Introduction

Image: tradebrains.in

In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to navigate market volatility and enhance returns. Whether you’re an aspiring trader or a seasoned investor, understanding the intricacies of options is essential for unlocking their true potential. This comprehensive guide, presented in a printable PDF format, will demystify the world of options trading, providing you with a solid foundation upon which to build your financial future.

Chapter 1: Unveiling the Basics of Options

Options, simply put, are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a defined expiration date. Options come in two primary forms: calls and puts. Calls grant the holder the right to buy an asset, while puts confer the right to sell. Familiarity with these basic concepts is crucial before delving into the nuances of options trading.

Chapter 2: Understanding the Language of Options

Options contracts are replete with specialized terminology that can bewilder beginners. This chapter clarifies these terms, empowering you to comprehend options contracts and make informed decisions. From understanding the strike price to deciphering the premium paid, you’ll gain a firm grasp of the language that permeates the world of options trading.

Chapter 3: Unraveling the Mechanics of Options Trading

The process of executing options trades involves an array of steps. This chapter dissects these steps, explaining how to open and close positions, exercise rights, and manage risk. Whether you’re seeking to capitalize on bullish or bearish market trends, a thorough understanding of the mechanics will serve you well.

Chapter 4: Examining Different Types of Options

Options contracts come in various forms, each tailored to specific investment strategies. This chapter delves into the differences between call and put options, American and European options, and index and stock options. By comprehending the nuances of each type, you can select options that align with your investment goals and risk tolerance.

Chapter 5: Mastering the Art of Option Pricing

Option pricing is a critical aspect of successful trading. This chapter introduces the Black-Scholes model, an indispensable tool for estimating the fair value of options contracts. By considering factors such as the underlying asset’s price, volatility, time to expiration, and risk-free rate, you’ll gain the ability to evaluate options and make informed pricing decisions.

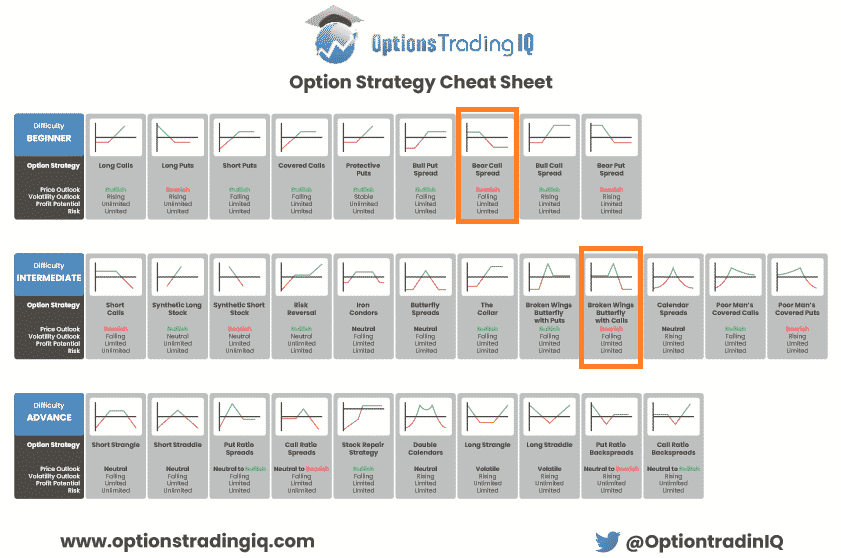

Chapter 6: Employing Option Strategies for Success

Options provide investors with an array of strategies to enhance returns and mitigate risks. This chapter explores these strategies, including covered calls, protective puts, and bull and bear spreads. From generating income to hedging against losses, you’ll discover how to harness the power of options strategies to elevate your investment performance.

Chapter 7: Expert Insights and Case Studies

Success in options trading often requires learning from those who have mastered the craft. This chapter features insights from seasoned experts in the field, providing valuable lessons and perspectives on navigating market fluctuations. Real-world case studies showcase the successful implementation of option trading strategies, further solidifying your understanding.

Chapter 8: Embracing Risk Management in Options Trading

Risk management is paramount in options trading. This chapter emphasizes the importance of evaluating risks associated with options positions. From understanding the concept of leverage to employing stop orders and hedging strategies, you’ll learn how to protect your capital and navigate market uncertainties with confidence.

Chapter 9: Ethical and Regulatory Considerations

Ethical and regulatory considerations are integral to responsible options trading. This chapter outlines ethical trading practices and regulatory frameworks that govern the industry. It highlights the importance of transparency, fair dealing, and adhering to established regulations, ensuring that your trading activities comply with both ethical standards and legal requirements.

Chapter 10: Ongoing Education and Refinement

The world of options trading is constantly evolving. This chapter underscores the significance of ongoing education and refinement to stay abreast of market trends, technological advancements, and regulatory changes. By continuously seeking knowledge and embracing feedback, you can sharpen your skills and adapt to the ever-changing investment landscape.

Conclusion

Embarking on the path of options trading empowers you to navigate market complexities and pursue financial success. This comprehensive guide has equipped you with a thorough understanding of the fundamentals, nuances, and best practices of options trading. By mastering the concepts outlined in this guide, you can confidently approach options as a valuable tool for enhancing your investment strategies and achieving your financial aspirations.

Image: optionstradingiq.com

Option Trading 101 Pdf

Image: www.youtube.com