In the complex realm of finance, understanding the nuances of long-term options trading is akin to navigating a labyrinth. However, with the right strategies and knowledge, this terrain can be traversed with confidence.

Image: marketsharegroup.com

Long-Term Options: A Deeper Dive

A long-term option differs from its short-term counterpart in terms of its temporal scope, lasting up to a year or more. This extended timeframe provides traders with greater potential flexibility while mitigating short-term fluctuations. Holding long-term options can yield significant returns during periods of sustained market trends, as the trader’s position benefits from favorable price movements.

Advantages of Long-Term Options

- Time Value Appreciation: Options gain time value as they approach their expiration date. Holding long-term options allows traders to capitalize on this time value appreciation, maximizing potential profits.

- Hedging Portfolio Risk: Long-term options serve as valuable hedging instruments. By strategically buying or selling options, traders can protect their portfolio against adverse market movements.

- Fewer Margin Calls: Compared to short-term options, long-term options require lower initial margin maintenance. This reduces the risk of margin calls and provides greater flexibility during market volatility.

Choosing Long-Term Options: Considerations

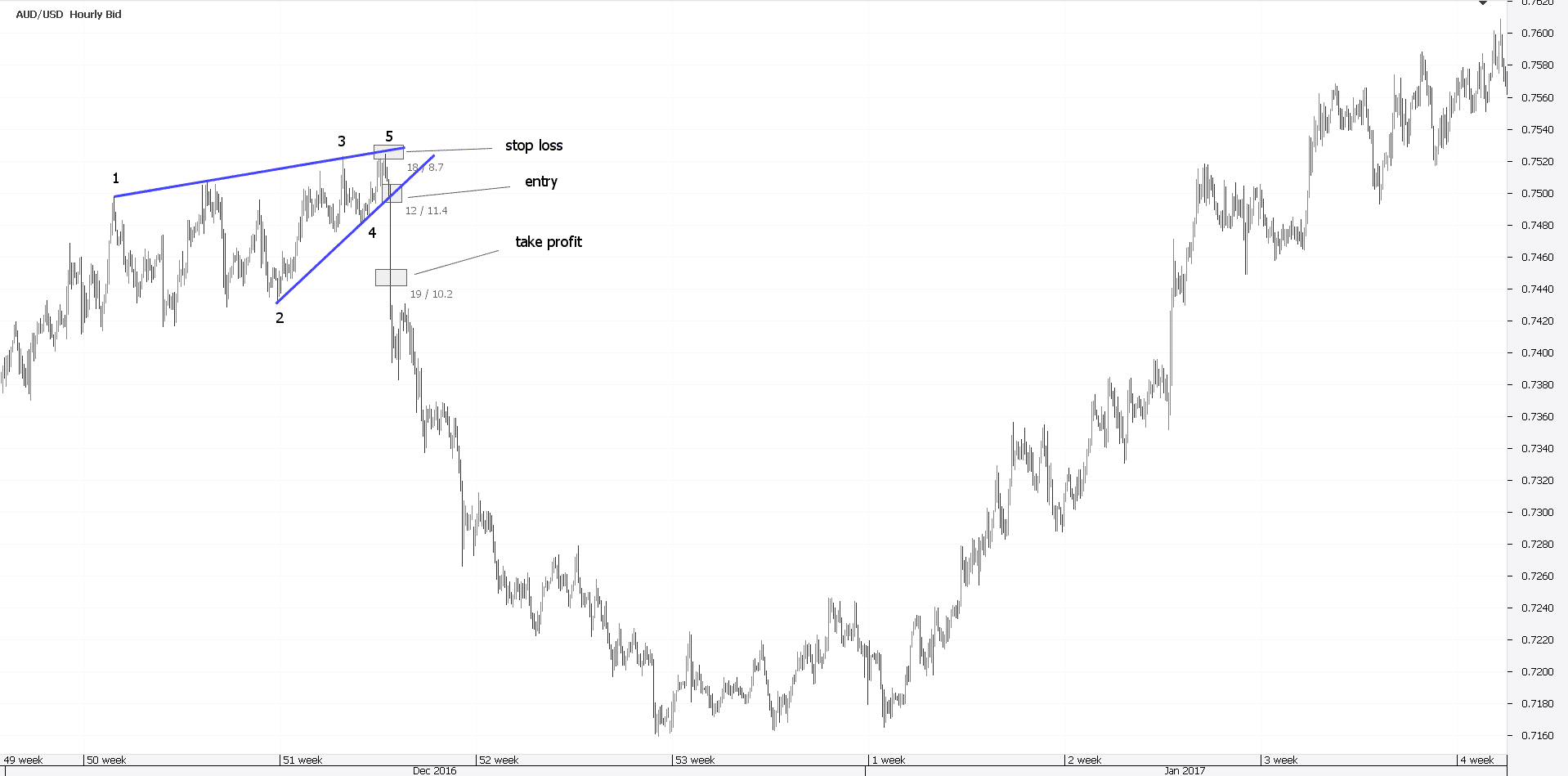

- Market Trend Analysis: When selecting long-term options, it’s crucial to analyze prevailing market trends and project future price movements. Identifying sustained bullish or bearish sentiments can enhance trading success.

- Option Pricing Models: Utilize appropriate option pricing models, such as the Black-Scholes model, to estimate the fair value of long-term options. This assessment helps determine potential profit margins.

- **Risk Management: As with any financial instrument, risk management is paramount. Consider the interplay between reward and risk when selecting long-term options. Implement stop-loss orders to limit potential losses.

Image: traderoomplus.com

Expert Insights and Tips

- Trade with the Trend: Align your long-term option trades with the prevailing market trend to increase the likelihood of profitable outcomes.

- Set Realistic Profit Targets: Don’t chase unrealistic profit expectations. Define reasonable profit targets and stick to them to avoid emotional trading decisions.

- **Manage Your Leverage: Leverage can amplify profits but also magnify losses. Employ leverage prudently and avoid overleveraging your account.

- **Seek Expert Advice: If you’re a novice trader, seek guidance from experienced financial advisors. They can provide valuable insights and assist you in making informed decisions.

FAQ on Long-Term Options Trading

- Q: What is the primary difference between long-term and short-term options?

- A: Long-term options have a duration of over a year, while short-term options typically expire within a few months.

- Q: What are the advantages of long-term options?

- A: Benefits include time value appreciation, portfolio hedging, and lower margin requirements.

- Q: How can I select profitable long-term options?

- A: Analyze market trends, utilize option pricing models, and manage risk wisely.

- Q: What are some tips for novice long-term options traders?

- A: Align trades with market trends, set realistic profit targets, manage leverage effectively, and seek expert advice when necessary.

How To Explain Long Term Options Trading

Image: www.forexboat.com

Conclusion

Long-term options trading offers a multifaceted approach to capturing market opportunities while mitigating short-term fluctuations. By implementing the strategies and advice outlined in this guide, you can enhance your comprehension of this intricate financial instrument and unlock its potential for profitable trading.

Are you interested in further exploring the captivating world of long-term options trading? Connect with our expert team for personalized guidance and unlock your trading potential today!