The world of options trading has gained immense popularity in recent years, and Robinhood has emerged as a prominent platform for retail investors looking to delve into this exciting market. In this comprehensive guide, we will explore the nuances of options trading on Robinhood, empowering you with the knowledge to make informed decisions and potentially maximize your returns.

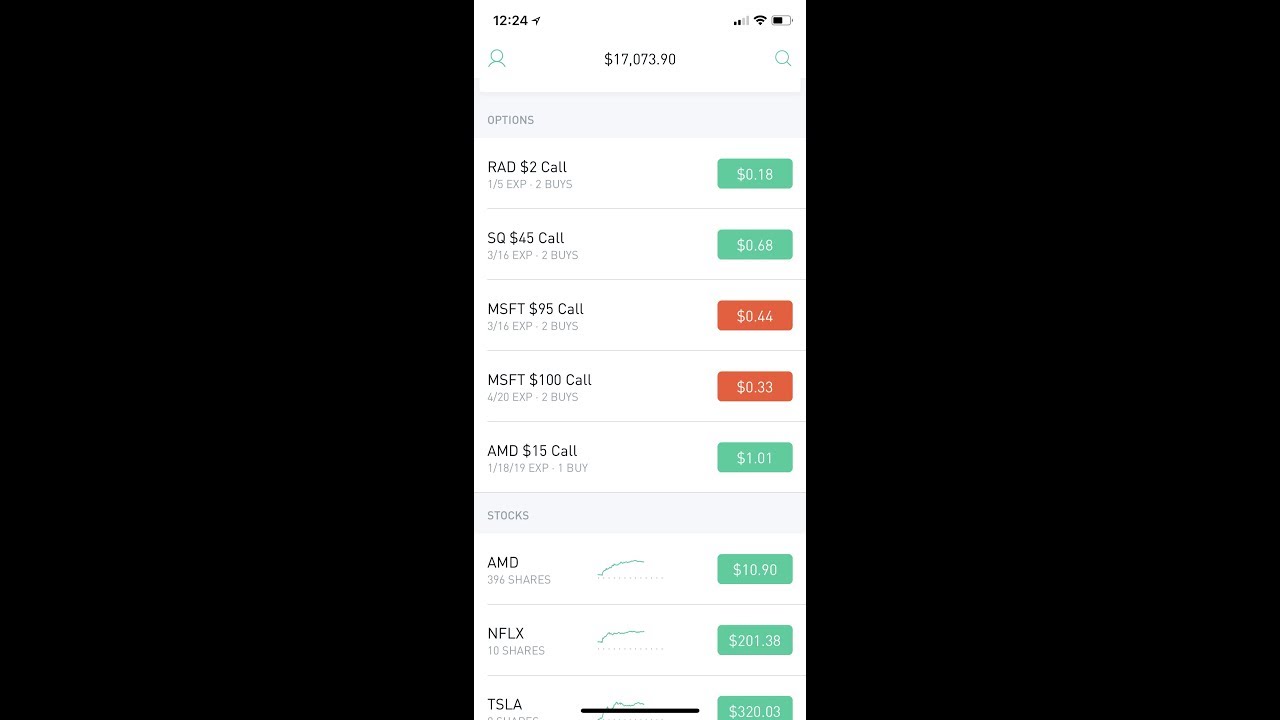

Image: www.youtube.com

Embarking on the Options Journey on Robinhood

Understanding Options Trading: Defining the Basics

Options are financial instruments that confer upon the holder the right, but not the obligation, to buy (in the case of call options) or sell (for put options) the underlying asset at a specified price before a particular date. These versatile contracts allow investors to participate in market movements without directly owning the underlying asset, providing opportunities for both speculation and hedging.

Exploring the History of Options Trading: A Testament to Ingenuity

The origins of options trading can be traced back to ancient Greece, where merchants would use forward contracts to manage the uncertainties associated with maritime trade. Over centuries, options have evolved from simple agreements to complex derivatives, shaping the modern financial landscape.

