Introduction

In the ever-evolving world of financial markets, the ability to leverage your investments can be an exhilarating yet treacherous endeavor. Nowhere is this more evident than in the realm of option contracts. Options provide investors with the extraordinary power to potentially amplify their returns, but also amplify their risks if not properly understood. This article aims to demystify the leverage effect associated with option contracts, guiding you through its intricacies and empowering you to make informed trading decisions.

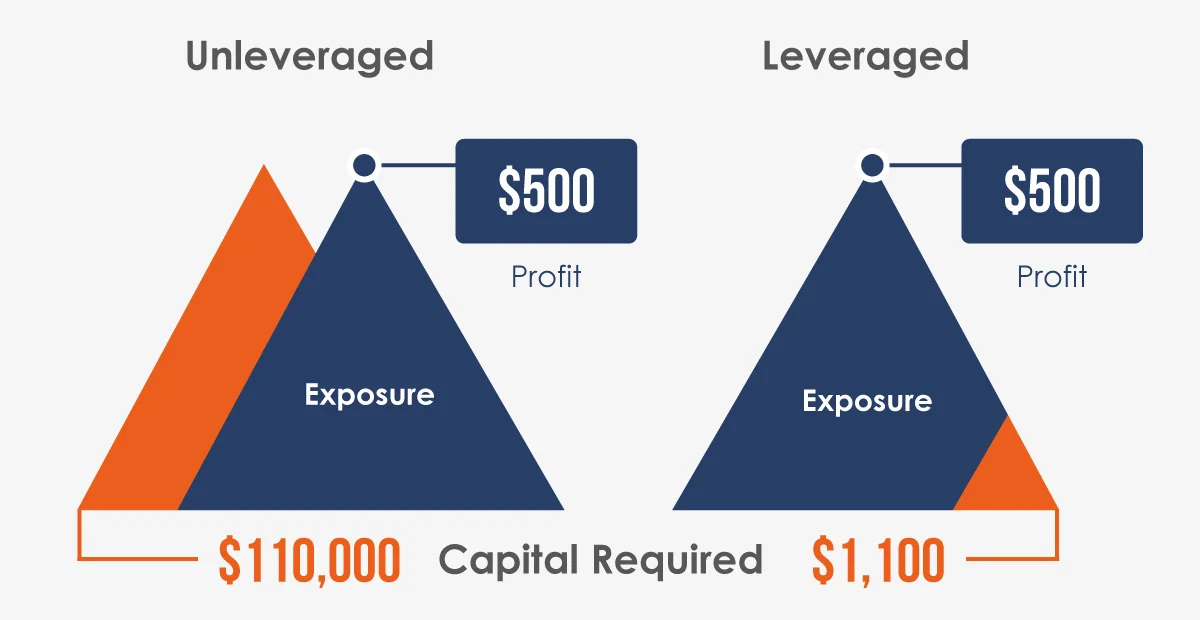

Image: www.atfx.com

Delving into Option Contracts

An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specified date (expiration date). The premium paid for an option contract represents the cost of this right. Unlike stocks, where you must purchase the underlying asset outright, options offer investors the flexibility to control a substantial number of shares without committing the full purchase price.

