As a seasoned trader, I’ve witnessed firsthand the transformative power of options. To succeed in this dynamic market, understanding the complexities of options trading is essential. In this blog post, we delve into the intricacies of Interactive Brokers’ option trading levels, empowering you with the knowledge to navigate the market confidently.

Image: congxeppcg.com

Interactive Brokers’ Option Trading Levels

Interactive Brokers offers four distinct option trading levels, each catering to varying levels of experience and risk tolerance:

Level 1: Beginner

Designed for those new to options trading, Level 1 restricts access to simple options strategies such as long and short calls and puts. This limited exposure allows traders to gain fundamental knowledge without excessive risk.

Level 2: Intermediate

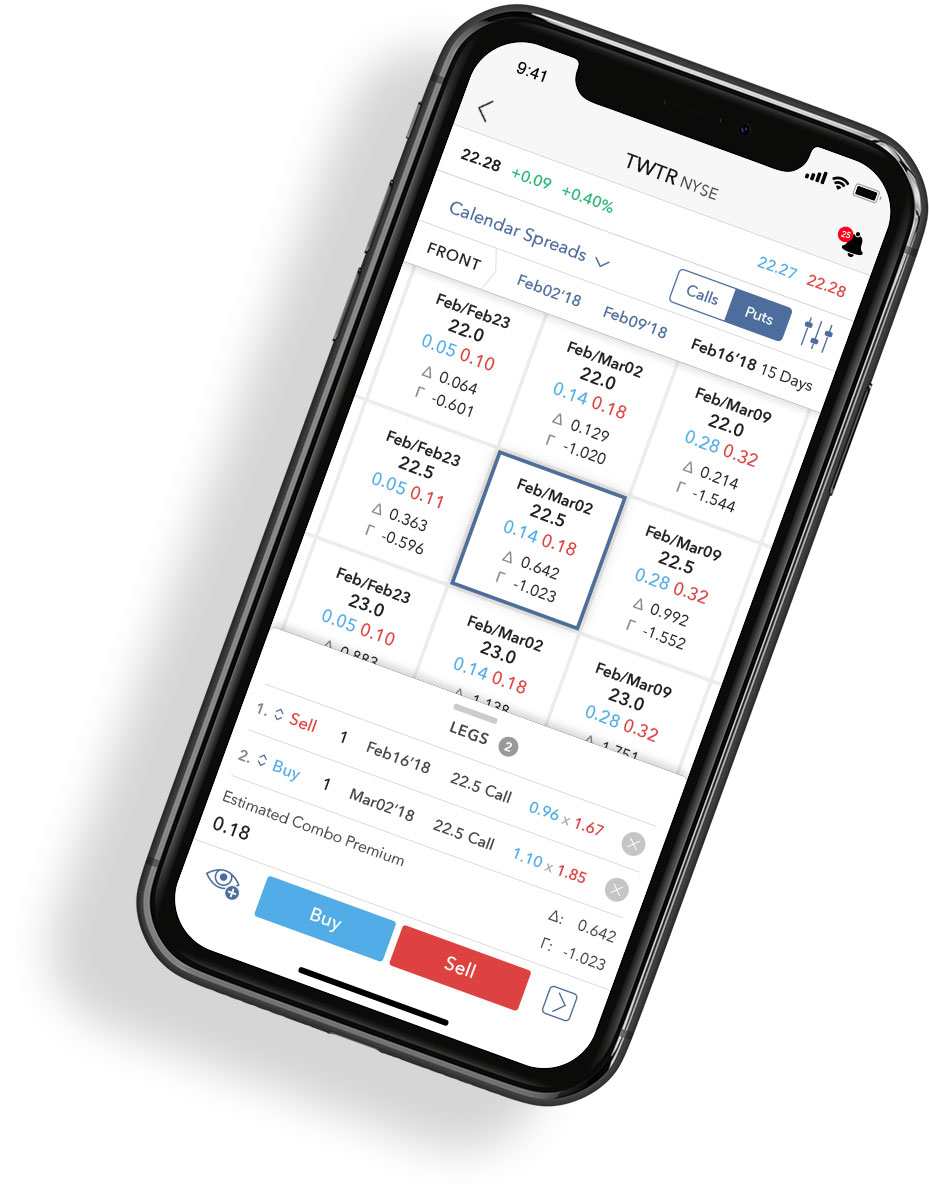

Level 2 expands trading permissions, allowing access to more complex strategies and trading capabilities. Intermediate traders can now execute spreads, multi-leg strategies, and close trades at the bid or ask price.

Image: www.forexbrokers.com

Level 3: Advanced

Level 3 grants experienced traders the ability to trade complex strategies, engage in position hedging, and advanced scenario optimization. This level is suitable for sophisticated traders with a deep understanding of options trading.

Level 4: Professional

Level 4 is tailored for institutional and professional traders with extensive experience. It offers unparalleled access to advanced trading tools, including the ability to trade illiquid options and utilize sophisticated trading algorithms.

Navigating the Option Trading Levels

Progression through the option trading levels at Interactive Brokers is a gradual process that requires consistent performance and a commitment to continuous learning.

As traders gain experience and demonstrate proficiency, they can apply for a higher level. This involves submitting trading records, passing written exams, and undergoing portfolio evaluations. Interactive Brokers thoroughly assesses each application to ensure that traders have the necessary knowledge, skills, and risk management capabilities.

Tips for Success in Option Trading

To enhance your success in option trading, consider the following expert advice:

- Trade within your risk tolerance: Assess your financial situation and only trade with capital you can afford to lose.

- Educate yourself thoroughly: In-depth knowledge of options trading is crucial. Take courses, read books, and attend webinars.

- Start with simple strategies: Complexity can be daunting for beginners. Focus on mastering basic strategies before venturing into advanced ones.

- Practice on a paper trading account: Experiment with different strategies in a simulated environment before executing real trades.

- Monitor the market regularly: Stay abreast of market trends, news, and economic data that could impact option prices.

FAQ on Option Trading Levels

Q: What are the key differences between the option trading levels?

A: Each level expands trading permissions and access to more complex strategies. Level 1 is designed for beginners, while Level 4 is tailored for institutional traders.

Q: How do I apply for a higher trading level?

A: Submit trading records, pass exams, and undergo portfolio evaluations to demonstrate proficiency and adherence to risk management guidelines.

Q: Can I trade options with Interactive Brokers if I am a beginner?

A: Yes, you can trade options at Level 1, which is designed for beginners and restricts access to simpler strategies to manage risk.

Interactive Brokers Option Trading Level

Image: www.youtube.com

Conclusion

Understanding Interactive Brokers’ option trading levels is essential for navigating the complex world of options. Choose a level that aligns with your experience and risk tolerance. Remember, education, practice, and a commitment to continuous learning are crucial for success in this market. Join us in the exciting world of options trading and unlock the potential of these powerful financial instruments.