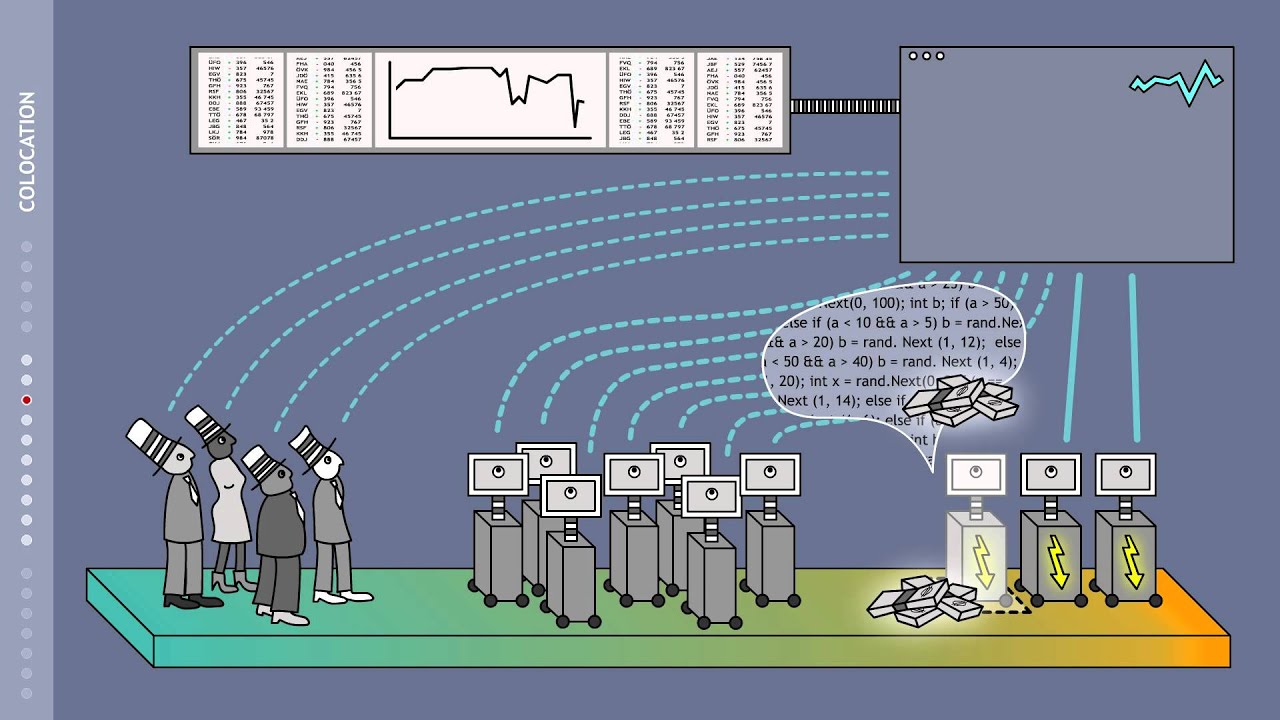

In the fast-paced world of finance, high-frequency trading (HFT) has revolutionized the way options are traded. This lightning-fast technique leverages sophisticated algorithms and computer systems to execute trades in milliseconds, offering traders unparalleled speed and precision.

Image: www.youtube.com

Unveiling High-Frequency Trading

Definition: High-frequency trading involves employing algorithms to exploit short-term price fluctuations in an automated manner. Traders use complex trading strategies and proprietary technology to analyze market data, identify opportunities, and execute trades within fractions of a second.

History and Significance: HFT gained prominence in the early 2000s. Its ability to process large volumes of data and capitalize on minute price movements has transformed the financial landscape, creating new opportunities for traders.

Benefits of HFT: HFT provides several advantages, including reduced execution latency, increased liquidity, and improved price discovery. By capturing fleeting opportunities, traders can potentially generate substantial profits.

Understanding HFT Option Strategies

HFT in the options market leverages various strategies to maximize returns. These strategies combine traditional option trading techniques with the speed and automation of algorithms.

Some common HFT option strategies include:

- Pairs Trading: Trading two correlated options with contrasting volatility and liquidity levels.

- Statistical Arbitrage: Exploiting minute discrepancies between the theoretical and observed prices of options.

- Volatility Targeting: Utilizing options to hedge against risk and target specific volatility levels.

- Gamma Scalping: Capitalizing on the gamma exposure of options, which changes with the underlying asset’s price.

These automated strategies require significant computational power, extensive data analysis, and real-time risk management.

Latest Trends and Developments in HFT

The HFT landscape is constantly evolving, with rapid advancements in technology and artificial intelligence. Some of the latest trends shaping the industry include:

- Increased use of machine learning and deep learning algorithms for automated decision-making.

- Adoption of distributed computing platforms for faster data processing.

- Growing focus on risk management and regulatory compliance.

Image: avaicourse.org

Tips and Expert Advice for HFT Traders

Succeeding in HFT requires a combination of technical expertise, market knowledge, and risk management skills. Here are some tips and advice from experienced traders:

- Master Algorithms: Gain a deep understanding of the algorithms and models used in HFT.

- Study Market Data: Analyze historical and real-time market data to identify trading opportunities.

- Develop Risk Management Strategies: Establish robust risk management procedures to mitigate potential losses.

- Leverage Industry Tools: Utilize HFT platforms, data providers, and analysis software.

By implementing these recommendations, traders can enhance their understanding and refine their HFT strategies.

FAQs on High-Frequency Trading

- Q: Is HFT legal?

A: Yes, HFT is legal and operates within regulatory frameworks. - Q: Is HFT profitable?

A: HFT can be profitable, but success depends on factors such as market conditions, strategy, and risk management. - Q: Is HFT suitable for all traders?

A: HFT requires specialized knowledge, expertise, and capital. It may not be appropriate for all trader profiles.

High Frequency Trading Option Strategy

Image: kulyfyyepi.web.fc2.com

Conclusion

High-frequency trading has revolutionized the options market, providing traders with unparalleled speed, precision, and opportunities for profit generation. By understanding the principles, strategies, trends, and advice outlined in this article, traders can harness the power of HFT to maximize their market edge.

Are you intrigued by the fast-paced world of high-frequency trading and option strategies?