In the realm of investment, options trading offers a tantalizing blend of opportunity and risk. With a meticulous understanding of the intricacies of this complex market, traders have the potential to reap significant rewards. However, behind the promise of high returns lies an equally important element often overlooked by novice traders – the costs associated with option trading. Like a hidden reef lurking beneath the shimmering surface, these costs can erode profits and even derail trading strategies. To navigate the waters of option trading successfully, a thorough understanding of these costs and their impact is essential.

Image: www.pinterest.co.uk

A Deep Dive into the Costs of Option Trading

The complexities of option trading present a wide range of costs to consider, each with its unique effect on the overall returns. These costs can be broadly categorized into two primary groups: direct and indirect costs.

Direct costs are those immediately involved in the transaction itself. These include:

-

Option Premium: The premium paid upfront to acquire an option contract. This is the primary cost of option trading and represents the value of the option’s right to buy or sell an asset.

-

Brokerage Commissions: Fees charged by the brokerage firm for executing the trade. These commissions can vary based on the firm, the type of option traded, and the volume of trades.

-

Regulatory Fees: Imposed by regulatory authorities, these fees are designed to cover the costs of market oversight and regulation. They are typically a small percentage of the transaction value.

Indirect costs, while not directly related to the transaction, can nevertheless impact overall returns. These include:

-

Slippage: The difference between the expected price of execution and the actual price obtained. This can occur during periods of high market volatility, resulting in potential losses or reduced profits.

-

Time Decay: The gradual loss of value of an option contract as its expiration date approaches. Options with shorter expiration dates incur more rapid time decay than longer-term options.

-

Margin Interest: If an option trader uses margin trading, interest charges will be incurred on the borrowed funds used to purchase the options.

Minimizing Costs and Maximizing Returns

While the costs associated with option trading are unavoidable, there are strategies traders can employ to minimize their impact and maximize returns:

-

Negotiate Brokerage Commissions: Firms often offer lower commissions for higher trading volumes. By negotiating with the broker, traders can secure more favorable rates.

-

Consider Indirect Costs: Indirect costs like slippage and time decay can be mitigated by choosing the right trading strategies. Shorter-term options, for example, face greater time decay and should be traded with caution.

-

Use Limit Orders: Limit orders allow traders to specify the maximum or minimum price at which they are willing to execute a trade. This helps avoid slippage during market volatility.

-

Understand Margin Trading: If margin trading is necessary, ensure a complete understanding of the interest charges and potential risks involved.

-

Education and Due Diligence: Knowledge is power in the trading world. Taking the time to educate oneself on option trading strategies, market dynamics, and the potential costs involved will empower traders to make informed decisions.

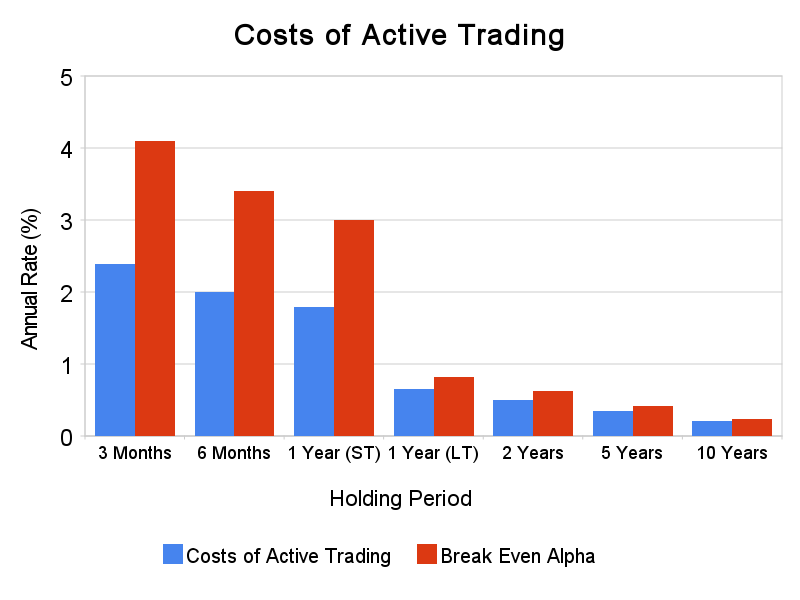

Image: www.mariposacap.com

Option Trading Costs

Image: www.projectfinance.com

Conclusion

The realm of option trading is replete with opportunities and challenges. While the potential rewards are alluring, it is crucial to be mindful of the costs associated with this complex market. By understanding the various direct and indirect costs involved and adopting effective strategies to mitigate their impact, traders can position themselves for success. Embracing a mindset of continuous learning and prudent risk management will pave the way for informed decision-making and the full realization of returns.