Unveiling the Secret Weapon for Profitable Option Trading

As an aspiring options trader, recording and analyzing your trades is paramount to enduring success. A meticulously maintained trade journal becomes an invaluable tool, allowing you to identify patterns, enhance strategies, and amplify profitability. But how do you create and maintain an effective options trading journal? Let’s delve into the art of keeping a journal that will empower your trading endeavors.

Image: www.rocketsheets.com

Defining an Options Trading Journal

An options trading journal is a comprehensive record of every trade you make. It includes details such as the underlying security, option type, strike price, expiration date, entry and exit prices, and profit or loss. It’s a repository of your trading history, a window into your strengths and weaknesses, and a compass guiding your journey towards increased profitability.

Benefits of Maintaining a Trading Journal

- Performance Analysis: Track your trades over time to assess your overall performance, identify bottlenecks, and pinpoint areas for improvement.

- Strategy Evaluation: Evaluate the effectiveness of your trading strategies by analyzing their performance under various market conditions.

- Emotional Awareness: Identify emotional triggers that influence your trading decisions, enabling self-reflection and behavioral adjustments.

- Learning and Growth: Learn from your successes and failures by documenting your thought processes and identifying patterns in your trading.

- Tax Filing: Simplify tax filing by having a comprehensive record of your trades for tax reporting purposes.

Essential Elements of an Options Trading Journal

- Trade Details: Record the underlying security, option type, strike price, expiration date, entry and exit prices, and profit or loss for each trade.

- Trading Rationale: Note your reasons for entering each trade, outlining your expectations and the underlying market analysis that informed your decision.

- Trading Plan: Document your trading plan, including your entry and exit criteria, risk management parameters, and overall trading strategy.

- Market Conditions: Record key market indicators, such as volatility, market trends, and economic news, to contextualize your trades.

- Personal Metrics: Track your personal metrics, such as your win rate, average profit per trade, and risk-to-reward ratio, to assess your progress and areas for improvement.

- Notes and Observations: Write down any additional notes or observations that may be relevant to your trades, such as technical indicators, chart patterns, or news events.

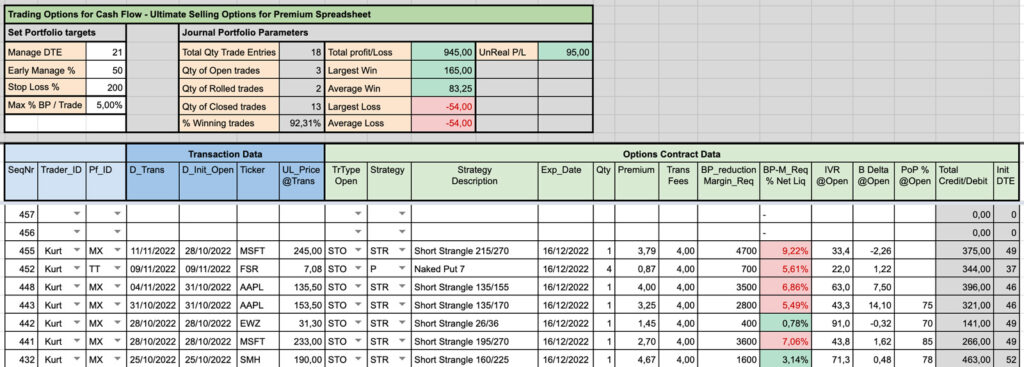

Image: www.tradingoptionscashflow.com

Creating a Journal That Works for You

- Choose the Right Platform: Select a journal format that aligns with your preferences and needs. You can use a physical notebook, a spreadsheet, or a dedicated trading journal software.

- Consistency is Key: Discipline yourself to update your journal promptly after each trade. Consistency is crucial for accruing meaningful data and gaining valuable insights.

- Be Objective and Honest: Record your trades accurately and objectively, without sugarcoating or distorting your results. Honesty is essential for self-improvement.

- Regular Review: Set aside regular time to review your journal and analyze your trading performance. Reflection is the fuel that drives progress.

- Seek Professional Help: If you find yourself struggling to maintain an effective journal or decipher your trading data, consider seeking guidance from a professional trader or mentor.

How To Keep An Options Trading Journal

Image: www.pinterest.com

Conclusion

Harnessing the power of an options trading journal is an indispensable step towards achieving sustained profitability in the dynamic market of options trading. By meticulously recording and analyzing your trades, you gain the foresight to refine your strategies, regulate your emotions, and learn from your experiences. Remember, a well-maintained trading journal is a tapestry woven with the threads of knowledge, self-discovery, and unwavering commitment to success. It is a legacy that will endure beyond individual trades, empowering you to conquer the challenges and reap the rewards that accompany the exhilarating realm of options trading.