The Nifty 50 index, a benchmark of the Indian stock market, has gained immense popularity among traders due to its high volatility and liquidity. Trading Nifty options, which provide the right but not the obligation to buy or sell the index at a predetermined price, presents a unique opportunity for investors to capitalize on market movements. Nifty options trading calls, issued by experienced analysts, offer valuable insights into market trends and potential trading strategies. Understanding the nuances of Nifty options trading calls can be instrumental in maximizing profits and minimizing risks.

Image: stockboxtech.com

Delving into the World of Nifty Options

An option contract grants the holder the right, but not the responsibility, to buy (call option) or sell (put option) an underlying asset at a specified price (known as the strike price) within a certain period (referred to as the expiration date). Nifty options trading calls involve the purchase of a call option, giving the buyer the right to purchase the Nifty at the strike price before the expiration date. Call options are typically employed in bullish market scenarios where traders expect the Nifty to rise in value.

Anatomy of a Nifty Option Call

Understanding the key components of a Nifty option call is vital for successful trading:

- Symbol: Unique identifier of the option contract, which includes the ticker ‘Nifty’, followed by the expiry date in the format ‘MMYY’ and a call/put indicator (CE/PE), and the strike price.

- Strike Price: The price at which the holder can buy or sell the underlying Nifty index.

- Expiratory Date: The date on which the option contract expires and becomes worthless. Nifty options expire once a month.

- LTP (Last Traded Price): The most recent traded price of the option contract in the market.

- Open Interest: The total number of outstanding contracts of a particular option series and strike price that have not been closed or executed.

Charting the Course: Nifty Options Trading Calls Unveiled

Professional analysts meticulously research market trends, technical indicators, and economic data to provide Nifty options trading calls. These calls are categorized as follows:

- Monthly Calls: Focus on long-term trends, issued for a period of one month or more.

- Weekly Calls: Analyze shorter-term market movements, typically issued for one week or less.

- Intraday Calls: Provide real-time insights for traders looking to capitalize on short-term price fluctuations within the same trading day.

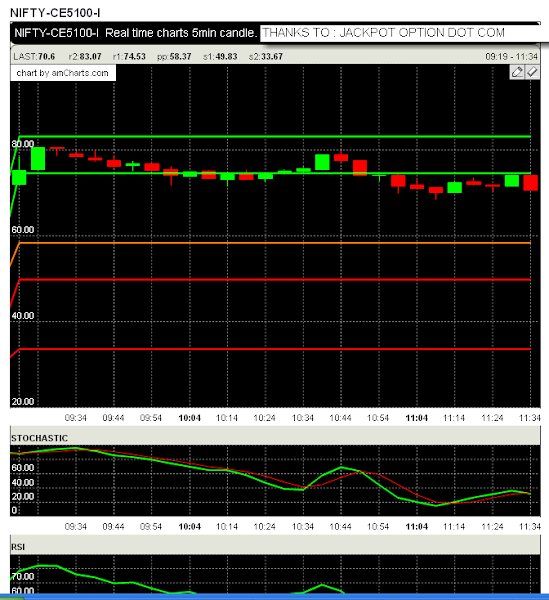

Image: www.traderji.com

Nifty Options Trading Calls

Image: sanapidyqel.web.fc2.com

Dissecting the Anatomy of a Nifty Options Call

- Call Symbol: NiftyCE20SEP35000

- Strike Price: 35000

- Expiratory Date: 20th September

- LTP: Rs. 200

- Open Interest: 2,500,000

- Call Function: Purchase Nifty at Rs 35,000 by