We’ve all heard stories of investors striking it rich in the stock market, seemingly overnight. But what if you don’t have a crystal ball or the time to dedicate to constant market monitoring? Enter non-directional weekly options trading, a strategy designed to capitalize on the passage of time, regardless of market fluctuations.

Image: thecoursedl.com

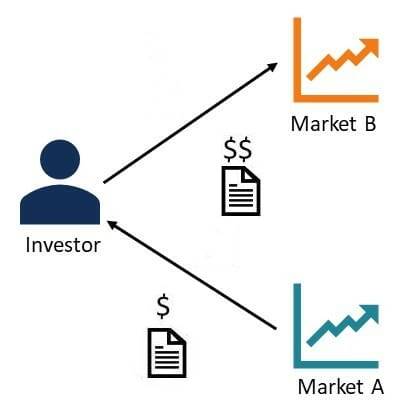

Non-directional options trading, simply put, involves buying and selling options contracts that don’t speculate on the direction of an underlying asset. Instead, traders focus on profiting from the decay of time premiums. It’s a strategy that can generate consistent income, even in volatile markets.

How Weekly Options Trading Works

Options contracts grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a certain price (strike price) on or before a set date (expiration date). Time is a critical factor in options trading as the value of an option decays as the expiration date approaches. This phenomenon is known as time decay and is the cornerstone of non-directional weekly options trading.

In weekly options trading, traders buy out-of-the-money (OTM) options contracts, meaning the strike price is slightly above (for call options) or below (for put options) the current market price of the underlying asset. OTM options are typically inexpensive, offering a relatively low barrier to entry.

As time passes, the value of these OTM options erodes due to time decay. The closer the contract gets to expiration, the less time value it retains. This decay is amplified as the probability of the option expiring worthless increases. It’s this decay that traders leverage in non-directional options trading.

The Mechanics of Non-Directional Options Trading

Non-directional options trading typically involves executing a combination of strategies:

-

Option Buying: Buying OTM call or put options with a short expiration period (e.g., weekly contracts).

-

Rolling Options: Exiting a losing option position by selling it and reinvesting the proceeds in a new option contract with a further out expiration date.

-

Closing Positions: Profiting from option contracts by selling them back to the market before expiration.

Traders aim to time these trades to maximize the benefit of time decay while limiting the potential for significant losses.

Expert Insights on Non-Directional Options Trading

According to experienced trader Mark Sebastian, “Non-directional weekly options trading is not about predicting the future; it’s about managing time and playing the odds.” Renowned market strategist Larry Connors emphasizes the importance of disciplined risk management in this strategy, stating, “It’s not about hitting home runs with every trade. It’s about managing your losses and letting the winners run.”

Image: www.quantsapp.com

Tips for Success in Non-Directional Weekly Options Trading

-

Understand the Risks: While non-directional options trading can be profitable, it’s crucial to recognize the inherent risks involved. Only allocate capital you’re willing to lose.

-

Choose Liquid Underlyings: Select options contracts for underlying assets with high liquidity (e.g., major stock indices, ETFs, or high-priced individual stocks).

-

Manage Your Trades: Monitor your positions regularly and make adjustments as needed. Don’t hesitate to roll or close positions to limit losses or lock in profits.

-

Set Realistic Expectations: Non-directional options trading is not a get-rich-quick scheme. Consistent profits require patience, discipline, and a clear trading plan.

Non Directional Weekly Options Trading System

Image: www.derivbinary.com

Conclusion: Time Is on Your Side

Non-directional weekly options trading offers a powerful way to harness the power of time in financial markets. By focusing on the decay of time premiums, traders can generate consistent income, regardless of market direction. However, it’s imperative to approach this strategy with a solid understanding of risk management and a realistic approach to potential rewards. Embrace the passage of time as your ally, and you too can unlock the potential of non-directional weekly options trading.