Unveiling the Costs Involved in Options Trading on IG

Options trading offers a powerful tool to manage risk and enhance returns in the financial markets. When engaging in options trading on IG, it’s crucial to understand the fee structure to make informed decisions and optimize your trading strategy. This comprehensive guide will delve into the intricacies of IG options trading fees, empowering you with the knowledge to navigate this dynamic market effectively.

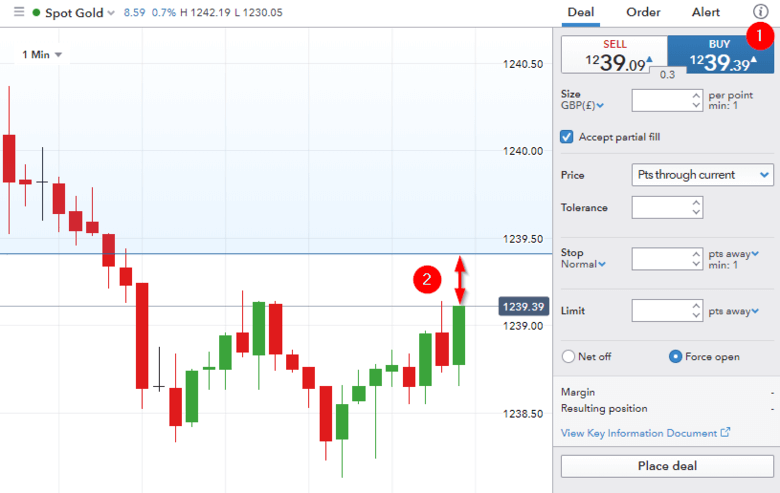

Image: www.stitcher.com

IG, a reputed online broker, provides a user-friendly platform for options trading, offering traders access to a wide range of underlying assets. However, it’s essential to be aware of the fees associated with each trade, as these can impact your profitability.

Understanding the IG Options Pricing Structure

IG’s options pricing structure is designed to cover the costs associated with providing the trading platform and executing orders. These fees typically comprise two components:

- Option Premium: This is the price you pay to acquire an option contract. It represents the market value of the right to buy or sell the underlying asset at a predetermined price and time.

- IG Trading Fees: These are the fees charged by IG for facilitating your trade. They vary depending on the type of option contract and the underlying asset.

The IG trading fees for options include:

- Option Market Fee: A per-contract fee charged on both the opening and closing of an options trade.

- Exchange Fee: A fee charged by the exchange where the option is traded. This fee is passed through to the trader by IG.

- Clearing Fee: A fee charged by the clearinghouse that processes and settles the trade.

The total IG options trading fees can vary based on factors such as the underlying asset, the option’s expiration date, and the trader’s account type. It’s advisable to carefully consider these fees and incorporate them into your trading strategy to ensure optimal performance.

Navigating Fee Structures for Successful Options Trading

To navigate the IG options trading fees effectively, consider the following tips and expert advice:

- Compare Fees with Other Brokers: Before committing to IG, compare their fees with those of other reputable brokers to identify the most competitive rates.

- Choose Contracts with Favorable Fees: Opt for options contracts with lower option premiums and associated fees. This can help enhance your profit potential.

- Maximize Trading Volume: Negotiate with IG to reduce fees on high-volume trades. Greater trading activity can lead to substantial cost savings.

- Consider Spread Trading: Spread trading involves simultaneously opening multiple related options positions with offsetting risks. This strategy can potentially reduce overall fees and increase profitability.

By adhering to these best practices, you can minimize the impact of IG options trading fees and unlock more favorable trading outcomes.

FAQs on IG Options Trading Fees

- Q: What is an option market fee?

A: An option market fee is a charge levied by IG on both the opening and closing of an options trade to cover the costs of facilitating the transaction. - Q: Do exchange fees vary based on the underlying asset?

A: Yes, exchange fees can vary depending on the underlying asset traded. Some assets may have higher trading volumes or higher volatility, which can influence the associated exchange fees. - Q: How can I negotiate lower fees with IG?

A: Your trading volume and account standing can influence your ability to negotiate lower fees. High-volume traders or those with substantial account balances may have more bargaining power. - Q: Is spread trading a viable way to reduce fees?

A: Yes, spread trading can potentially reduce overall fees by offsetting risks and reducing the number of individual contracts traded.

Image: financefeeds.com

Ig Options Trading Fees

Image: www.forexfees.com

Conclusion

Understanding IG options trading fees is crucial for informed trading decisions. By carefully considering the fee structure and implementing savvy trading strategies, you can maximize your profit potential and navigate the complexities of the options market effectively. Whether you’re a seasoned trader or just starting your journey in options trading, this comprehensive guide has equipped you with the knowledge to make informed choices and achieve your financial goals.

Are you interested in learning more about IG options trading fees and how they can impact your trading? Share your thoughts and questions in the comments section below. Let’s engage in a conversation that deepens our understanding of this dynamic aspect of financial markets.