Have you ever wanted to try your hand at options trading but were put off by the high fees other platforms charge? Robinhood has emerged as a popular choice for options traders with its commission-free structure. Options trading is a viable alternative to traditional trading, allowing for increased profit potential. In this article, we’ll delve into the specifics of Robinhood’s options trading fees, decode the complex world of options trading, and provide you with tips and expert advice to equip you for success in this dynamic market.

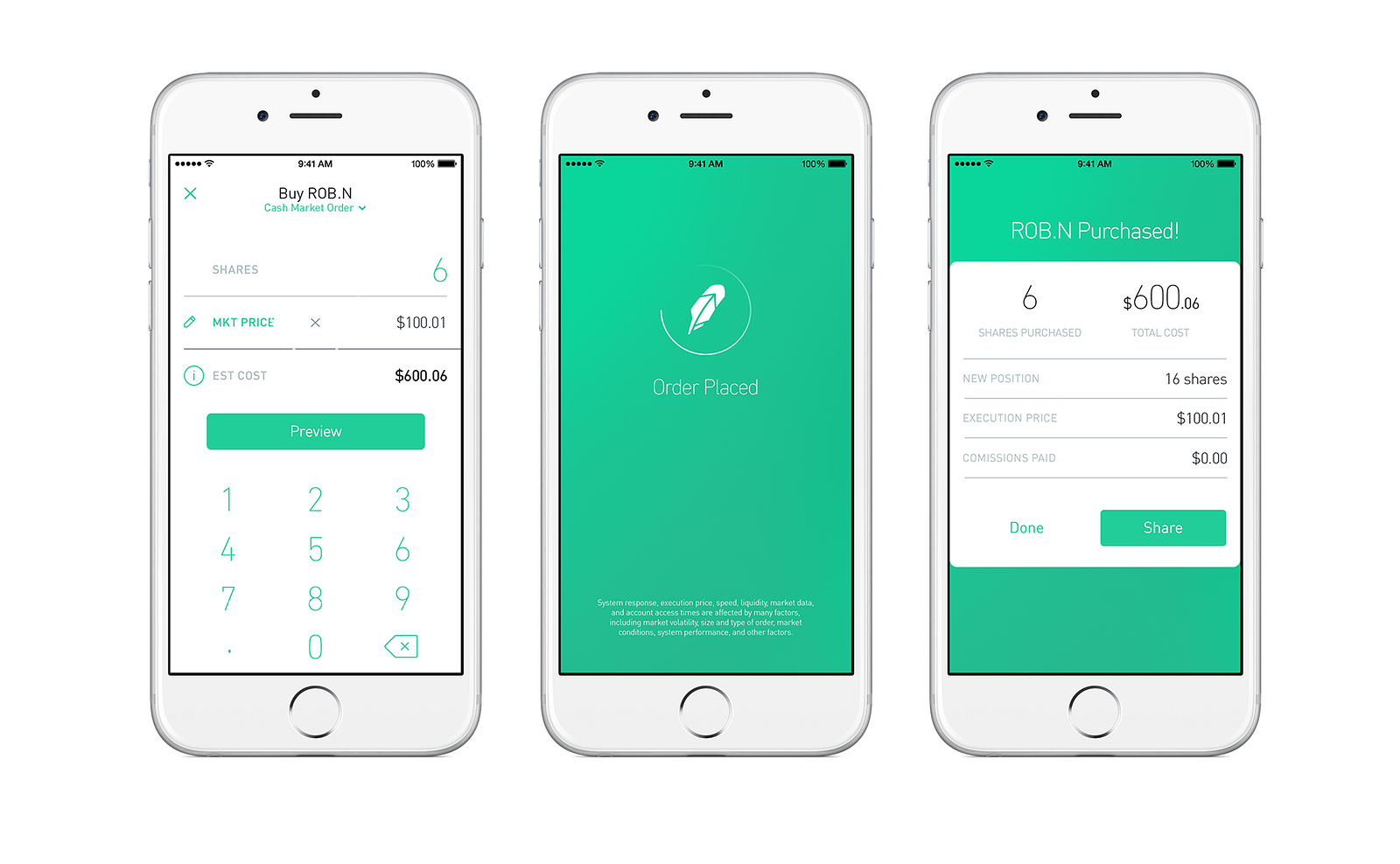

Image: medium.com

Robinhood Options Trading Fees: A Game-Changer

Robinhood disrupted the trading industry by pioneering commission-free trading for stocks, Exchange-Traded Funds (ETFs), and options. This has significantly lowered the barrier of entry for aspiring traders, particularly those with smaller accounts. The beauty of Robinhood’s offering lies in the fact that you can trade options for free, regardless of the number of contracts. This is in stark contrast to traditional brokerages, which typically charge exorbitant fees per contract, making frequent trading an expensive endeavor.

What is Options Trading?

Options trading is a derivative strategy that grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a set expiration date. Options come in two flavors: calls and puts. Calls give you the right to buy, while puts give you the right to sell. By skillfully constructing options strategies, you can potentially amplify your profits or protect your investments from losses.

Understanding Option Premiums and Expiration Dates

An option’s premium is the price you pay to acquire the contract. It reflects the time value and intrinsic value embedded in the option. As the expiration date nears and the asset price moves in your favor, the premium increases. However, the value of an option decays over time, owing to the erosion of time value. Thus, optimal timing is crucial to maximize your returns.