Navigating Options Trading on Robinhood

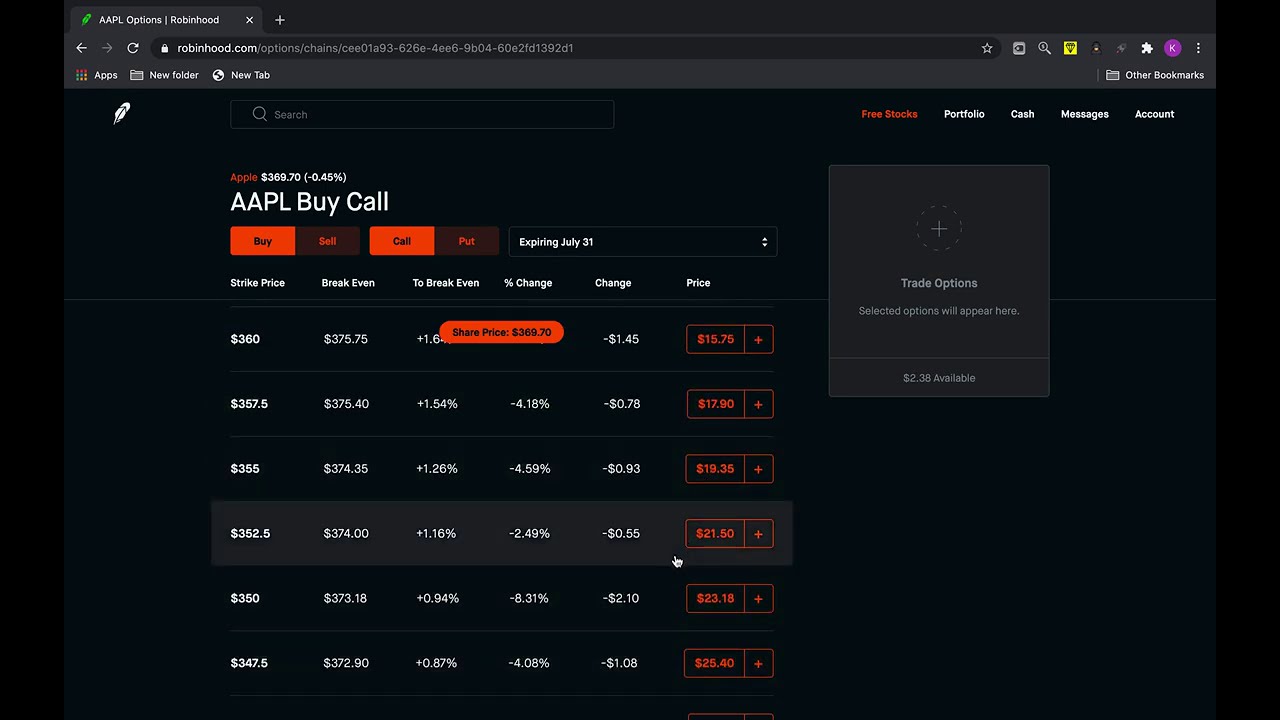

Image: www.youtube.com

Options Trading Robinhod

Image: medium.com

Demystifying Option Types: A Blueprint for Traders

In the realm of options, there are two primary types to grasp: call and put options. Call options grant the holder the right to buy the underlying asset, while put options bestow the right to sell. Understanding these options empowers you to craft strategies aligned with your investment goals.

Mastering Option Premiums: The Cornerstone of Pricing

Options premiums, the price you pay to acquire an options contract, are pivotal in options trading. These premiums are influenced by various factors, including the price of the underlying asset, the time until expiration, and implied volatility. A thorough understanding of premium dynamics is crucial for informed decision-making.

Delving into Expiration and Exercise: The Temporal Dimensions

Options possess two critical temporal dimensions: expiration and exercise. Expiration refers to the date after which the options contract becomes void. Exercise, on the other hand, refers to the act of converting an options contract into a transaction for the underlying asset. Mastering the nuances of expiration and exercise is imperative for effective options trading.

Harnessing Greeks: Unveiling the Hidden Determinants

Greeks are a set of metrics that quantify the risk and sensitivity of options contracts. Delta measures the change in the option’s price relative to the underlying asset’s price, gamma gauges the rate of change in delta, theta assesses the decay in the option’s value over time, and vega reflects the impact of volatility on the option’s price. Expertise in Greeks enables traders to fine-tune options strategies and mitigate risk.

Tips and Expert Insights: Empowering Your Options Journey

To elevate your options trading endeavors, consider these invaluable tips:

– Begin cautiously and gradually increase your involvement as you gain experience.

– Diligently research and select suitable options strategies that align with your investment objectives.

– Pay close attention to earnings announcements and economic conditions, as these can significantly impact options prices.

– Practice sound risk management techniques, such as diversification and position sizing.

– Seek guidance from experienced traders or educational resources to enhance your knowledge.

Frequently Asked Questions

To address common queries, here’s a comprehensive FAQ:

Q: Am I eligible for options trading on Robinhood?

A: To engage in options trading on Robinhood, you must satisfy specific criteria, including meeting minimum account balance requirements and passing an options trading quiz.

Q: Are there risks involved in options trading?

A: Yes, options trading carries substantial risk. Losses can exceed the amount invested.

Q: What strategy should I implement as a beginner options trader?

A: Covered calls and cash-secured puts are relatively beginner-friendly options strategies.

Q: How do I calculate options profits?

A: To determine options profits, calculate the difference between the option’s premium value and the price of the underlying asset.

Q: What is the maximum time frame for options?

A: The maximum duration for most options is approximately two years.

Call to Action

Delve into the dynamic world of options trading with this comprehensive guide as your compass. Remember that education and practice are the cornerstones of successful options trading. Embrace this opportunity to expand your financial horizons and potentially unlock new avenues for growth.

Are you intrigued by the possibilities of options trading on Robinhood? Let us know in the comments below!