In the dynamic world of investing, the ability to trade options with minimal brokerage fees can unlock significant savings and empower traders with greater control over their portfolio. Low brokerage option trading has emerged as a revolutionary concept that is reshaping the financial landscape, offering numerous advantages and paving the way for more accessible and profitable investing strategies.

Image: topecn.com

This comprehensive guide will delve into the intricacies of low brokerage option trading, providing readers with a thorough understanding of its concepts, mechanics, and potential benefits. By exploring the historical evolution, fundamental principles, and real-world applications of this innovative approach, investors can navigate the complexities of the market with confidence and maximize their earning potential.

Historical Evolution of Low Brokerage Option Trading

The origins of low brokerage option trading can be traced back to the late 20th century, when technological advancements and the advent of electronic trading platforms challenged the traditional fee structures of brokerage firms. Prior to this, brokers charged exorbitant commissions on each trade, making option trading inaccessible to many individual investors.

The rise of discount brokers in the 1980s and 1990s disrupted the industry by introducing reduced commissions and simplified account structures. This paved the way for the emergence of online brokerages, which further lowered fees and democratized access to option trading.

Today, the ongoing technological revolution has given rise to a new generation of fintech companies that offer low and even zero brokerage options for option trading. These platforms leverage automation, economies of scale, and innovative business models to minimize operating expenses and pass on cost savings to traders.

Understanding Option Trading

Options are financial instruments that provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility allows investors to speculate on market movements, hedge against risk, and enhance their portfolio returns.

There are two main types of options: calls and puts. A call option gives the buyer the right to purchase an asset at a fixed price, while a put option grants the right to sell an asset at a predetermined price. Options are categorized as either in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM), depending on their relationship to the current market price of the underlying asset.

Benefits of Low Brokerage Option Trading

The advent of low brokerage option trading has brought numerous benefits to investors, including:

-

Reduced Transaction Costs: Low brokerage fees significantly reduce the expenses associated with option trading, allowing investors to retain a greater portion of their profits. This cost reduction can be especially advantageous for active traders who execute multiple trades daily.

-

Improved Profit Potential: By minimizing brokerage fees, investors can maximize their earnings on each trade. The savings can accumulate over time, boosting the overall profitability of their option trading strategies.

-

Increased Accessibility: Low brokerage option trading has made it possible for more people to participate in option trading, regardless of their financial resources. The reduced barriers to entry have democratized access to complex financial instruments, empowering a broader range of investors to pursue their financial goals.

-

Enhanced Trading Flexibility: Low brokerage fees provide investors with greater flexibility to adjust their portfolios and execute trades based on market changes. The reduced cost burden encourages more frequent trading and allows investors to take advantage of short-term opportunities without incurring high transaction fees.

-

Increased Control: By choosing a low brokerage option trading platform, investors assume greater control over their trading costs. The transparency and predictability of fees empower traders to make informed decisions and allocate their resources effectively.

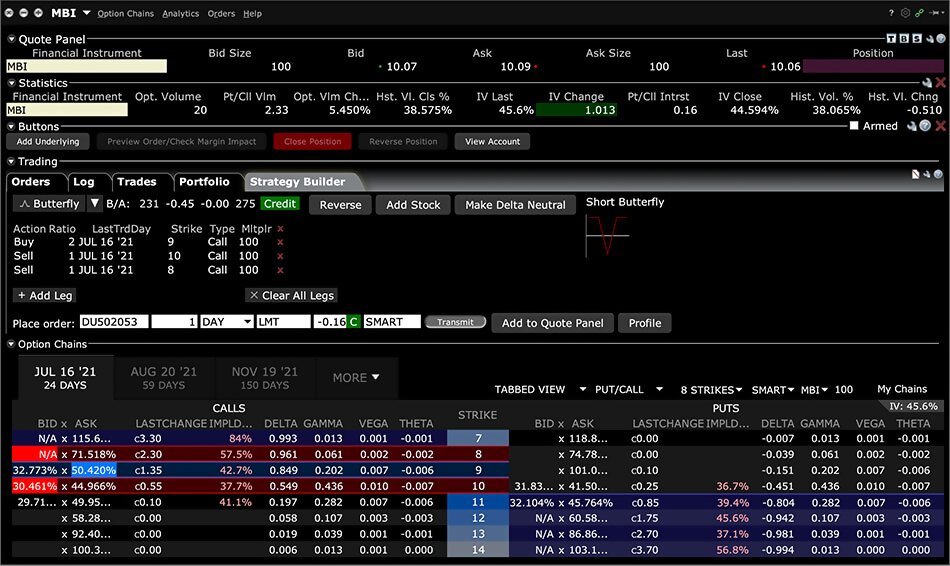

Image: www.interactivebrokers.co.uk

Choosing a Low Brokerage Option Trading Platform

When selecting a low brokerage option trading platform, there are several key factors to consider, including:

-

Brokerage Fees: The most critical factor is the brokerage fees charged on each trade. Compare the fee structures of different platforms to identify the most competitive rates that meet your trading needs.

-

Trading Platform and Functionality: The trading platform should be user-friendly, intuitive, and provide the necessary tools and resources for option trading. Consider features such as live market data, technical analysis tools, and mobile trading capabilities.

-

Regulation and Reputation: Choose platforms that are regulated by reputable financial authorities and have a proven track record of reliability and customer satisfaction. Conduct thorough due diligence to ensure the platform’s compliance with industry standards and ethical practices.

-

Customer Support: Assess the quality of customer support offered by the platform. Responsive and knowledgeable support can be invaluable, especially for new or experienced traders who may encounter questions or technical issues.

-

Additional Services: Some platforms offer additional services beyond option trading, such as margin trading, retirement accounts, or educational resources. Consider the value of these services and how they align with your investment objectives.

Low Brokerage Option Trading

Image: www.5paisa.com

Real-World Applications of Low Brokerage Option Trading

Low brokerage option trading has found widespread application across financial markets and can be used for a variety of strategies, including:

-

Speculation: Options can be utilized to speculate on the future price movements of assets. Traders can purchase calls if they anticipate a price increase or buy puts if they expect a price decrease to profit from favorable market conditions.

-

Hedging: Options are powerful hedging tools that can protect against potential losses in existing investments. By employing option strategies such as protective puts or collars, investors can define their risk appetite and safeguard their portfolio value.

-

Income Generation: Options can also serve as a source of income through premium selling. By selling options, investors receive a premium upfront and assume an obligation to buy or sell the underlying asset at a specified price. This strategy can generate income even if the options expire worthless.

-

Volatility Trading: Options provide a unique way to