The Leverage Effect

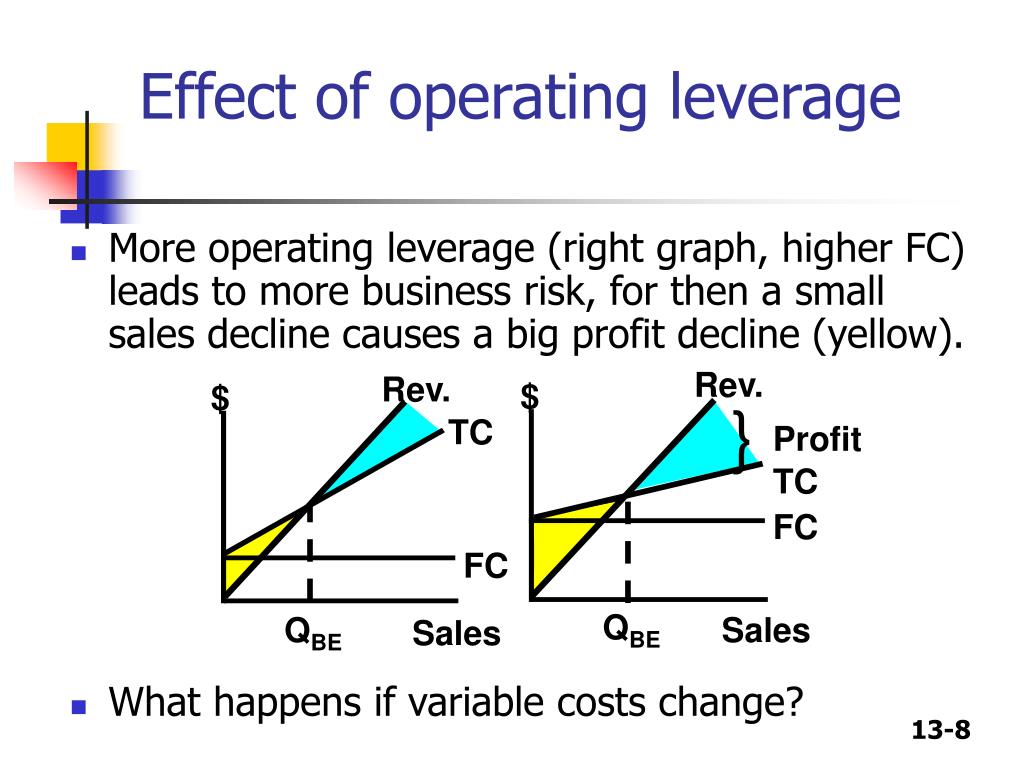

The leverage effect in option contracts arises from the asymmetry between an option’s premium and the potential profit it can generate. Since the premium is a fixed cost, the profit potential is theoretically unlimited. This means that even a small increase in the underlying asset’s value can result in a disproportionately large increase in the option’s value, amplifying your returns. However, it is crucial to remember that this double-edged sword also exposes you to amplified losses if the underlying asset moves against you.

Harnessing Leverage Wisely

To successfully navigate the leverage effect, a disciplined approach is paramount. Begin by defining clear investment goals and risk tolerance. Research the underlying asset thoroughly to make informed trading decisions. Remember, options are volatile instruments, and their value can fluctuate rapidly. Opt for strategies that align with your risk appetite and time horizon. Consider using protective strategies like stop-loss orders to limit potential losses.

Image: www.slideserve.com

Expert Insights

“The leverage effect can be a powerful tool for experienced traders,” advises renowned options expert Mark Douglas. “However, it is essential to understand the risks involved and to trade within your means. Focus on prudent risk management and a disciplined trading plan.”

Echoing this sentiment, veteran trader Dan Zanger emphasizes, “Options provide the opportunity for substantial gains, but they also carry significant risks. It is imperative to fully comprehend the dynamics of the leverage effect before diving in.”

Actionable Tips

-

Start small: Trade with modest amounts initially to gain experience and build confidence.

-

Stay informed: Monitor the underlying asset’s performance and economic indicators to make well-informed trading decisions.

-

Practice risk management: Implement stop-loss orders and position sizing strategies to mitigate potential losses.

-

Seek professional guidance: Consider consulting with a financial advisor or taking educational courses to enhance your understanding of options trading.

Leverage Effect Associated With Trading Option Contracts

Image: www.researchgate.net

Conclusion

The leverage effect associated with option contracts can be a transformative force in your investment journey. By embracing it judiciously, you can amplify your profit potential while managing risks. Remember, options are a powerful tool that can propel you towards financial success. However, remember that informed decision-making, risk management, and a disciplined trading mindset are non-negotiables. May this guide empower you to unlock the transformative potential of options and navigate the financial markets with confidence.