Options trading can be an intimidating realm for those new to the world of finance. But fear not, young Padawan, for this comprehensive guide will provide you with the knowledge and confidence to navigate this complex terrain like a pro. Let’s dive right in and unravel the secrets of options trading, empowering you to make informed decisions and potentially reap the rewards.

Image: www.soup.io

What’s the Buzz About Options?

What Exactly Are Stock Options?

Think of stock options as contracts that give you the right, but not the obligation, to buy or sell a specific number of shares of a particular stock at a predetermined price (known as the strike price) on or before a certain date (the expiration date). These contracts act like tickets that grant you the option to exercise this right if and when you choose.

Types of Options: Call vs. Put

Options come in two main flavors: calls and puts. Calls give you the right to buy a stock, while puts provide the right to sell. When you buy a call option, you’re betting that the stock price will rise above the strike price. Conversely, if you buy a put option, you’re anticipating that the stock price will fall below the strike price.

Understanding Option Terminology

Unraveling the lingo is crucial for options trading. Here’s a glossary to familiarize yourself with:

- Premium: The price you pay for an option contract.

- Strike Price: The agreed-upon price at which you can buy or sell the stock.

- Expiration Date: The date by which you must exercise your right to buy or sell the stock.

- In The Money (ITM): When the strike price is favorable for exercising the option.

- Out of The Money (OTM): When the strike price is unfavorable for exercising the option.

Image: victorytale.com

The Mechanics of Options Trading

Once you’ve grasped the basics, it’s time to get down to the nitty-gritty of options trading. Here’s how it works:

- Identify an Opportunity: Analyze market trends and identify stocks with potential for price movement that aligns with your call or put strategy.

- Choose Your Option: Decide if you want to buy a call or put based on your prediction of the stock’s price movement.

- Set Strike Price and Expiration: Determine the strike price and expiration date that align with your investment goals and risk tolerance.

- Pay the Premium: The premium is the cost of your option contract. Keep in mind, it’s an upfront investment, regardless of whether you exercise your right to buy or sell.

- Monitor and Adjust: Regularly track the stock’s price and monitor market conditions. If necessary, adjust your strategy or close out the position to limit losses.

Tips and Expert Advice

Navigating the world of options trading requires a blend of knowledge, strategy, and expert guidance. Here are a few tips to help you along the way:

- Educate Yourself: Dive into books, online resources, and consult with financial advisors to build a strong foundation in options trading.

- Start Small: Don’t jump in headfirst with large investments. Start with smaller trades to gain experience and understand the risks involved.

- Manage Risk: Risk management is paramount. Options trading can amplify potential gains but also magnifies losses. Set stop-loss orders to limit downside risk.

- Stay Informed: Keep up-to-date with market news, company announcements, and industry trends that may impact your options positions.

- Seek Professional Advice: If you’re a complete newbie or dealing with complex trading strategies, don’t hesitate to consult with a qualified financial professional.

Frequently Asked Questions (FAQs)

Q: Are options trading suitable for beginners?

A: While options trading offers the potential for higher returns, it’s not recommended for complete novices due to its complexity and inherent risks.

Q: How can I minimize losses in options trading?

A: Implement risk management strategies, such as setting stop-loss orders, trading smaller positions initially, and diversifying your portfolio.

Q: What is the difference between a futures contract and an options contract?

A: Options contracts give you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a particular date. Futures contracts, on the other hand, obligate you to buy or sell a certain quantity of an underlying asset at a predetermined price on a specific date.

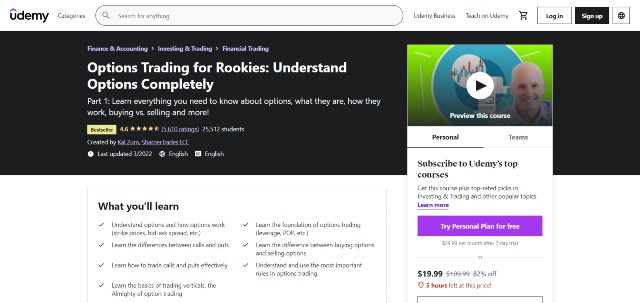

Options Trading For Rookies Complete Guide To Stock Options

Image: www.youtube.com

Conclusion

Options trading can be a powerful tool for discerning investors seeking to enhance their portfolios. However, it’s crucial to approach this domain with caution and a deep understanding of the associated risks. By arming yourself with the knowledge and strategies outlined in this guide, you can unlock the potential of options trading and make informed decisions that align with your financial goals.

Do you feel equipped to embark on your options trading journey? Remember, knowledge is your most valuable asset in this arena. Continue to learn, seek guidance when needed, and let this guide serve as your trusty compass. The world of options trading awaits your exploration. Good luck!