In the fast-paced world of options trading, mastering intraday charts is crucial for refining your trading strategies and maximizing your profit potential. I still remember my first successful intraday trade – it was like adrenaline coursing through my veins. The feeling of executing a well-calculated trade and witnessing immediate returns is unparalleled. And every subsequent successful trade only serves to fuel this exhilaration.

Image: www.adigitalblogger.com

The Anatomy of Intraday Option Trading Charts

Intraday option trading charts are the visual representations of the price movements of an underlying asset within a single trading day. They play a pivotal role in identifying trading opportunities, predicting market direction, and gauging market sentiment.

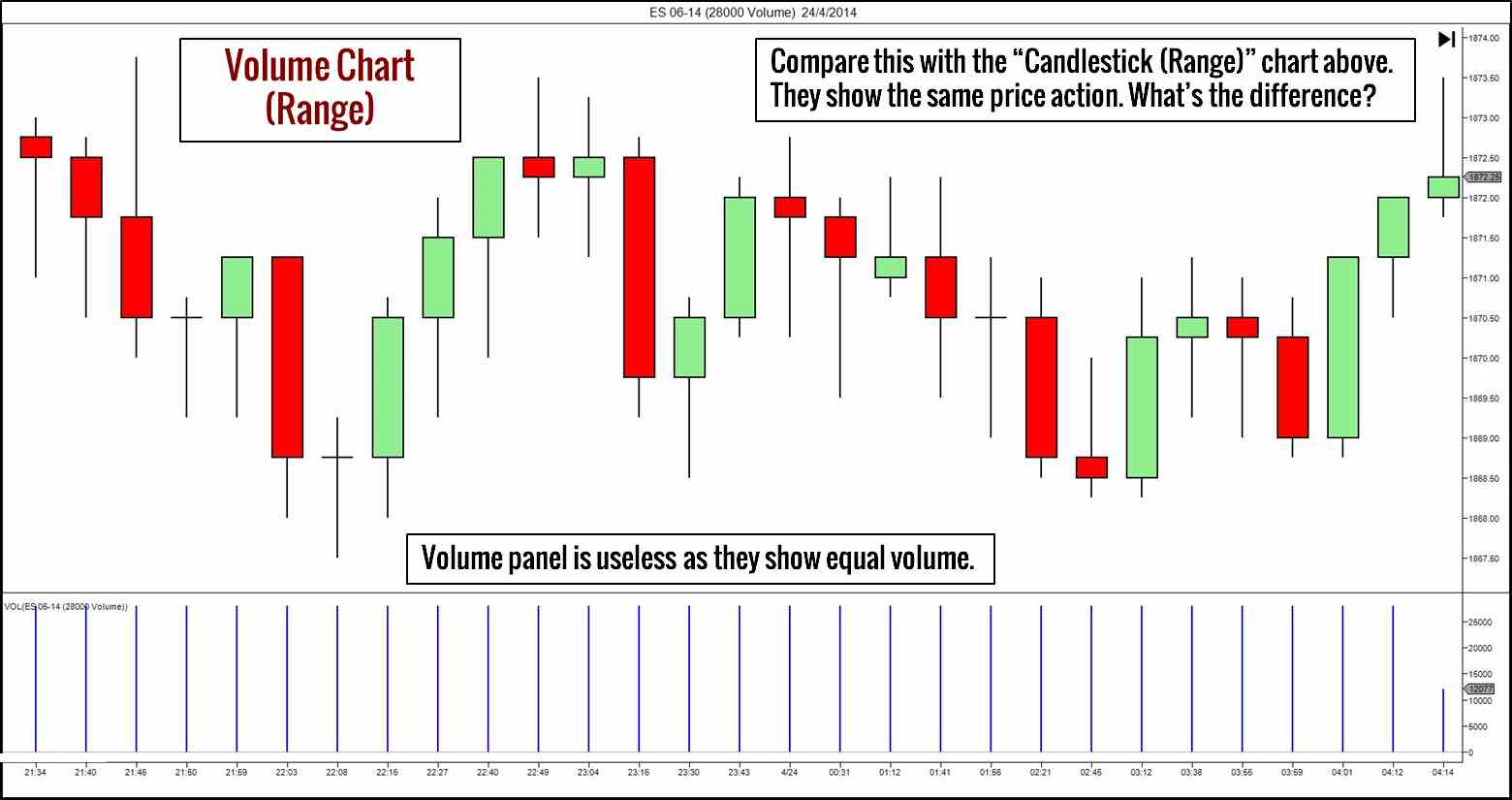

Traders use various chart types to analyze price action, each providing unique insights. Some commonly used chart types include bar charts, candlestick charts, line charts, and point-and-figure charts. Bar charts display the open, close, high, and low prices for each time interval, while candlestick charts provide additional information about market sentiment by incorporating the size and color of the candlesticks. Line charts offer a simplified view of price movements, connecting closing prices with straight lines. Point-and-figure charts are unique in that they disregard time and focus solely on price changes.

Candlestick Patterns

Candlestick patterns are a versatile tool for identifying trading opportunities and predicting market direction. These patterns are formed by the combination of multiple candlesticks and provide traders with valuable insights into market sentiment and price behavior.

There are numerous candlestick patterns, each with its unique characteristics and implications. Some of the most commonly recognized candlestick patterns include the hammer, inverted hammer, shooting star, engulfing, and piercing patterns. By studying these patterns, traders can anticipate potential price reversals, identify trend continuations, and assess market psychology.

Technical Analysis Techniques for Intraday Trading

Intraday option trading charts are the canvas upon which traders apply their technical analysis techniques. Technical analysis involves studying historical price data to identify patterns and trends that can help traders make informed trading decisions.

One of the most widely used technical analysis techniques is trend identification. Traders use trendlines, moving averages, and other indicators to determine the overall direction of an asset’s price movement. By identifying trends, traders can capitalize on momentum and position themselves for profitable trades.

Other technical analysis techniques include support and resistance levels, Fibonacci retracements, and stochastic oscillators. Support and resistance levels represent price points that have been tested multiple times and act as barriers to price movement. Fibonacci retracements help traders identify potential areas of price reversal based on historical price ratios. Stochastic oscillators measure market momentum and identify overbought or oversold conditions.

