In the labyrinthine world of finance, options data stands as a beacon, guiding astute traders towards enlightened decision-making. Join us on an enthralling journey as we explore the intricate depths of options data, empowering you with the knowledge to navigate this complex landscape.

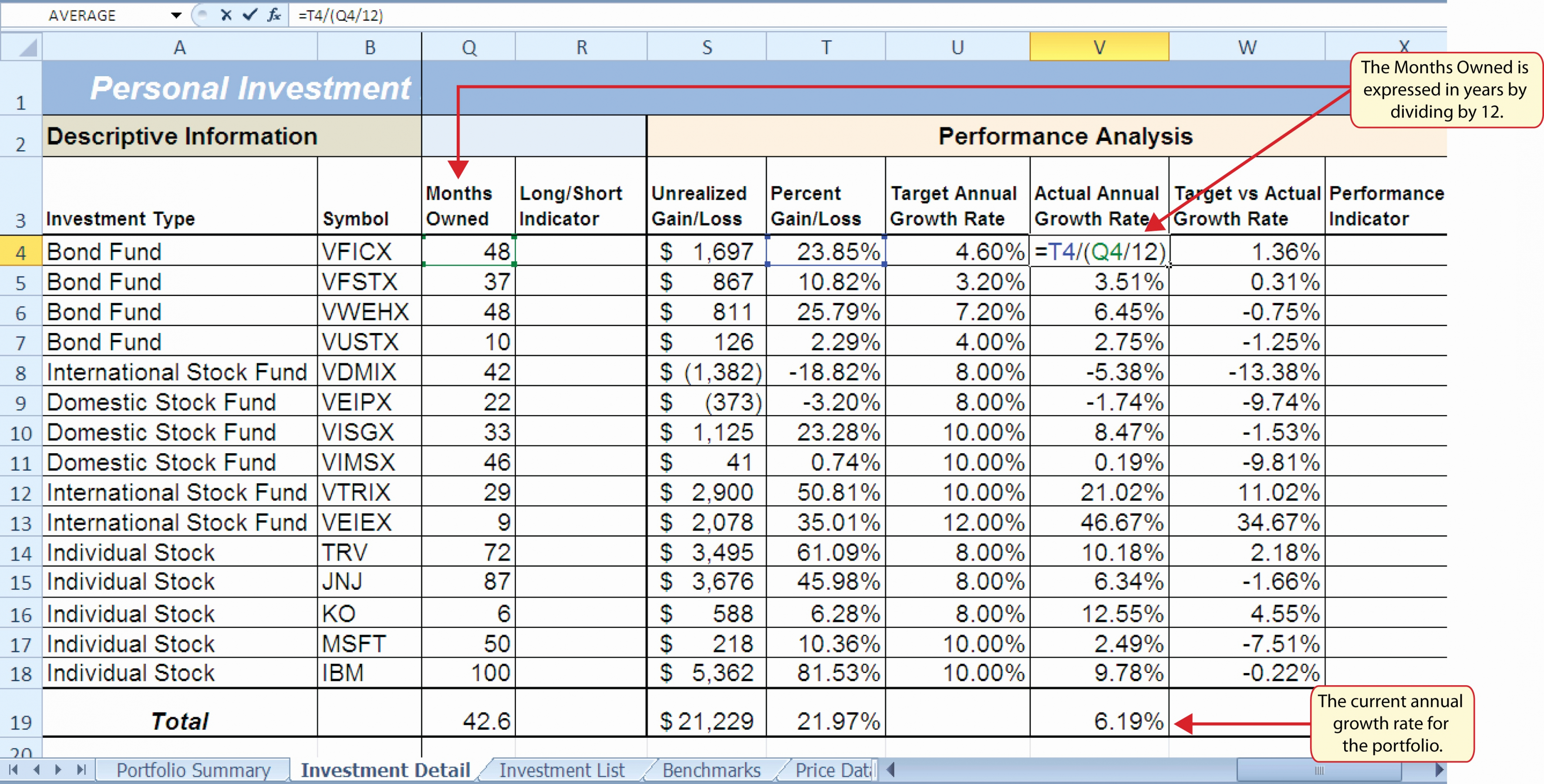

Image: db-excel.com

The Essence of Options Data: Unlocking Market Insights

Options, financial contracts that convey the right but not the obligation to buy or sell an underlying asset at a predetermined price, harbor a wealth of valuable data. This data offers traders a panoramic view of market sentiment, volatility expectations, and potential trading opportunities.

Deciphering Options Data: A Step-by-Step Approach

Historical Data:

Delving into the annals of history, traders can analyze historical options data to discern patterns and trends. This retrospective examination reveals how options prices have fluctuated in response to various market conditions.

Implied Volatility:

Implied volatility (IV) represents the market’s expectation of an underlying asset’s future volatility. High IV indicates heightened volatility expectations, while low IV suggests a more stable market environment.

Open Interest:

Open interest gauges the number of outstanding options contracts. A rise in open interest signals increased market participation and heightened anticipation, while a decline portends diminishing interest.

Volume:

Volume measures the number of options contracts traded within a specific period. High volume denotes active trading and robust market activity, while low volume suggests a less engaged market.

Expert Insights and Actionable Guidance

From the Oracle of Omaha:

Warren Buffett, the revered investing sage, espouses the prudent use of options to mitigate risk and enhance returns. He advises investors to “buy options when you are comfortable with the risk and sell them when you are not.”

Leveraging Sentiment Analysis:

Dr. Richard Nisbett, renowned psychologist, emphasizes the profound impact of sentiment on market behavior. Options data can unveil investor sentiment, enabling traders to gauge market biases and position accordingly.

Image: financewikki.com

How To Use Options Data For Trading

Image: www.visualcapitalist.com

Embarking on the Path to Trading Triumph

Practical Applications for Enhanced Trading:

Options data empowers traders to:

- Gauge market sentiment and identify hidden trading opportunities

- Measure volatility expectations and tailor trading strategies accordingly

- Refine risk management protocols and hedge against potential losses

- Enhance portfolio performance and achieve long-term financial goals

A Call to Action: Empower Your Trading Odyssey

The world of options data awaits your eager exploration, promising a transformative journey towards trading excellence. Grasp this opportunity to master the tools and techniques, unlock market insights, and ascend to the ranks of astute and successful traders.