With lightning-fast executions and an intricate dance of algorithms, high-frequency trading has taken center stage in the realm of options markets. Picture a maze of computerized systems, operating at a relentless pace, making countless trades in milliseconds to capitalize on the slightest price fluctuations. In this article, we’ll navigate the complex terrain of option high-frequency trading, exploring its definitions, latest advancements, and how it’s shaping the financial landscape.

Image: dollarsandsense.sg

Harnessing the power of technology, high-frequency traders employ sophisticated algorithms to analyze vast amounts of market data, identify trading opportunities, and execute trades in real-time. This relentless pursuit of speedy transactions grants them an edge over traditional traders, enabling them to capitalize on the most fleeting price discrepancies.

Unveiling the Mechanics of High-Frequency Trading

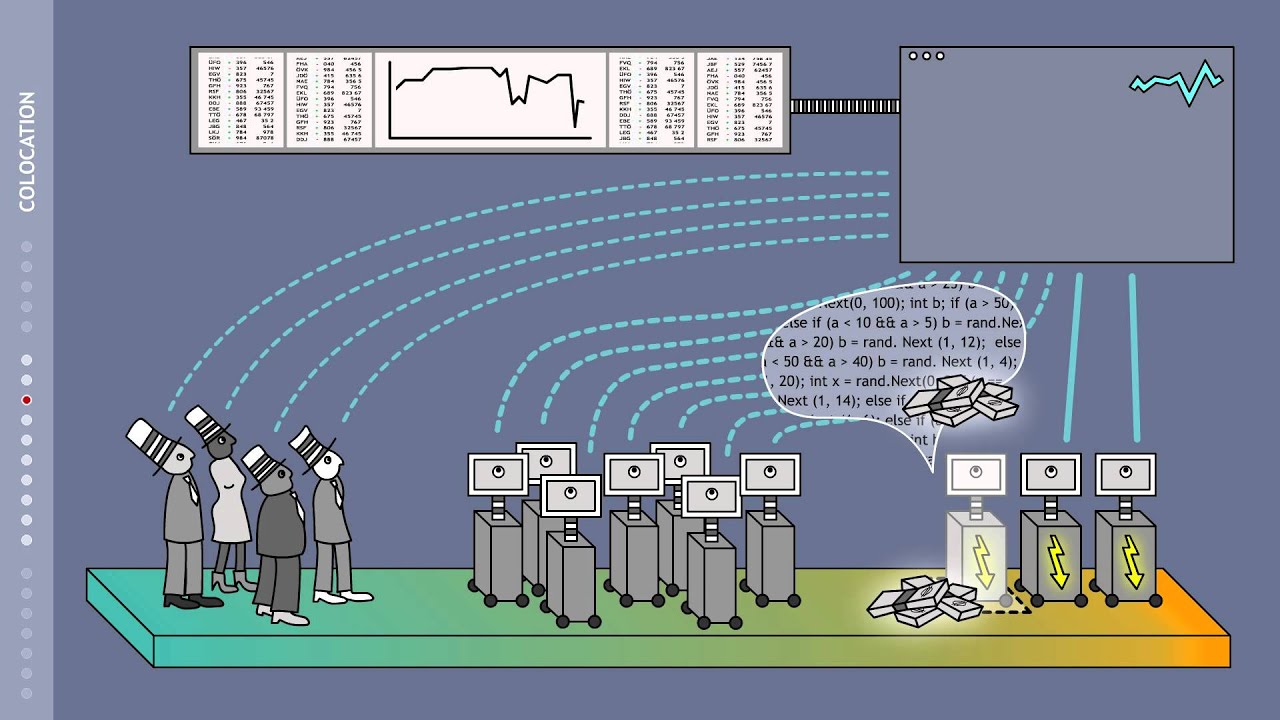

At the heart of option high-frequency trading lies a meticulously orchestrated symphony of technology and market insights. High-frequency traders leverage cutting-edge hardware, such as specialized servers co-located within exchanges, to minimize latency and maximize execution speed. Their algorithms, fueled by intricate mathematical models and statistical analysis, sift through vast datasets to detect trading opportunities and generate optimized order placement strategies.

By embracing automation and lightning-fast executions, high-frequency traders introduce a dynamic game theory element into the market. Their actions, while primarily driven by algorithmic decision-making, can inadvertently influence market behavior, leading to self-perpetuating trends or even rapid price swings. Understanding this complex interplay between algorithms and market dynamics is crucial for navigating the ever-evolving world of option high-frequency trading.

Navigating the Evolving Trends and Landscape

The landscape of option high-frequency trading is constantly evolving, with new technologies and strategies emerging to reshape market dynamics. Here are some key trends to watch out for:

- AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) algorithms are gaining prominence, enabling high-frequency traders to refine their models, predict market movements, and optimize trading strategies.

- Exchange Innovation: Exchanges are continuously introducing innovative technologies to support high-frequency trading, such as co-location facilities, low-latency trading platforms, and advanced data feeds.

- Regulatory Scrutiny: Regulatory agencies are paying close attention to high-frequency trading, aiming to ensure market fairness, transparency, and prevent potential threats to market stability.

Tips for Embracing High-Frequency Trading

If you’re considering venturing into the realm of option high-frequency trading, consider these key tips:

- Master the Markets: Understand the complexities of both option trading and high-frequency trading strategies to increase your chances of success.

- Harness Technology: Invest in cutting-edge software, hardware, and data feeds to stay competitive in the fast-paced world of high-frequency trading.

- Embrace Automation: Leverage automated execution strategies to execute trades swiftly and capitalize on fleeting market opportunities.

Image: randomglenings.blogspot.com

Frequently Asked Questions (FAQs)

To further enhance your understanding, here are answers to some commonly asked questions about option high-frequency trading:

- Q: Is option high-frequency trading profitable?

A: While option high-frequency trading has the potential to yield profits, it also carries significant risks. Success hinges on technical expertise, sophisticated algorithms, and a deep understanding of market dynamics. - Q: Is option high-frequency trading legal?

A: Yes, as long as it complies with existing regulations and industry guidelines, option high-frequency trading is a legitimate trading strategy.

Option High Frequency Trading

Image: www.youtube.com

Conclusion

The world of option high-frequency trading offers both opportunities and challenges. By comprehending its intricacies, grasping the driving forces behind its evolution, and applying sound strategies, you can enhance your ability to navigate this fast-paced and dynamic market. As the financial landscape continues to embrace technological advancements, high-frequency trading is poised to remain a prominent force in the years to come.

So, are you intrigued by the captivating world of option high-frequency trading? Are you ready to embrace the challenges and harness the potential gains? The choice is yours! Step into this realm of lightning-fast executions, razor-sharp analysis, and algorithmic finesse, where opportunity awaits the well-equipped.