Introduction

Image: dcf.fm

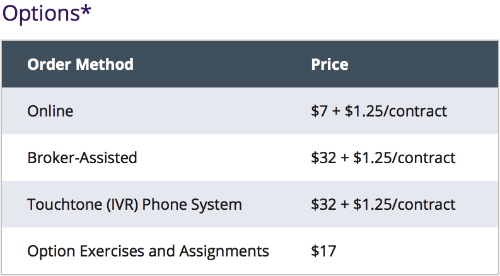

In the realm of financial markets, options trading offers a captivating blend of potential rewards and controlled risk. However, excessive commissions can chip away at your profits, leaving you with diminished returns. Embark on this comprehensive guide to discover the lowest commissions on options trading and maximize your earning potential.

Understanding Options Trading

An option contract conveys a right, but not an obligation, to buy (call) or sell (put) an underlying asset at a specified price within a predetermined time frame. Understanding the basics of options trading is crucial for navigators in this dynamic landscape.

Impact of Commissions

Each trade incurs a commission, which subtracts from your profits. Minimizing commissions is vital, especially for frequent traders and those working with smaller accounts. Lower commissions allow for more efficient capital allocation, leading to enhanced portfolio performance.

Factors Influencing Commissions

Various factors influence options trading commissions, including:

- Brokerage Firm: Different brokerages offer varying commission rates based on account type, trade volume, and membership status.

- Option Type: Call and put options typically carry different commission structures.

- Trade Size: Larger trades often warrant lower commission rates due to volume discounts.

- Order Type: Market orders typically incur higher commissions than limit orders.

Lowest Commission Brokers

Numerous online brokerages offer competitive commissions for options trading. Here are a few highly-rated options:

- M1 Finance: $0 per trade for options

- Fidelity: $0.65 to $1.00 per contract for options

- Webull: $0 per trade for options

- Tastyworks: $0 per trade for options

- TD Ameritrade: $0.65 per contract for options

Choosing the Right Broker

When selecting a broker, consider these factors:

- Commission Rates: Compare commission structures and choose a broker offering the lowest rates that align with your trading frequency and account size.

- Trading Platform: The platform should be user-friendly, efficient, and provide advanced features for options trading.

- Customer Service: Look for brokers with exceptional customer support to address any queries or issues promptly.

Tips for Minimizing Commissions

In addition to choosing a low-commission broker, implement these strategies to further reduce costs:

- Negotiate: Contact your broker and negotiate lower commissions based on your trade volume and history.

- Use Limit Orders: Limit orders avoid market volatility and often incur lower commissions.

- Trade During Off-Peak Hours: Trading during less popular hours can lead to lower commissions.

- Bundle Trades: Combine multiple trades into a single order to qualify for reduced commissions.

Unlock Your Trading Potential

Understanding the lowest commissions on options trading empowers you with the tools to optimize your returns. By carefully selecting a broker and implementing wise trading strategies, you can unleash your full trading potential and navigate the financial markets with greater efficiency.

Image: wigynyqiqih.web.fc2.com

Lowest Commissions On Options Trading

Image: www.youtube.com