Introduction: Navigating the Options Trading Landscape

Options trading offers investors the potential for significant returns, but it also carries inherent risks. As such, it’s crucial to exercise due diligence when choosing a brokerage firm for your options trading needs. Fidelity, a renowned financial services provider, offers a robust options trading platform, but it’s essential to thoroughly vet their services before committing your funds. This comprehensive guide will delve into essential factors to consider when evaluating Fidelity’s options trading platform to ensure it aligns with your investment goals and risk tolerance.

Image: www.youtube.com

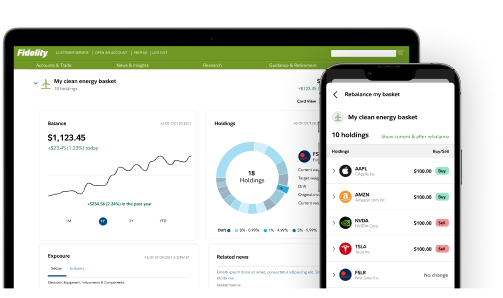

Fidelity Options Trading Platform: An Overview

Fidelity offers a sophisticated options trading platform that caters to a wide range of investors, from beginners to seasoned professionals. Their platform provides real-time market data, advanced trading tools, and educational resources. Fidelity’s options offerings include a diverse selection of contracts, such as calls, puts, spreads, and multi-leg strategies. Notably, they offer commission-free trading for online equity and ETF options trades, making it an attractive option for cost-conscious traders.

Assessing Platform Features and Functionality

-

Trading Tools: Fidelity provides an array of trading tools to enhance your options trading experience, including customizable charting capabilities, technical indicators, and volatility scanners. These tools empower traders to analyze market trends, identify trading opportunities, and manage their positions effectively.

-

Margin Trading: Leverage can magnify potential returns, but it also amplifies risks. Fidelity offers margin trading for options, allowing investors to borrow funds to purchase additional contracts. However, it’s crucial to understand the risks associated with margin trading and determine if it aligns with your investment objectives.

-

Options Trading Education: A comprehensive library of educational resources is invaluable for both novice and experienced options traders. Fidelity provides a range of articles, webinars, and videos covering topics from options basics to advanced trading strategies.

Evaluating Fees and Commissions

As mentioned, Fidelity offers commission-free trading for online equity and ETF options trades. However, it’s essential to be aware of other fees associated with options trading, such as margin interest and assignment fees. Understanding the fee structure is crucial for calculating potential trading costs and determining the profitability of your strategies.

Image: www.stockbrokers.com

Customer Support and Reliability

Fidelity maintains a reputation for excellent customer support, with dedicated options trading specialists available via phone, chat, and email. It’s critical to ensure that you have access to timely and professional assistance when navigating complexities in options trading, especially during volatile market conditions.

Security and Account Protection

Robust account security measures are paramount to safeguarding your funds and personal information. Fidelity employs industry-standard encryption protocols and fraud prevention mechanisms to protect its customers. Furthermore, they offer multi-factor authentication for added security and peace of mind.

Pros and Cons of Fidelity Options Trading

Pros:

- Commission-free trading for online equity and ETF options trades

- Comprehensive trading platform with advanced tools and features

- Margin trading with access to leverage

- Extensive educational resources on options trading

- Excellent customer support

- Reliable and secure account protection

Cons:

- Fees associated with margin trading and assignment

- Limited support for non-US residents

- May not be suitable for beginners with minimal options trading experience

Fidelity Options Trading Vetting

Image: rafacaturrofiasih.blogspot.com

Conclusion: Making an Informed Decision

Fidelity’s options trading platform offers a compelling combination of trading tools, educational resources, and competitive pricing. However, it’s essential to thoroughly vet their services and ensure they align with your individualized trading needs. Consider your risk tolerance, trading style, and financial objectives to determine if Fidelity is the optimal brokerage firm for your options trading journey. By conducting thorough due diligence and understanding the intricacies of options trading, you can increase your chances of success in this multifaceted market.