Navigating the complex world of financial markets demands knowledge, strategy, and an unwavering commitment to risk management. Options trading, an intricate yet powerful tool, empowers traders to amplify their returns and mitigate potential losses. However, mastering options trading requires a deep understanding of the underlying strategies and concepts. In this comprehensive guide, we embark on a transformative journey, exploring the intricacies of trading strategies using options PPT, unlocking the secrets of informed decision-making and empowering you to harness the full potential of this dynamic financial landscape.

Image: www.slideserve.com

Understanding Options: Power at Your Fingertips

Options contracts, a cornerstone of modern finance, grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique characteristic provides traders with unmatched flexibility, allowing them to tailor their trading strategies to suit their risk tolerance and profit goals.

Diving into Trading Strategies: A World of Possibilities

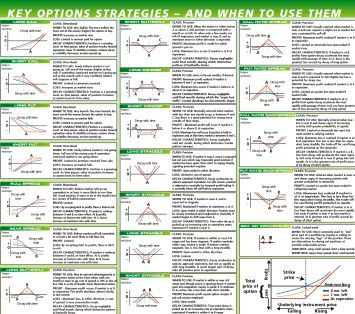

The realm of trading strategies using options PPT is vast and ever-evolving, with each strategy designed to suit specific market conditions and trader objectives. Some of the most widely used strategies include:

- Covered Call Strategy: A conservative strategy where options sellers generate income by selling covered call options against underlying stocks they already own.

- Uncovered Call Strategy: A more aggressive strategy where options sellers sell call options without owning the underlying stocks, exposing themselves to unlimited risk but also offering the potential for higher returns.

- Put Selling Strategy: This strategy involves selling put options, granting the option buyer the right to sell an underlying asset at a specific price. Put selling generates income if the asset price remains above the strike price.

- Straddle Strategy: A neutral strategy involving simultaneous purchase of both a call and a put option with the same strike price and expiration date. The profit potential of a straddle strategy stems from significant price fluctuations in either direction.

Expert Insights: Unlocking the Secrets of Success

Navigating the labyrinth of trading strategies using options PPT requires guidance from experienced professionals. Here’s a glimpse into the wisdom of industry experts:

- “Options trading provides a powerful toolset for risk management and income generation. However, it’s crucial to approach options trading with a deep understanding of the strategies involved and a clear risk management plan.” – Mark Douglas, renowned trading psychologist and author

- “Trading options is akin to owning the keys to a treasure chest. But like any valuable possession, it demands responsibility, knowledge, and a strategic approach.” – Steve Burns, founder of NewTraderU

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1536x1086.png)

Image: howtotrade.com

Trading Strategies Using Options Ppt

Image: marketsmuse.com

Conclusion: Embracing the Power of Informed Decision-Making

Trading strategies using options PPT offer immense opportunities for savvy investors and traders. By thoroughly comprehending the concepts, strategies, and expert insights outlined in this article, you possess the knowledge to navigate the financial markets with confidence and make informed decisions. Remember, the path to financial success through options trading lies not merely in knowledge acquisition but in its skillful application. May this guide serve as your unwavering companion, empowering you to unlock the full potential of this dynamic financial landscape and achieve your trading aspirations.