Introduction

The world of option trading holds immense potential for savvy investors seeking to augment their financial portfolio. Option trading empowers individuals to capitalize on market movements without directly purchasing the underlying asset. Embark on a captivating journey into the realm of option trading as we delve into the nitty-gritty, empowering you with actionable insights and expert strategies to maximize your trading prowess.

Image: investarindia.com

Mastering the Basics

Option trading, in its essence, revolves around the concept of purchasing contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined strike price on or before a specified expiration date. Understanding the different types of options, including calls and puts, is paramount to successful trading. Additionally, grasping the intrinsic and time values of options empowers traders to evaluate their potential returns.

Embracing Advanced Strategies

Beyond the basics, option traders can incorporate versatile strategies tailored to capitalize on varying market scenarios. Long calls, for instance, offer leverage to profit from anticipated stock price increases. Conversely, long puts provide the potential to benefit from downward price movements. Mastering these strategies enables traders to navigate market fluctuations with strategic precision.

Leveraging Technical Analysis

Technical analysis, the art of discerning patterns and trends from historical price data, serves as an invaluable tool for option traders. By studying charts and applying technical indicators, traders can identify opportune entry and exit points, enhancing their chances of successful trades. Popular indicators employed by option traders include moving averages, Bollinger Bands, and relative strength indexes.

Image: www.tradingview.com

Technical Analysis Beyond Charts

While technical analysis predominantly entails scrutinizing charts and identifying patterns, it extends beyond these confines. Advanced techniques involve analyzing volume, open interest, and implied volatility to glean insights into market sentiment and potential price movements. Mastering these nuances empowers traders to make informed decisions based on a comprehensive understanding of market dynamics.

Tapping into Sentiment Analysis

Harnessing sentiment analysis, the process of gauging market sentiment through social media platforms and other data sources, provides option traders with a competitive edge. By discerning the overall market sentiment, traders can align their trading strategies to capitalize on prevailing market trends. For instance, a surge in positive sentiment may indicate potential opportunities in bullish strategies.

Conclusion

Embracing the empowering world of option trading unveils a boundless realm of opportunities for astute investors. By implementing the strategies outlined in this article, you can elevate your trading prowess and harness the power of options to maximize your returns. As you deepen your understanding and refine your skills, you will discover the transformative potential of option trading, enabling you to navigate market fluctuations with unwavering confidence.

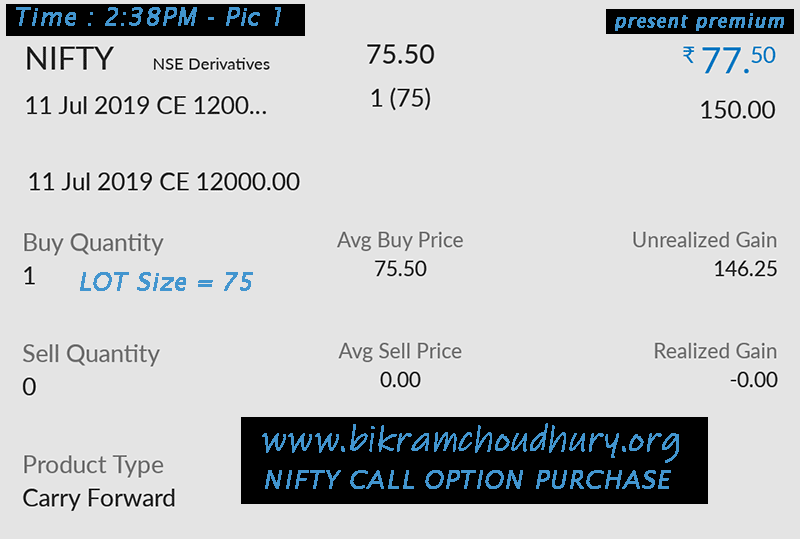

Nifty Option Trading Tips Today

Image: www.bikramchoudhury.org

Are You Ready to Step into the Arena of Option Trading?

The world of option trading awaits your arrival. Embark on this exciting journey and witness your financial horizons expand. Remember, success in option trading lies in continuous learning and adapting to the ever-evolving market landscape. Embrace the challenge, hone your skills, and seize the opportunities that await you in the captivating realm of option trading.