Embarking on the Journey of Algorithmic Trading

In the fast-paced world of finance, technology has revolutionized the way we trade. The advent of options trading algorithms has empowered traders with the ability to automate decision-making, execute trades with lightning speed, and optimize risk management. Let’s delve into the intricacies of options trading algorithms, exploring their benefits, complexities, and tips for successful implementation.

Image: www.nirmalbang.com

Understanding Options Trading Algorithms: A Definition and History

Options trading algorithms are computer-driven programs designed to analyze market data, identify trading opportunities, and execute trades based on predefined rules. Historically, traders relied on manual calculations, but the exponential growth of financial data and trading volume demanded more efficient solutions. Algorithms emerged as a game-changer, enabling traders to navigate market complexities more effectively.

Types of Options Trading Algorithms: A Diverse Portfolio

The landscape of options trading algorithms is vast and diverse, catering to various trading styles and objectives. Some popular types include:

- Delta Neutral Algorithms: These algorithms maintain a delta-neutral portfolio, hedging against price fluctuations while capturing market volatility.

- Statistical Arbitrage Algorithms: They exploit statistical inefficiencies in pricing, identifying overvalued or undervalued options.

- High-Frequency Trading Algorithms: These algorithms execute large numbers of trades very quickly, capitalizing on fleeting market inefficiencies.

- Machine Learning Algorithms: They leverage advanced machine learning techniques to analyze vast amounts of data, predicting future price movements.

Empowering Traders: Unveiling the Benefits of Options Trading Algorithms

Options trading algorithms offer an arsenal of advantages for traders, facilitating decision-making and enhancing profitability. Key benefits include:

- Speed and Efficiency: Algorithms can analyze and process data at unmatched speeds, allowing for swift execution of trades.

- Risk Management: Algorithmic trading enables traders to implement robust risk management strategies, reducing the potential for losses.

- Objectivity: Unlike human traders, algorithms are not affected by emotional biases, enabling more rational decision-making.

Image: topfxmanagers.com

Expert Insights: Unlocking the Secrets of Successful Algorithm Implementation

Harnessing the full potential of options trading algorithms requires careful implementation and ongoing optimization. Here’s some expert advice:

- Define Trading Objectives: Clearly define the goals and objectives of the algorithm, including risk tolerance and return expectations.

- Thorough Backtesting: Perform rigorous backtesting on historical data to assess the algorithm’s performance and identify potential pitfalls.

- Continuous Monitoring: Regularly monitor and adjust the algorithm as market conditions or trading strategies evolve.

Common FAQs: Questions and Answers from the Trading Community

Q: Are options trading algorithms suitable for beginners?

A: While algorithms can provide benefits, beginners should gain experience with manual trading before venturing into algorithmic trading.

Q: How can I develop my own options trading algorithm?

A: Developing proprietary algorithms requires expertise in programming, finance, and risk management. Consider seeking assistance from professionals.

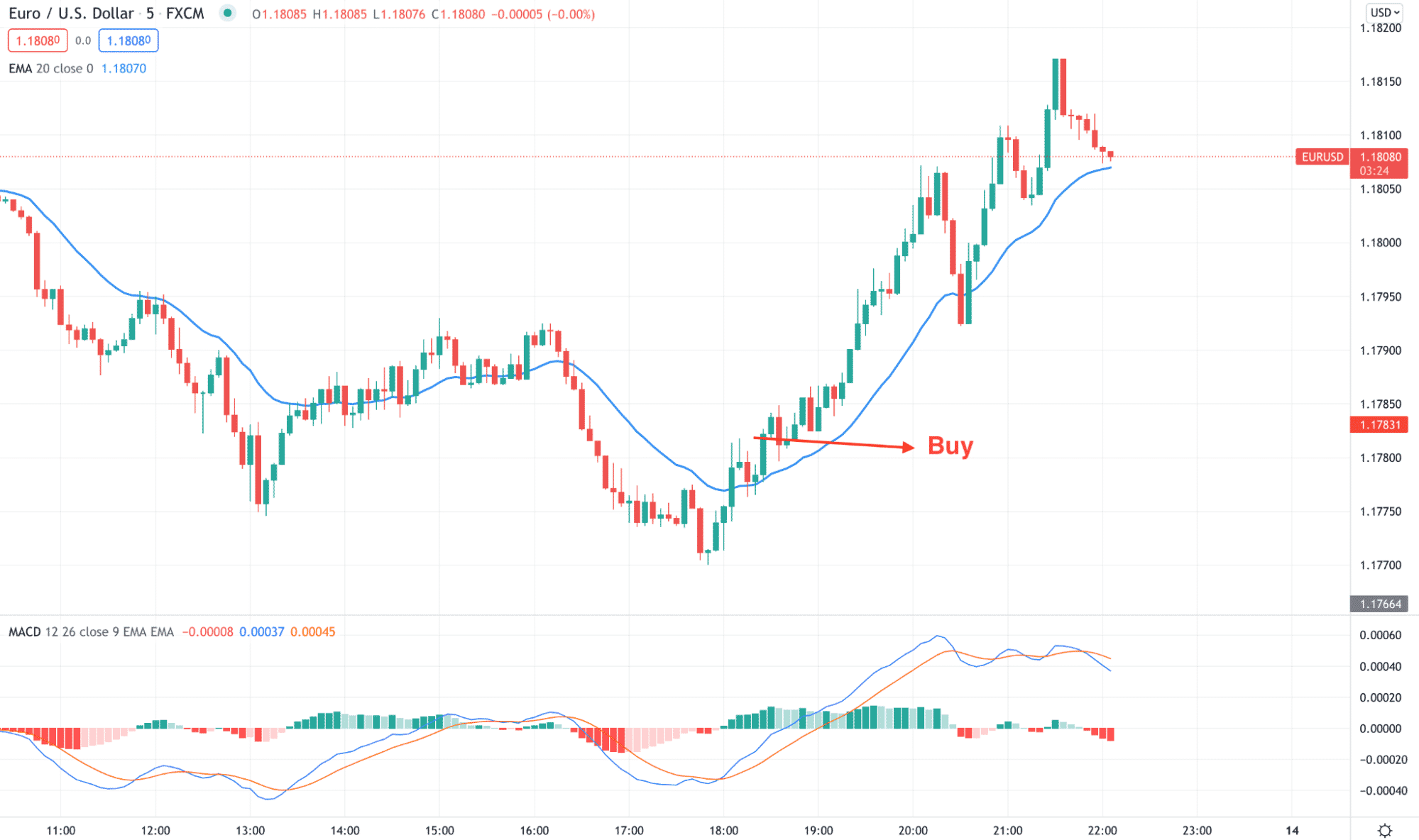

Options Trading Algo

Image: www.lanoti.ar

Conclusion: A Call to Action

Options trading algorithms have revolutionized the trading landscape. By understanding their types, benefits, and implementation tips, traders can harness their power to enhance their strategies. However, remember that algorithmic trading is not a magic bullet. It требует thorough preparation, ongoing monitoring, and a solid understanding of options trading principles.

Would you like to delve deeper into the world of options trading algorithms? Are you ready to explore the possibilities of automating your trades and unlocking new opportunities? Get started on your journey today and experience the transformative power of technology in the realm of finance.