes.

A Temporal Tapestry: Weekly and Quarterly Expirations

In addition to the standard monthly expiration cycle, some options may abide by weekly or quarterly expiration schedules. Weekly expirations, often occurring on Fridays, provide traders with short-term trading strategies that can capitalize on market fluctuations within a single week. Quarterly expirations, on the other hand, offer longer holding periods, allowing traders to execute strategies that span several months.

Image: www.pinterest.com

Strategic Implications of Expiration Dates

Understanding option trading calendar is not merely an academic pursuit but a cornerstone for strategic trading decisions. The expiration date of an option contract has profound implications, influencing both its value and the trader’s course of action.

Time Decay’s Relentless Tick: Theta’s Imprint

As time relentlessly marches towards an option’s expiration date, its value undergoes a gradual erosion. This phenomenon, known as time decay or theta decay, stems from the dwindling amount of time remaining for the option to be exercised. Options with shorter time to expiration experience more pronounced time decay, while those with longer time horizons exhibit a more gradual decline.

The Perilous Brink: Near-Expiration Options

As an option approaches its expiration date, it enters a perilous zone known as near-expiration. During this period, time decay intensifies, and the option’s value becomes highly sensitive to price fluctuations in the underlying asset. Traders must tread carefully during this phase, as even minor price movements can significantly impact the option’s value.

The Dreaded Expiration Day: Settlement or Lapse

The culmination of the option’s life cycle arrives on expiration day. On this fateful date, the option holder must make a critical decision: exercise the option and acquire or sell the underlying asset, or allow the option to expire worthless. This decision hinges on whether the option is in-the-money (ITM), out-of-the-money (OTM), or at-the-money (ATM).

Unveiling the Key Players in Option Trading

The option trading calendar is not a solitary entity but rather part of a complex ecosystem involving various key players who shape its dynamics and influence its intricacies.

Clearinghouses: Guardians of Option Contracts

Clearinghouses act as the central clearing counterparties in the options market, standing as guarantors for all option transactions. They assume the risk associated with each contract, ensuring the smooth settlement of trades and protecting both buyers and sellers from default.

Exchanges: The Marketplaces of Options

Option exchanges are the bustling marketplaces where options are traded. These venues provide a structured platform for buyers and sellers to interact, execute transactions, and determine the prices of options. Major exchanges like the Chicago Board Options Exchange (CBOE) and the International Securities Exchange (ISE) facilitate a vast majority of option trading activities.

Market Makers: Liquidity Providers

Market makers are the lifeblood of option markets, providing liquidity by continuously quoting prices for both buying and selling options. They play a crucial role in ensuring efficient price discovery and reducing transaction costs for traders.

Navigating the Option Trading Calendar: A Strategic Compass

To successfully navigate the complexities of the option trading calendar, traders must possess a keen understanding of the intricate interplay between time decay, expiration dates, and market dynamics. Here are some strategic insights to guide their journey:

Timing is Paramount: Capturing Market Opportunities

Traders must develop a discerning eye for identifying optimal trading opportunities, carefully considering the time to expiration and the potential impact of time decay on option value. Strategic timing can maximize profits and minimize losses.

Understanding Volatility’s Impact: Embracing Market Dynamics

Volatility is an inherent characteristic of option trading, and traders must cognizant of its influence on option pricing. Monitoring volatility levels and anticipating its potential impact on option values can lead to informed trading decisions.

Hedging Strategies: Mitigating Risk

Options can be used as hedging instruments, enabling traders to mitigate risk and protect their portfolio from adverse market movements. Understanding how options can be incorporated into hedging strategies is essential for risk management.

Embark on the Path of Option Trading Mastery

The option trading calendar is an indispensable tool for unlocking the complexities of options trading, empowering traders with the knowledge to make informed decisions. By embracing its nuances and mastering its intricacies, traders can navigate the financial markets with confidence, harnessing the power of options to maximize their trading potential.

Option Trading Calendar

Image: aqipaqerakaj.web.fc2.com

Additional Tips for Enhanced Option Trading

-

Diligent Research: Engage in thorough research to comprehend the underlying assets, market conditions, and historical data relevant to your trading strategies.

-

Paper Trading: Before venturing into live trading, consider practicing your strategies through paper trading platforms that simulate real-world scenarios without financial risk.

-

Seek Mentorship: Identify experienced traders or mentors who can guide your journey, providing valuable insights and support.

-

Continuous Learning: Stay abreast of market trends, regulatory changes, and innovative trading techniques through ongoing education and industry engagement.

-

Risk Management Paramount: Always prioritize risk management strategies to safeguard your trading capital and minimize potential losses.