Introduction

Options are versatile financial instruments that allow traders to speculate on the price movement of an underlying asset, such as a stock or index. However, day trading options comes with its own set of rules and regulations. This article delves into the nuances of the day trading rule and how it applies to options, providing a comprehensive understanding of the risks and compliance requirements involved in this fast-paced trading strategy.

:max_bytes(150000):strip_icc()/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

Image: fabalabse.com

The Day Trading Rule

The day trading rule, also known as the pattern day trading rule, is a Securities and Exchange Commission (SEC) regulation that restricts excessive day trading for accounts with less than $25,000 in equity.

- Definition: Day trading involves buying and selling the same security multiple times during a trading day, typically with the intention of profiting from short-term price fluctuations.

- Regulation: According to the day trading rule, accounts with less than $25,000 in equity are limited to three day trades per five business days. A day trade is defined as the purchase and sale of the same security on the same trading day.

- Purpose: The rule aims to prevent excessive speculation and risk-taking by inexperienced traders with limited capital.

Understanding the Risks

Day trading options carries inherent risks, especially for traders with limited experience and capital:

- Increased Volatility: Options markets tend to be more volatile than stock markets, making it more difficult to predict price movements and potentially leading to larger losses.

- Time Decay: Options contracts have a defined expiration date, and their value gradually decays over time. This means that even if the underlying asset’s price moves favorably, the option’s value may still decline if it expires worthless.

- Margin Trading: Options traders often use margin to increase their potential profits, but this also amplifies potential losses. Margin trading magnifies both gains and losses, requiring traders to have strict risk management strategies in place.

Application to Options

The day trading rule applies to any security, including options. This means that traders with accounts under $25,000 in equity are subject to the three-day trade limit for all options contracts they buy and sell within the same trading day.

- Example: If a trader buys and sells an Apple call option and a Tesla put option within the same day, that counts as two day trades.

- Impact: Traders may need to adjust their trading strategies to avoid exceeding the day trade limit. This may involve reducing the number of trades per day or spreading trades over multiple days.

- Violating the Rule: Exceeding the day trade limit can lead to account limitations or even trading bans. It’s crucial to monitor trades carefully and stay within the permissible limit.

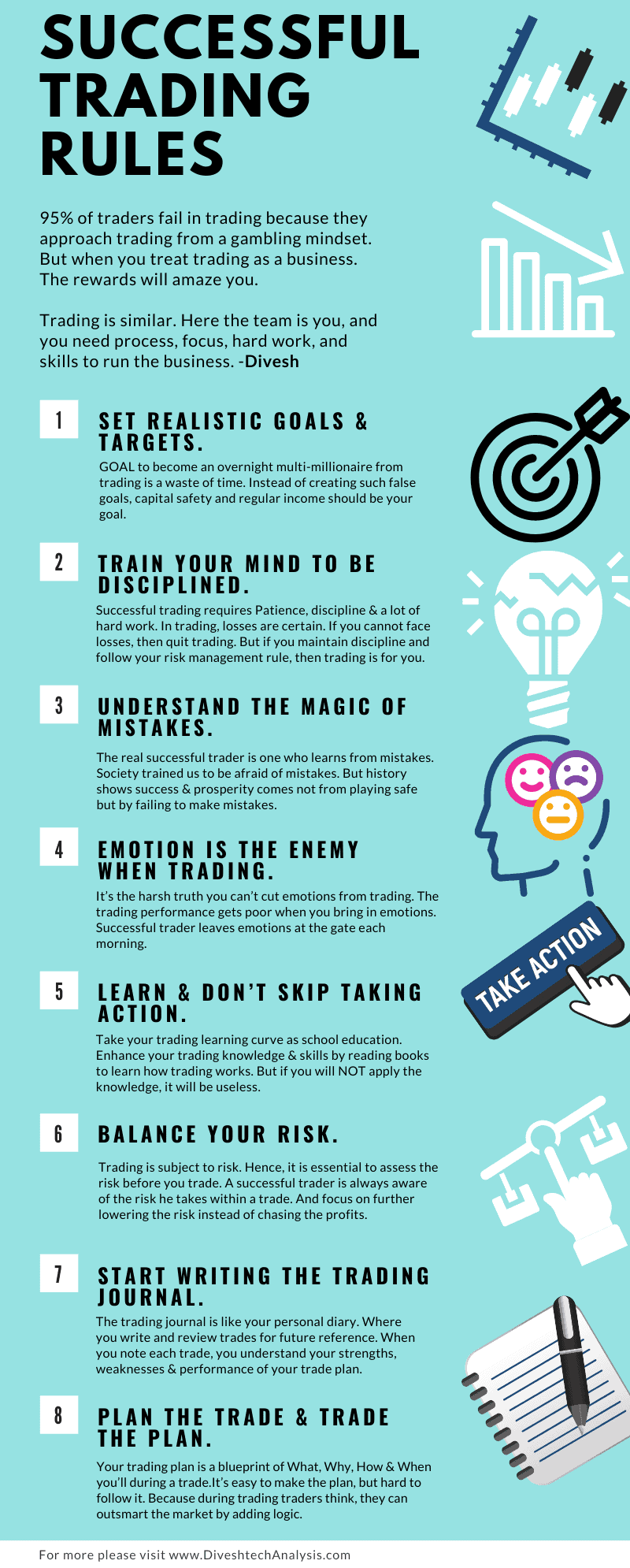

Image: www.diveshtechanalysis.com

Expert Tips for Options Day Traders

To mitigate risks and improve profitability, follow these expert tips for options day trading:

- Start With Small Positions: Begin with small trade sizes to limit potential losses while gaining experience and confidence.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically exit positions when the price falls to a predetermined level, protecting against excessive drawdowns.

- Manage Your Risk: Develop a clear risk management plan that outlines acceptable trade sizes, stop-loss levels, and profit targets.

- Stay Informed: Monitor market news, economic data, and technical indicators to make informed trading decisions.

- Be Patient: Options day trading requires patience and discipline. Avoid impulsive trades and stick to a well-defined trading strategy.

FAQ on Options Day Trading

Q: Can I day trade options with less than $25,000?

A: Yes, you can, but you’re limited to three day trades per five business days.

Q: What happens if I violate the day trading rule?

A: You may face account limitations or restrictions on trading activity.

Q: What is the best way to manage risk in options day trading?

A: Start with small positions, use stop-loss orders, and develop a comprehensive risk management plan.

Q: Is it possible to make a consistent profit from options day trading?

A: While possible, it requires significant experience, skill, and a disciplined approach.

Q: What resources are available to help me learn about options day trading?

A: Educational platforms, books, online courses, and trading forums offer valuable information for начинающих.

Does The Day Trading Rule Apply To Options

Conclusion

The day trading rule plays a significant role in options trading, setting limits for accounts with less than $25,000 in equity. Understanding the rule’s implications and implementing proper risk management strategies is crucial for traders aiming to navigate the fast-paced world of options day trading.

Are you interested in learning more about day trading or expanding your knowledge of options? Continue exploring our blog for valuable insights, expert advice, and practical tips.