In the ever-evolving world of financial markets, option trading plays a pivotal role, offering investors the potential for substantial gains while hedging against risks. Among the various options trading strategies, limit price option trading stands out as a prudent approach, allowing traders to execute trades at specific prices within a predefined range.

Image: www.pinterest.com

Limit price option trading grants traders greater control over their trades by enabling them to set predetermined price parameters. By understanding the nuances of this strategy, traders can enhance their trading decisions, increase profitability, and navigate the unpredictable market landscape with greater confidence.

The Art of Limit Price Option Trading

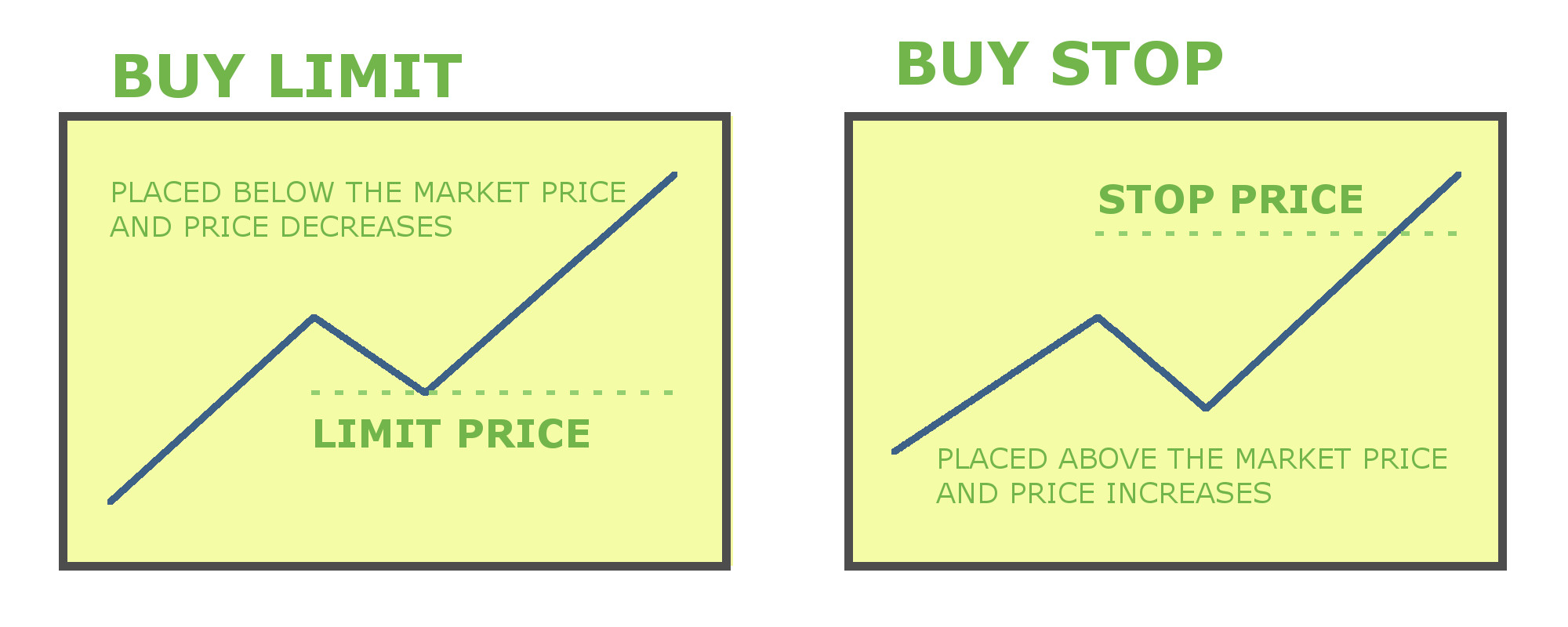

Limit price option trading involves placing orders to buy or sell options contracts at particular price levels that the trader deems favorable. By setting a limit price, traders ensure that their trades are executed only when the market price meets or surpasses the specified threshold.

This approach differs from market orders, where trades are executed at the best available price in the current market conditions. Limit price orders, on the other hand, provide traders with the flexibility to secure trades at a target price, avoiding potential price fluctuations that could erode their profit margins.

Advantages of Limit Price Option Trading

Traders who embrace limit price option trading reap numerous benefits. These include:

- Control over Execution Price: Limit price orders empower traders to determine the exact price point at which their options contracts are bought or sold, reducing the risk of unfavorable price movements.

- Smoothing Market Impact: Placing limit price orders can mitigate the impact of large orders on market prices, preventing sudden price changes and safeguarding against slippage.

- Risk Mitigation: Limit price orders assist traders in managing risk by preventing trades from being executed at extremely unfavorable prices, reducing potential losses.

li>Increased Profit Potential: By setting a precise limit price, traders can optimize their profit potential and avoid selling options contracts at unfavorable prices.

Disadvantages of Limit Price Option Trading

Despite its advantages, limit price option trading also has some potential drawbacks:

- Delayed Execution: Setting limit prices may result in delayed order execution, especially in fast-moving markets, as traders may need to wait for the market price to reach the specified level.

- Missed Opportunities: By setting limit prices, traders may miss out on favorable price movements beyond their predefined range, potentially limiting their profit potential.

- Complexity: Limit price option trading requires a deeper understanding of market dynamics and technical analysis compared to market orders, making it less suitable for novice traders.

Image: howtotradeonforex.github.io

Applications of Limit Price Option Trading

Limit price option trading finds applications in various trading scenarios, such as:

- Trading Wider Ranges: Traders can utilize limit price orders to trade options contracts across a wider price range, increasing their chances of executing trades at desired price levels.

- Time-Sensitive Trading: This strategy is ideal for traders who have a specific time frame to complete their trades, as it allows them to set limit prices and avoid constant order monitoring.

- Minimizing Slippage: In highly volatile markets, limit price orders help traders minimize slippage, ensuring that trades are executed as close as possible to the intended price.

Hedging Strategies: Limit price option trading can be incorporated into hedging strategies, allowing traders to establish downside protection or lock in gains at specific price levels.

Limit Price Option Trading

Image: www.chegg.com

Conclusion

Limit price option trading is a valuable strategy for traders seeking greater control over their trades and enhancing their profitability. By setting specific price thresholds, traders can navigate market fluctuations, mitigate risks, and optimize their trading outcomes. This approach demands a thorough understanding of market dynamics and a well-informed trading plan. By embracing limit price option trading, traders can elevate their trading skills and navigate the complex landscape of financial markets with increased confidence.

Explore additional resources or engage with experienced traders to expand your knowledge and master the art of limit price option trading. Remember, the key to successful trading lies in continuous learning and adaptability. Embrace the opportunities that this strategy presents, and unlock your trading potential.