In the realm of financial markets, options trading stands as a powerful tool for investors seeking to navigate risk and enhance their returns. For those seeking to harness this potential, Angel Broking, a leading brokerage firm in India, offers a seamless platform to activate option trading. In this comprehensive guide, we will delve into the intricacies of activating option trading in Angel Broking, empowering you to unlock the full spectrum of opportunities this market has to offer.

Image: www.pinterest.com

Option Trading: A Catalyst for Investment Success

Options, financial instruments rooted in derivatives, provide investors with the flexibility to speculate on the future price movements of underlying assets, such as stocks, indices, and commodities. They enable traders to control risk while optimizing their potential profits. However, before embarking on this exciting journey, it is imperative to activate option trading functionality within your Angel Broking account.

Step-by-Step Guide to Activate Option Trading in Angel Broking

To activate option trading in Angel Broking, follow these straightforward steps:

- Log in to your Angel Broking account: Access the Angel Broking platform through their website or mobile application.

- Navigate to the dashboard: Once logged in, you will be directed to your account dashboard.

- Locate the ‘Activate Option Trading’ option: Within the dashboard, search for the “Activate Option Trading” section.

- Submit the activation request: Click on the “Activate Now” button and submit the necessary information, including your trading experience and investment goals.

- Complete the risk assessment test: To ensure your understanding of option trading and its associated risks, you will be required to complete a risk assessment test.

- Await approval: Angel Broking will review your activation request and risk assessment results. Upon approval, you will receive confirmation via email or SMS.

Understanding the Basics of Option Trading

With your option trading functionality now activated, let us delve into the foundational concepts that will guide your trading endeavors:

Image: learn.quicko.com

Types of Options:

- Call Options: Grant the holder the right to buy the underlying asset at a predefined price on or before a specific date.

- Put Options: Provide the holder the right to sell the underlying asset at a predefined price on or before a specific date.

Key Terms:

- Strike Price: The predetermined price at which the underlying asset can be bought (in the case of call options) or sold (in the case of put options).

- Expiration Date: The date on which the option contract expires.

- Premium: The price paid by the option buyer to acquire the option contract.

Strategies for Successful Option Trading

Navigating the world of option trading demands a strategic approach to maximize returns and mitigate risks. Here are some tried-and-tested strategies to enhance your trading performance:

Bullish Strategies:

- Long Call: Buying a call option when you believe the underlying asset’s price will rise.

- Covered Call: Selling a call option while owning the underlying asset, creating downside protection and potentially generating income.

Bearish Strategies:

- Long Put: Buying a put option when you anticipate a decline in the underlying asset’s price.

- Protective Put: Buying a put option while owning the underlying asset, hedging against potential losses.

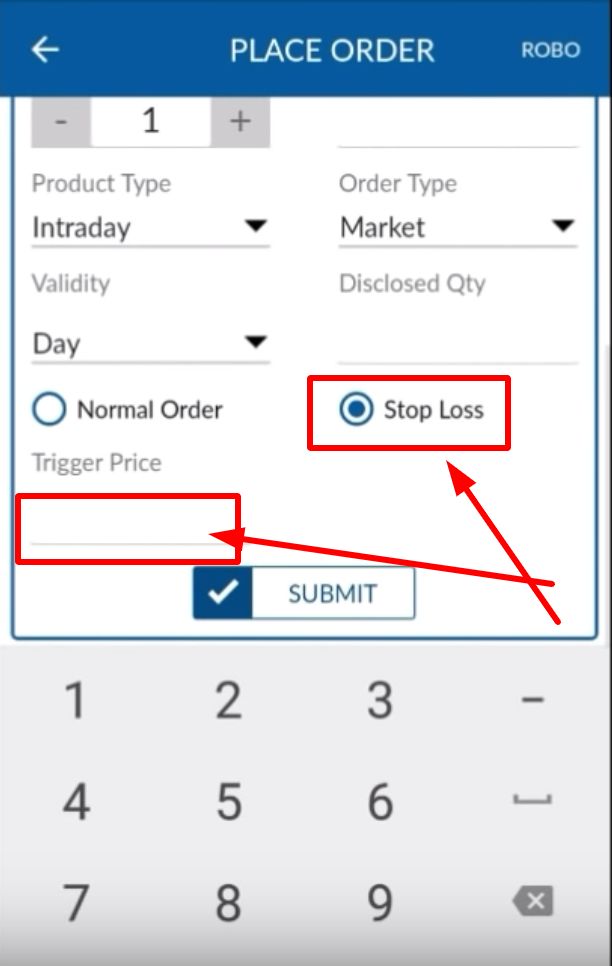

How To Activate Option Trading In Angel Broking

Image: www.adigitalblogger.com

Neutral Strategies:

- Iron Condor: Selling a call option and a corresponding put option at higher and lower strike prices, respectively.

- Strangle: Selling a call option and a corresponding put option at the same expiration date but with different strike prices.