If you’re looking to ramp up your income, you may consider trading options. It’s a popular strategy that experienced traders use to amplify returns. And the Motley Fool, a renowned financial media and investment advisory company, is one of the most popular names in the options trading world.

Image: www.dumblittleman.com

In this comprehensive guide, we’ll delve into everything you need to know about the Motley Fool’s options trading recommendations and strategies. Keep reading to learn:

- What is options trading?

- Motley Fool’s approach to options trading

- Pros and cons of Motley Fool’s options trading services

- Tips for maximizing success with Motley Fool’s options recommendations

So, if you’re ready to take your financial portfolio to the next level, read on and explore the potential benefits of options trading with the Motley Fool.

What is Options Trading?

Options trading involves the buying and selling of options contracts. An option contract gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options contracts are usually utilized to manage risk or to speculate on the future price of an asset.

The Motley Fool’s Approach to Options Trading

The Motley Fool focuses on recommending low-risk, high-reward options trades. The company’s team of experts meticulously analyzes market trends, company fundamentals, and other factors to pinpoint options contracts with a high probability of success.

One of the key tenets of the Motley Fool’s options trading strategy is to identify “asymmetrical” trades. These trades have a high potential upside with limited downside risk. Typically, the Fool recommends selling options contracts that are out-of-the-money, meaning that their strike price is significantly different from the current price of the underlying asset.

Pros and Cons of Motley Fool’s Options Trading Services

As with any investment strategy, the Motley Fool’s options trading services have their advantages and disadvantages. Here are a few pros to consider:

- Time-Saving Convenience: The Motley Fool does the vast majority of the heavy lifting for you. With their research and recommendations, you can skip the time-consuming task of analyzing charts and financial statements.

- Access to Experts: The Motley Fool’s team of experts has a deep understanding of options trading. By following their recommendations, you’re leveraging their expertise for your own financial gain.

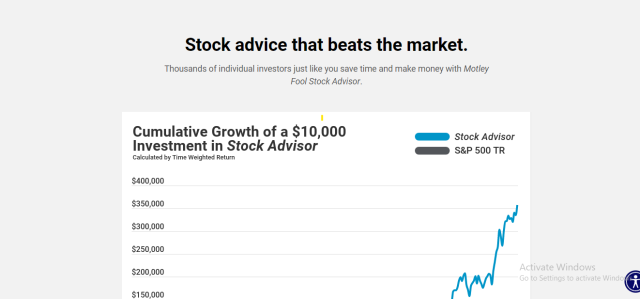

- Proven Track Record: The Motley Fool has a consistent history of success in helping investors achieve their financial goals.

However, there are also a few cons to keep in mind:

- Subscription Fee: The Motley Fool’s options trading services come with a subscription fee. While this fee is minimal compared to the potential returns, it’s still something to consider.

- Limited Control: When you follow the Motley Fool’s recommendations, you’re entrusting your investment decisions to someone else. If you’re uncomfortable with this level of dependence, you may want to seek out other options.

- Complexity: Options trading can be a complex and daunting subject. Even with the Motley Fool’s guidance, it’s important to have a basic understanding of options trading before getting started.

Image: www.dumblittleman.com

Tips for Maximizing Success with Motley Fool’s Options Recommendations

If you decide to join the Motley Fool’s options trading service, here are a few tips to help you maximize your success:

- Do Your Own Research: Supplement the Motley Fool’s recommendations with your own research. This will help you fully understand each trade and its potential risks and rewards.

- Start Small: When you’re starting out, it’s wise to start with small trades. This will allow you to learn and become more comfortable with options trading.

- Follow Their Risk Management Guidelines: The Motley Fool emphasizes the importance of risk management. Always follow their recommended position sizing and risk-reduction strategies.

- Don’t Chase Losses: If you experience a losing trade, resist the urge to chase your losses. Stick to your plan and take a break from trading until you’re ready to regain emotional control.

- Be Patient: Options trading is not a get-rich-quick scheme. It takes time to master the strategies and build a successful track record.

Motely Fool Options Trading

Image: blogonyourown.com

Conclusion

The Motley Fool’s options trading services are a valuable resource for investors looking to amplify their returns. The company’s experienced team of experts, emphasis on risk management, and track record of success make them a reliable partner in your financial journey.

However, it’s important to remember that options trading is not a risk-free endeavor. Always conduct your own research,