Introduction

In today’s fast-paced financial landscape, options trading has emerged as a popular avenue to navigate market volatility and potentially amplify returns. At the helm of this burgeoning industry stand online option trading brokerages, digital platforms that empower individuals to trade options contracts from the comfort of their homes. This comprehensive guide will delve into the intricacies of online option trading brokerages, empowering you with the knowledge to make informed decisions in this dynamic market.

Image: www.interactivebrokers.com

Understanding the Basics of Online Option Trading Brokerages

Option trading brokerages serve as intermediaries between traders and the options market, facilitating the buying and selling of options contracts. These contracts represent the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price and time. Brokerages provide traders with access to trading platforms, order execution capabilities, market data, and educational resources.

Key Considerations When Choosing an Online Option Trading Brokerage

The choice of an online option trading brokerage can significantly impact your trading experience. Several key factors warrant consideration:

-

Fees and Commissions: Brokerages vary in their fee structures, including trading commissions, account fees, and margin interest rates. Understanding these costs upfront can optimize your profitability.

-

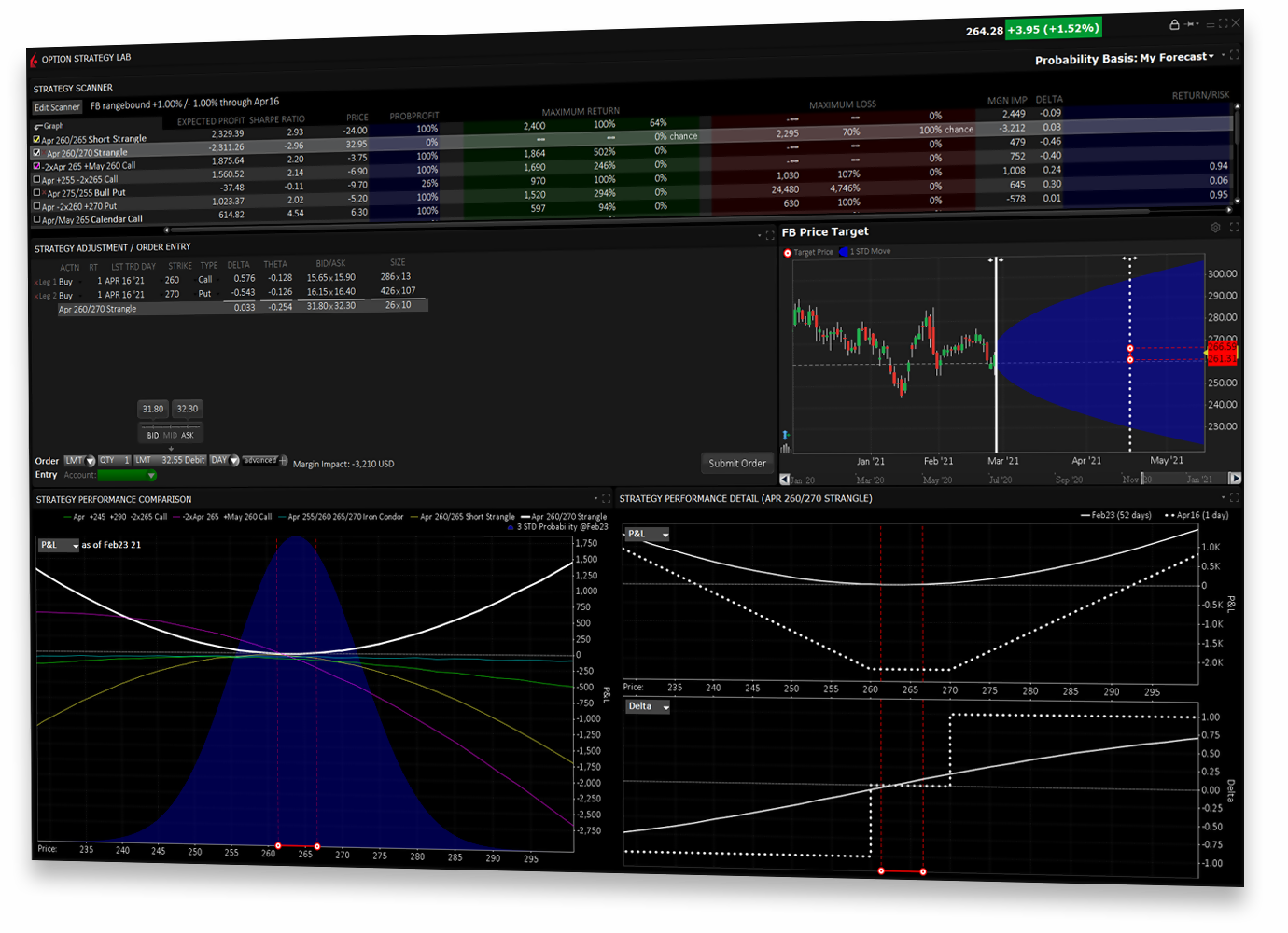

Trading Platform: The trading platform is the hub of your trading activities. Factors to evaluate include the platform’s user interface, ease of navigation, charting capabilities, and order types supported.

-

Market Data and Research: Reliable market data and insightful research are crucial for making informed trading decisions. Assess the quality and depth of the resources provided by potential brokerages.

-

Account Types: Different brokerages offer various account types, tailored to suit diverse trading needs. Consider your trading style, experience level, and financial objectives before selecting an account type.

-

Customer Support: When facing trading difficulties or queries, efficient customer support is invaluable. Evaluate the availability, responsiveness, and reliability of the brokerage’s customer service channels.

Expert Insights: Unlocking Trading Success

Seasoned option traders emphasize the significance of emotional control and risk management in navigating market fluctuations. They advocate for developing a trading plan, conducting thorough research, and adhering to a disciplined trading approach.

Actionable Tips for Aspiring Traders:

-

Start with a simulated trading account to hone your skills without risking real capital.

-

Diligently study options pricing models, such as the Black-Scholes model, to gain a comprehensive understanding of contract valuation.

-

Seek mentorship or engage with trading communities to learn from experienced traders and stay abreast of market trends.

Image: financesonline.com

Online Option Trading Brokerages

Image: www.angelone.in

Conclusion

The intricacies of online option trading brokerages can be formidable, especially for novice traders. However, by equipping yourself with the knowledge outlined in this guide, you can chart a path towards informed decision-making and empower yourself to navigate the complexities of the options market. Remember, the key to success lies in continuous learning, emotional fortitude, and a disciplined approach to trading. We encourage you to explore additional resources and engage with the trading community to expand your knowledge and enhance your trading journey.