Embarking on the Adventure

In a world where financial freedom tantalizes, exploring avenues to augment income holds immense appeal. One such path lies in the intriguing realm of options trading. Options offer tremendous potential for profit generation, but navigating this intricate landscape requires a deliberate and well-informed approach.

Image: www.youtube.com

Understanding Options Trading

Options are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified expiration date. This flexibility allows traders to employ various strategies to capitalize on price fluctuations while managing risk exposure.

The types of options include calls, which grant the right to buy the underlying asset, and puts, which convey the right to sell it. Each option contract represents 100 shares of the underlying asset.

Key Elements of Options Trading

- Strike Price: The predetermined price at which the underlying asset can be bought or sold.

- Expiration Date: The date on or before which the option can be exercised.

- Premium: The price paid to purchase an option contract.

Options Trading Strategies

Traders employ diverse options trading strategies to achieve their investment goals. Some popular strategies include:

- Covered Call Writing: Selling call options against an underlying asset you own.

- Cash-Secured Put Selling: Selling put options while having the cash to buy the underlying asset if the option is exercised.

- Iron Condor: A combination of bull and bear put spreads used to profit from limited price movements.

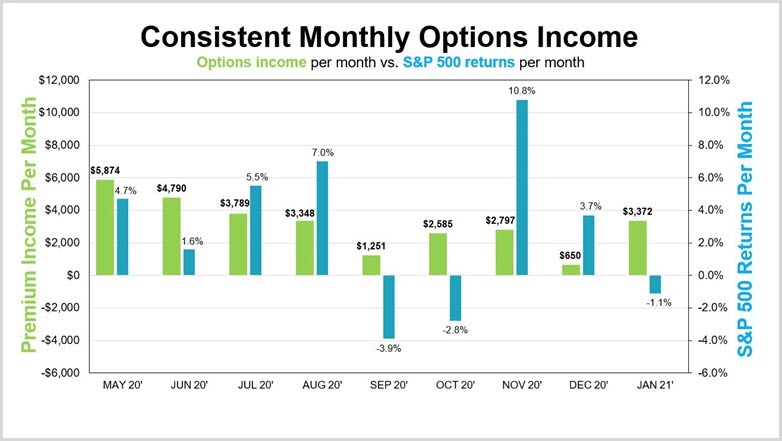

Image: theministerofcapitalism.com

Trends in Options Trading

The options trading landscape is constantly evolving. Here are some key trends:

- Rising Popularity of Volatility: Increased market volatility has fueled interest in options trading as a means to hedge against risk and capitalize on price fluctuations.

- Advancements in Technology: Trading platforms and mobile apps now offer sophisticated tools that facilitate options analysis and execution.

- Social Media Influence: Forums and social media platforms have become valuable resources for information sharing and collaboration among options traders.

Expert Tips and Advice

Seasoned options traders offer invaluable insights to enhance your trading journey:

- Start Small: Begin with small trades to gain experience and avoid substantial losses.

- Manage Risk: Understand the potential risks associated with options trading and employ risk management techniques to mitigate losses.

- Educate Yourself: Continuously expand your knowledge of options trading through books, articles, and seminars.

Expounding on the Tips

Managing risk is paramount in options trading. Techniques such as position sizing, stop-loss orders, and diversification can help limit potential losses.

Ongoing education is essential for success. Stay abreast of market trends, study successful traders, and seek professional guidance when necessary.

Frequently Asked Questions (FAQs)

- Q: Can anyone trade options?

- A: Yes, but a thorough understanding of options trading is recommended before starting.

- Q: Is options trading profitable?

- A: Potential profits can be significant, but it also carries risks.

- Q: What are the best options trading strategies?

- A: The most suitable strategy depends on individual goals and risk tolerance.

- Q: Can I use options to hedge against risk?

- A: Yes, options offer flexibility to create hedging strategies to mitigate potential losses.

How To Trading Options For Income

Image: www.ino.com

Conclusion

Trading options for income presents both challenges and opportunities. By embracing a comprehensive approach, developing a solid understanding of options trading, and honing your skills over time, you can unlock the potential of this lucrative financial instrument. Embrace the adventure and elevate your financial possibilities.

Are you ready to venture into the realm of options trading? The world of options awaits your exploration!