Gold: A Timeless Investment

Throughout history, gold has captivated human imagination, symbolizing wealth, power, and permanence. Its intrinsic value and scarcity have made it an enduring investment beyond political and economic flux. Today, gold continues to serve as a sanctuary asset amidst market volatility and global uncertainties.

Image: fbs.com

In this article, we will delve into the realm of gold trading options, exploring the strategies, techniques, and insights you need to tap into the gold market’s potential. Whether you’re a seasoned trader or a novice seeking to diversify your portfolio, this comprehensive guide will equip you with the knowledge to navigate the gold trading landscape effectively.

What are Gold Trading Options?

Gold trading options confer upon the buyer (holder) the right, but not the obligation, to buy or sell a specified amount of gold at a fixed price (strike price) on a predetermined date (expiration date). This unique financial instrument grants traders both the potential for significant gains and the flexibility to manage risk.

Call Options vs. Put Options

When trading gold options, you can choose between two primary types: call options and put options.

- **Call options**: Grant the holder the right to buy gold at the strike price by the expiration date. They are ideal for bullish traders anticipating an upward movement in gold prices.

- **Put options**: Provide the holder with the right to sell gold at the strike price by the expiration date. These options benefit bearish traders who expect gold prices to decline.

Factors Influencing Gold Prices

Understanding the factors that influence gold prices is pivotal for successful trading. Key indicators include:

- **Economic indicators**: Interest rates, inflation levels, and GDP growth can impact gold demand and prices.

- **Political events**: Geopolitical tensions, currency fluctuations, and central bank policies can influence gold’s safe-haven status.

- **Global supply and demand**: Fluctuations in gold production, consumption, and reserves affect price dynamics.

Image: www.ydeho.com

Trading Tips and Expert Advice

1. **Risk management**: Carefully assess your risk tolerance and align your trading strategies accordingly. Use stop-loss orders to mitigate losses and protect your capital.

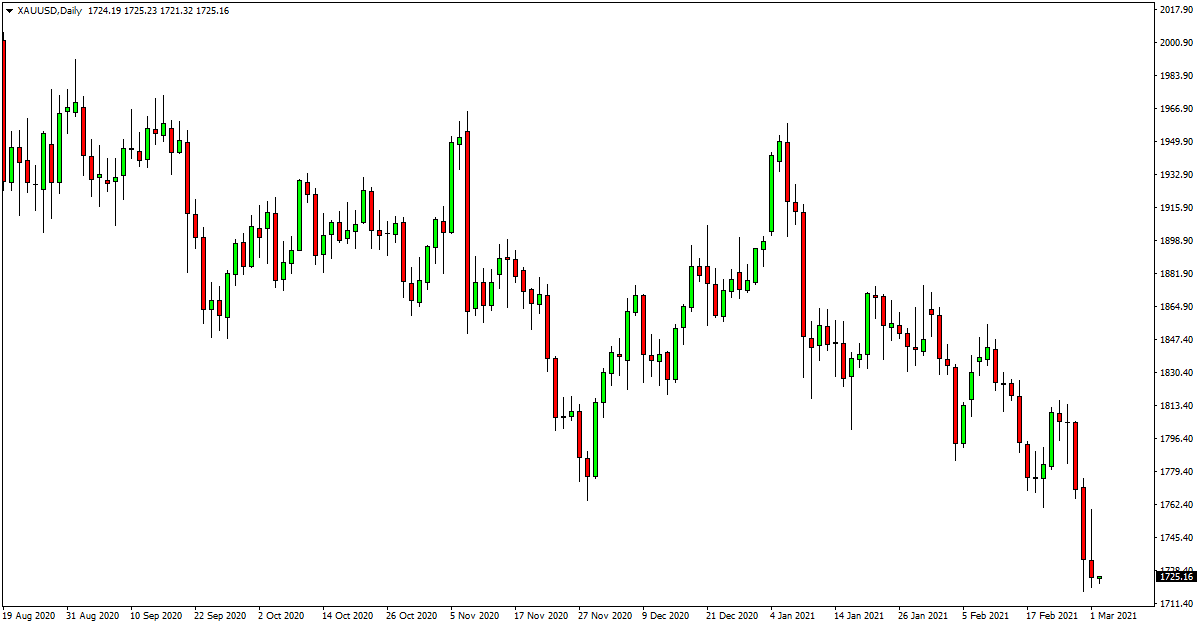

2. **Technical analysis**: Study gold price charts and historical data to identify patterns and potential trading opportunities. Utilize technical indicators such as moving averages and support/resistance levels.

3. **Fundamental analysis**: Stay informed about economic and geopolitical events that can influence gold prices. Monitor news, government reports, and central bank statements.

4. **Diversification**: Incorporate gold trading into a diversified portfolio of assets. This strategy helps hedge against market fluctuations and enhances overall portfolio stability.

FAQ on Gold Trading Options

- **Q: What is the difference between buying and selling gold options?**

- **A: Buying an option grants you the right to buy or sell gold at the strike price, while selling an option obligates you to fulfill the contract if the option is exercised against you.**

- **Q: How do I determine the profitability of an option trade?**

- **A: Compare the premium (cost) of the option to the potential profit if the option is exercised.**

- **Q: What factors affect the premium of an option?**

- **A: Premium pricing is influenced by time to expiration, strike price, gold price volatility, and interest rates.**

Gold Trading Options

Image: learnpriceaction.com

Conclusion

Gold trading options offer a versatile tool for traders seeking to capitalize on market opportunities. By understanding the fundamental principles detailed in this comprehensive guide, you can equip yourself to navigate the gold market confidently. Whether you choose call options or put options, the key to successful trading lies in a combination of risk management, technical analysis, fundamental analysis, and diversification. Embrace the insights and knowledge presented herein, and embark on a rewarding journey in the realm of gold trading.

Are you ready to explore the options and make your mark in the gold trading market?