In today’s fast-paced financial landscape, options trading has emerged as a popular strategy for investors seeking to enhance their portfolio returns. Among the leading brokerages offering options trading services, Options House stands out with its competitive trading fees and extensive educational resources. This comprehensive guide delves into everything you need to know about Options House trading fees, empowering you to make informed decisions that maximize your trading profits.

Image: broker-reviews.org

Introduction to Options House Trading Fees

Options House, a subsidiary of E*Trade Financial Corporation, is a renowned online brokerage specialized in options trading. It offers a wide range of options products, including single-leg options, multi-leg options, and options spreads, catering to the needs of both novice and experienced traders. To facilitate seamless trading, Options House has established a transparent fee structure that aligns with industry standards, ensuring traders are fully informed about the costs associated with their trades.

Commission Fees: Breaking Down the Cost of Trading

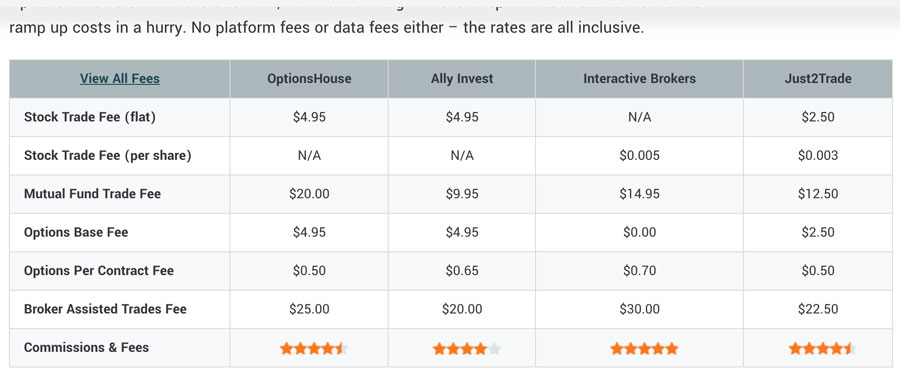

Understanding the commission fees charged by your broker is paramount when evaluating trading costs. Options House’s commission fees vary based on the type of option contract being traded. For single-leg options, traders incur a base commission per contract, typically ranging from $0.50 to $1.50. Multi-leg options and options spreads carry slightly higher commission fees due to their complex nature. The exact fees associated with these advanced trading strategies can be found on the Options House website.

Additional Fees: Understand the Hidden Costs

Beyond commission fees, traders should be aware of additional fees that may apply to their trades. These fees include regulatory fees, such as the Securities and Exchange Commission (SEC) fee, Financial Industry Regulatory Authority (FINRA) fee, and Options Regulatory Fee (ORF), all of which are passed through to traders. Additionally, certain trading strategies may incur assignment fees if the option is exercised before its expiration date. Traders are advised to carefully review the Options House fee schedule to fully understand the potential costs involved in their trading activities.

Image: www.cryptimi.com

Trading Platform Fees: Accessing the Tools of the Trade

Options House offers a robust trading platform, accessible via desktop, mobile, and web interfaces, to facilitate seamless order execution. While the basic trading platform is included in the account fee, traders who require access to advanced features and tools, such as real-time market data, customizable charts, and enhanced risk management capabilities, may opt for the premium platform. The premium platform subscription fee varies depending on the trader’s account type and usage.

Account Maintenance Fees: The Cost of Keeping an Account

Options House requires traders to maintain a minimum account balance to keep their accounts active. Failure to meet the minimum balance requirement may result in account maintenance fees. These fees vary based on the account type and can range from $0 to $10 per month. Traders are encouraged to regularly review their account balances to avoid incurring unnecessary fees.

Options House Trading Fees

Image: www.advisoryhq.com

Conclusion

Options House trading fees are competitive within the industry, offering traders a cost-effective way to access the exciting world of options trading. The transparent fee structure and comprehensive educational resources provided by Options House empower traders to make informed decisions, optimizing their trading strategies while minimizing unnecessary expenses. By carefully considering the fees associated with their trades, traders can maximize their returns and achieve their financial goals.