The world of investing can be daunting, especially when you’re first starting out. With so many different types of investments to choose from, it can be difficult to know where to start. If you’re interested in learning more about options trading, one of the first things you’ll need to do is understand option trading dates. Trading options involves understanding the critical dates associated with the option contract:

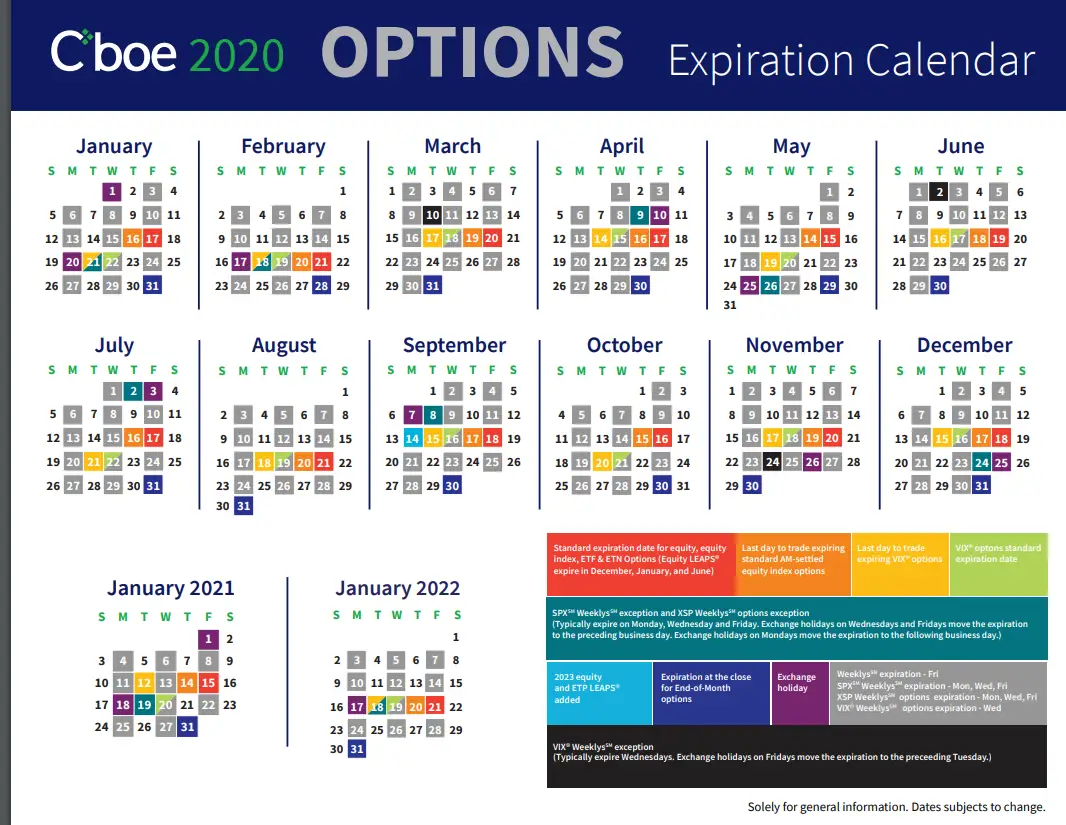

Image: www.pinterest.com

In this blog post, we’ll discuss all things option trading dates, including what they are, why they’re important, and how you can use them to your advantage when trading options.

Understanding Option Trading Dates

Option trading dates are the dates on which an option contract can be traded. An individual buying or selling an option can trade options every business day up until the expiration date. Each option contract has two key dates that every options trader should know before entering into a position:

1. The expiration date is the date when the option contract expires. On the expiration date, the option holder has the right—but not the obligation—to exercise the option. If the option is not exercised, it will expire worthless. Options expire on the third Friday of each month (except for March, June, September, and December, when they expire on the third Saturday).

2. The last trading day is the last day on which the option can be traded. It is typically one business day before the expiration date. On the last trading day, the option will trade until the end of the trading day. After the last trading day, the option will no longer be available for trading.

Why Option Trading Dates Are Important to Understand

1. Expiration Dates

Understanding option trading dates is important for a number of reasons. First, it helps you to avoid missing out on the opportunity to exercise your option. If you wait too long to exercise your option, it may expire worthless. Second, it helps you avoid the risk of being assigned on your option. An assignment occurs when the option holder is forced to buy or sell the underlying security at the strike price. Assignments can occur at any time up until the expiration date.

Image: mimevagebasoh.web.fc2.com

2. Last Trading Dates

Last trading dates are also important to understand because they can affect your ability to sell your option contract. Options that are not sold by the last trading date will expire worthless, so options traders generally want to ensure that they sell their option contracts before the last trading day.

How to Use Option Trading Dates to Your Advantage

There are a number of ways that you can use option trading dates to your advantage when trading options. One way is to use expiration dates to time your trades. For example, if you are bullish on a particular stock, you could buy a call option with an expiration date that is several months out. This would give you the right—but not the obligation –to buy the stock at a certain price for several months. If the stock price increases during that time, you could exercise your option and profit from the difference between the strike price and the market price.

As mentioned earlier, another way to use option trading dates to your advantage is to avoid the risk of being assigned. If you are selling an option, you want to avoid being assigned because this could force you to buy or sell the underlying security at a price that is not favorable to you. To avoid this, you can sell your option contract before the last trading date.

Expert Advice for Trading Options

Here are a few tips from experts to help you succeed in option trading:

- Do your research. Before you start trading options, take the time to learn as much as you can about the different types of options, the risks involved, and how to use options trading strategies.

- Start small. When you first start trading options, start small. This will help you to get a feel for the market and to learn how to manage your risk.

- Use a paper trading account. A paper trading account is a great way to practice trading options without risking any real money.

- Use popular option trading platforms and tools. A good trading platform can provide you with a variety of tools and resources to help you trade options more effectively.

FAQs About Option Trading Dates

- What is an expiration date?

An expiration date is the date when an option contract expires.

- What is a last trading day?

A last trading day is the last day on which an option can be traded.

- When do options expire?

Options expire on the third Friday of each month (except for March, June, September, and December, when they expire on the third Saturday).

- Can I trade options on the expiration date?

Yes, you can trade options on the expiration date, but you should be aware that the option will expire worthless if it is not exercised.

- Can I sell an option after the last trading date?

No, you cannot sell an option after the last trading date. Options that are not sold by the last trading date will expire worthless.

Option Trading Dates

Image: sixfigureinvesting.com

Conclusion

Trading options can be an effective way for active traders to build wealth. Before you start trading options, it is important to understand option trading dates. By understanding these dates, you can avoid missing out on the opportunity to exercise your option or being assigned on your option. You can use this knowledge to your advantage when trading options to maximize your profits.

Do you still have questions about option trading dates? Comment below.