In the realm of investing, the elusive bull market beckons with the promise of exponential returns. As the stock market ascends, savvy investors seek ingenious strategies to harness these bullish waves. Enter option trading, an empowering tool that empowers individuals to amplify their profits during this financial upswing.

Image: www.tradingpedia.com

Unveiling the Potential of Option Trading

Option trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset, such as stocks or indices, at a predetermined price within a specific time frame. This dynamic strategy allows investors to navigate market volatility and generate substantial gains beyond what traditional stock trading alone can offer.

Leveraging Bull Market Momentum

During a bull market, where overall market sentiment is positive, option trading strategies can be particularly effective for capturing profitable opportunities. Here are some potent strategies tailored for this market environment:

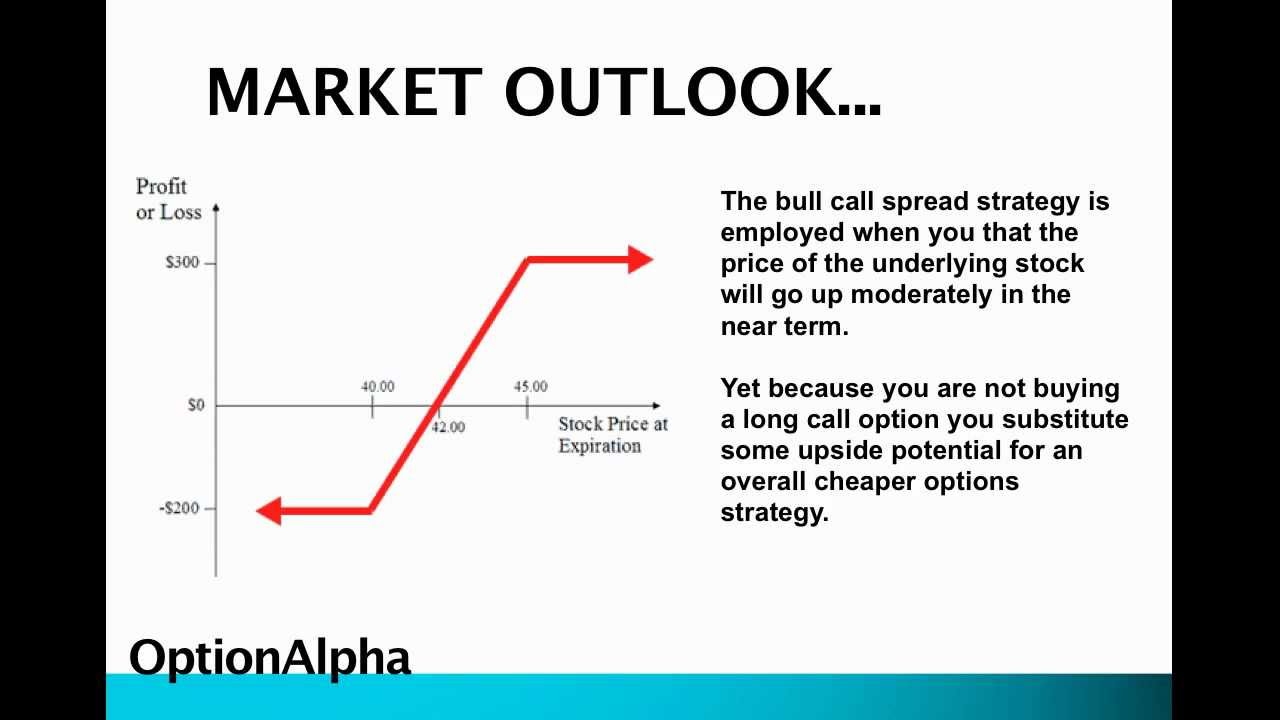

- Bullish Call Options: Buy call options on stocks or indices expected to continue their upward trajectory. As the underlying asset price rises, the premium of the call option increases, potentially delivering handsome profits.

- Covered Calls: Sell covered calls against stocks you already own. By doing so, you retain ownership of the stock while potentially generating additional income from the sale of call options. If the stock price continues to climb, you still benefit from the appreciation, while the premium from the call options serves as an added bonus.

- Long Strangles: Create a long strangle by buying one out-of-the-money call option and one out-of-the-money put option on the same underlying asset. This strategy provides a wide range of potential outcomes, with a profit zone that expands as volatility increases.

Navigating Market Volatility

While bull markets offer significant potential for gains, they are not immune to periods of volatility. To mitigate risk and enhance returns, consider these prudent practices:

- Understand the Risks: Before engaging in option trading, it is imperative to fully comprehend the inherent risks involved. Options can be complex and may result in significant losses if used improperly. Seek education and guidance from reputable sources.

- Manage Volatility: Volatility can impact option premiums and overall trading profitability. Monitor market conditions closely and adjust your strategies accordingly. Using stop-loss orders or position-sizing techniques can help manage risk during volatile periods.

- Exercise Discipline: Exercise discipline and stick to your trading plan. Avoid emotional or impulsive decisions that could jeopardize your financial objectives. Conducting thorough research and setting realistic expectations are crucial for long-term trading success.

Image: theforexguy.com

Option Trading Bull Market Strategies

Image: www.asktraders.com

Empowering Investors: Realizing Profitable Possibilities

Option trading in a bull market offers a wealth of opportunities for investors to amplify their profits and diversify their portfolios. By embracing these strategies, you can harness market momentum, navigate volatility, and uncover the immense potential of option trading. Remember to approach this endeavor with a blend of knowledge, strategy, and discipline, and you will be well-equipped to reap the rewards of this dynamic financial landscape.