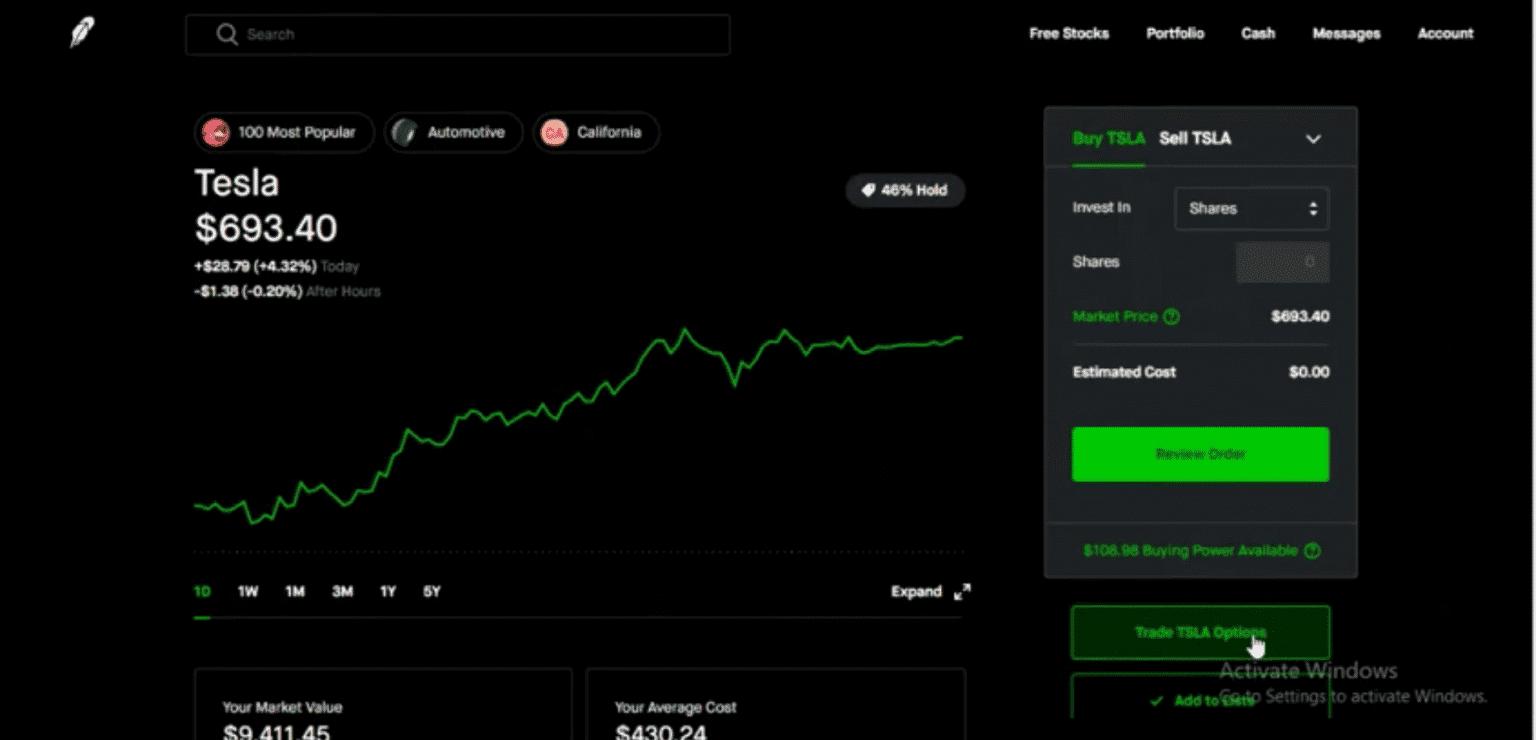

Image: marketxls.com

Decoding the Options Chain

The options chain is a tabulation of all available options for a given underlying asset. It displays various strike prices and expiration dates. Strike price refers to the specific price at which you can exercise your right to buy or sell the asset. The options chain provides a plethora of opportunities to tailor your strategies to suit your financial goals and risk tolerance.

Trading Options on Robinhood

Robinhood provides access to a wide range of options, covering stocks, ETFs, and indices. The platform’s user-friendly interface makes it easy for beginners to get started. Robinhood offers a plethora of educational resources and webinars, empowering you to gain a solid understanding of options trading principles.

Tips and Expert Advice for Robinhood Options Traders

- Start small: Begin with trades you can afford to lose. Gradually increase your position size as you gain experience and confidence.

- Manage risk: A key tenet of successful options trading is risk management. Employ stop-loss orders to limit potential losses.

- Stay updated: Keep abreast of market trends, company news, and geopolitical events. Knowledge is power, and it can equip you to make informed trading decisions.

- Understand your strategy: Before executing a trade, thoroughly comprehend the strategy’s mechanics, risks, and potential rewards.

- Learn from your mistakes: Every trade holds valuable lessons. Analyze your successes and setbacks to continuously refine your approach.

FAQ on Robinhood Options Trading Fees

- Q: How much does it cost to trade options on Robinhood?

A: Robinhood offers commission-free trading for all options contracts, regardless of the number of contracts traded. - Q: Are there any hidden fees associated with Robinhood’s options trading?

A: No, Robinhood does not charge any clearing or exercise fees. - Q: Can I trade options on margin with Robinhood?

A: Yes, Robinhood offers margin trading for options, allowing you to amplify your buying power. - Q: How does Robinhood determine margin requirements for options trades?

A: Margin requirements for options trades are dynamic and depend on factors such as the underlying asset’s volatility, strike price, and time to expiration.

Options Trading Fees Robinhood

Image: streetfins.com

Conclusion

With its competitive fee structure, user-friendly platform, and comprehensive educational resources, Robinhood has democratized options trading. By incorporating the tips and expert advice outlined above, you can leverage Robinhood to navigate the options market with confidence. Whether you are a seasoned pro or just starting your options trading journey, Robinhood provides a solid foundation for success.

Are you intrigued by the possibilities of options trading on Robinhood? Embark on your trading adventure today and unlock the potential for lucrative returns.