Image: www.youtube.com

Expert Advice and Tips for Intraday Option Trading with Charts

To enhance your intraday option trading success, consider the following expert advice and tips:

- Master the Art of Chart Analysis: Develop a deep understanding of different chart types and technical analysis techniques. This will empower you to identify trading opportunities and make informed decisions.

- Stay Informed about Market News: Keep abreast of the latest market news and events that could impact asset prices. This information will assist you in anticipating price movements and adjusting your trading strategies accordingly.

- Manage Your Risk: Exercise strict risk management principles by setting stop-loss orders and position sizing appropriately. This will protect your capital and prevent substantial losses.

- Utilize Trading Journals: Track your trades meticulously in a trading journal. This practice will enable you to identify areas for improvement, refine your strategies, and enhance your overall trading performance.

- Seek Mentorship: Consider seeking guidance from experienced options traders. They can provide valuable insights, share trading strategies, and assist you in developing the skills necessary for long-term success.

Intraday Option Trading Charts FAQs

- What is an intraday option trading chart?

- An intraday option trading chart is a visual representation of the price movements of an underlying asset within a single trading day.

- What are the different types of intraday option trading charts?

- Common chart types include bar charts, candlestick charts, line charts, and point-and-figure charts.

- How do I analyze intraday option trading charts?

- Apply technical analysis techniques such as trend identification, support and resistance levels, and technical indicators to identify trading opportunities.

- What tips should I follow for successful intraday option trading?

- Master chart analysis, stay informed about market news, manage risk effectively, utilize trading journals, and consider seeking mentorship.

Intraday Option Trading Charts

Image: porukeicestitke.com

Conclusion

Intraday option trading charts are an indispensable tool for options traders seeking to maximize their profit potential. By developing a comprehensive understanding of chart types, technical analysis techniques, and expert advice, you can elevate your trading skills and navigate the dynamic intraday markets with confidence. Embrace the power of intraday option trading charts and embark on a journey toward successful and profitable trading.

Are you intrigued by the world of intraday option trading charts and eager to delve deeper into this fascinating realm? Share your thoughts and experiences in the comments section below – let’s ignite a vibrant discussion on this engaging topic!