Understanding the Moving Average in Option Strategy

In the dynamic world of option trading, understanding market trends is crucial for successful decision-making. One essential tool that traders rely on to analyze price movements is the Moving Average (MA). MA is a technical indicator that provides traders with insights into the average price of an underlying asset over a specified period. By studying MA, traders can identify trends, determine support and resistance levels, and make informed trading decisions. This guide will delve into the intricacies of MA in option trading, explaining its significance, types, and practical applications.

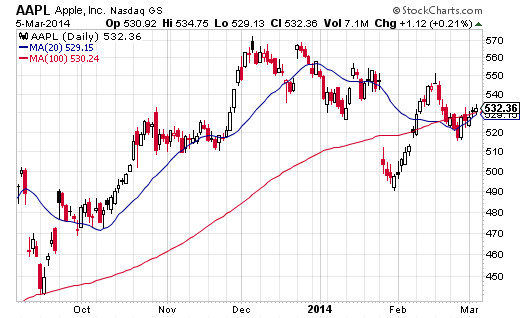

Image: movingaveragetrader.com

What is a Moving Average?

A moving average is a technical indicator that calculates the average price of an asset over a defined number of periods, typically days or trading sessions. The most common types of MAs are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). SMA gives equal weightage to all data points within the specified period, while EMA assigns exponentially higher weightage to recent data.

Significance of MA in Option Trading

MA plays a vital role in option trading, as it helps traders identify market trends and make informed decisions. By studying MA, traders can:

- Determine Market Trends: Rising MA indicates an uptrend, while falling MA suggests a downtrend.

- Set Support and Resistance Levels: MA levels often act as support (for rising MA) or resistance (for falling MA) levels, indicating significant price points.

- Time Option Entries and Exits: Traders can use MA crossovers (when a shorter-term MA crosses a longer-term MA) as potential entry or exit points for options trades.

- Manage Risk: MA can provide insights into market volatility, allowing traders to adjust their risk management strategies accordingly.

Types of Moving Averages

The two primary types of MAs used in option trading are:

- Simple Moving Average (SMA): Calculated by adding up the closing prices of an asset over a specified period and dividing the total by the number of periods.

- Exponential Moving Average (EMA): Calculated using a weighted average, giving more importance to recent closing prices. The EMA reacts faster to price changes compared to SMA.

Image: blog.dhan.co

Choosing the Right Period for MA

The period chosen for MA depends on the trader’s trading strategy and the asset being traded. Shorter-term MAs (e.g., 5-day or 10-day) provide more sensitivity to price changes, while longer-term MAs (e.g., 50-day or 200-day) help identify long-term trends.

Using MA in Option Trading Strategies

Traders can incorporate MA into various option trading strategies, including:

- MA Crossovers: Traders can use crossovers between short-term and long-term MAs to identify potential entry or exit points.

- MA Support and Resistance: Traders can use MA levels as potential support or resistance levels when setting up option trades.

- MA Trend Trading: Traders can follow market trends identified by MA to enter options trades in the direction of the trend.

- MA Divergences: Traders can look for divergences between MA and price action to identify potential trading opportunities.

What Is Ma In Option Trading

Image: the5ers.com

Conclusion

Moving Average (MA) is a versatile technical indicator that empowers option traders with valuable insights into market trends and price movements. Understanding the different types of MAs and their applications can significantly enhance the effectiveness of option trading strategies. By incorporating MA into their analysis, traders can increase their chances of identifying profitable trading opportunities while managing risk effectively. As with any technical indicator, it’s important to remember that MA is not a fail-safe method and should be used in conjunction with other trading tools for optimal results.