**Introduction**

In the realm of financial markets, options trading has emerged as an intriguing and potentially lucrative endeavor. Have you ever wondered how you can turn options into a source of income? In this comprehensive guide, we will delve into the intricacies of option trading, empowering you with the knowledge and strategies necessary to navigate this dynamic landscape.

Image: ujejocykixova.web.fc2.com

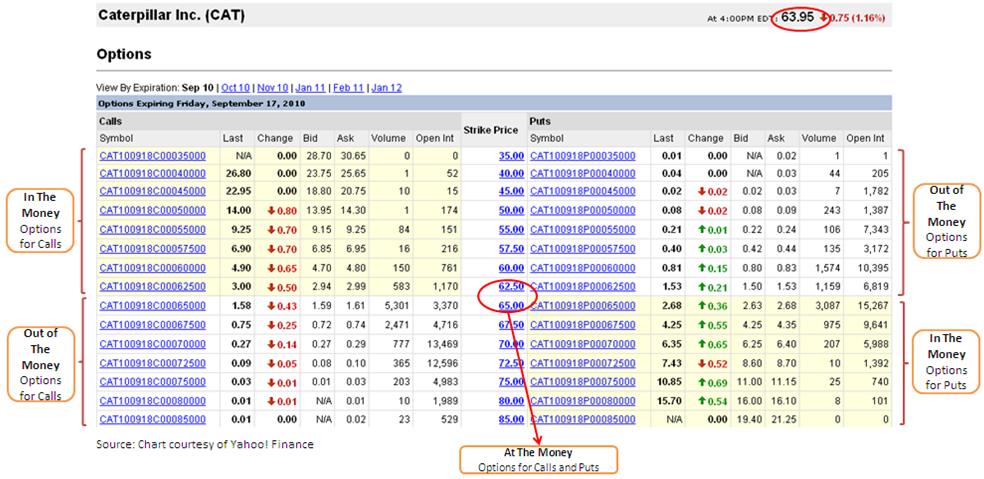

Options, derived from the Latin word “optio,” refer to contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price, known as the strike price, before or on a specific date, called the expiration date. These contracts allow for a multitude of trading strategies, catering to varying investment goals and risk appetites.

**Decoding the Basics of Option Trading**

Imagine a scenario where you anticipate the rise of a specific stock and believe its value will increase significantly. Instead of purchasing the stock directly, you could opt to buy a call option. This gives you the option (but not the obligation) to buy the stock at the agreed-upon strike price, regardless of its market value at the expiration date. If your prediction holds, you can exercise your right to buy the stock at a lower price than its current market value and potentially profit from the difference.

Conversely, if you foresee a decline in a stock’s value, you could opt for a put option. This grants you the right to sell the stock at the strike price, regardless of its market value. If the stock’s value indeed falls, you can exercise your right to sell it at a higher price than its current market value and profit from the difference.

**Navigating the Option Market**

Options trading occurs on exchanges designated for the purpose. The Chicago Mercantile Exchange (CME) is a prominent example, specializing in the trading of financial instruments such as options. An option’s value, also known as the **premium**, is influenced by various factors, including:

- The current market price of the underlying asset

- The strike price and expiration date of the option

- The volatility of the underlying asset

- The interest rate environment

Traders buy and sell options based on these factors, speculating on future market movements of the underlying asset.

**Understanding the Risks and Rewards**

Option trading involves inherent risks that must be acknowledged and managed. Unlike traditional stock purchases, options do not guarantee a return on investment. The potential for profit is balanced by the possibility of loss. The buyer of an option pays the seller a premium in exchange for the rights granted by the contract. If the option expires worthless, the buyer loses the premium paid. The seller of an option, on the other hand, can potentially profit from the premiums received, but may be obligated to fulfill the terms of the contract if it is exercised.

Image: theministerofcapitalism.com

**Strategies for Success**

Navigating the option market successfully requires a strategic approach. Common options trading strategies include:

- Buying Call Options: This strategy is employed when a trader anticipates an increase in the underlying asset’s value. If the asset’s price rises above the strike price, the trader can exercise the option and purchase the asset at a lower price, potentially realizing a profit.

- Buying Put Options: This strategy is used when a trader expects the underlying asset’s value to decrease. If the asset’s price falls below the strike price, the trader can exercise the option and sell the asset at a higher price, potentially generating a profit.

- Selling Covered Calls: In this strategy, an investor simultaneously sells a call option and owns the underlying asset. This generates an additional income stream from the premium received, but the investor may lose the opportunity to profit from further increases in the asset’s value if the buyer exercises the option.

- Shorting Puts: This involves selling put options without owning the underlying asset. The seller receives a premium but is obligated to buy the asset at the strike price if the option is exercised, potentially incurring a loss if the asset’s value declines.

**Expert Insights and Practical Tips**

Seasoned option traders recommend the following tips for enhancing your success:

- Understand the Basics: Acquire a comprehensive understanding of options terminology, pricing models, and trading strategies before venturing into the market.

- Manage Risk: Carefully evaluate the risks associated with each trade and employ prudent risk management strategies to mitigate potential losses.

- Do Your Research: Analyze historical trends, market news, and industry reports to make informed decisions about potential opportunities.

- Stay Disciplined: Follow a clear trading plan and avoid emotional decision-making, which can lead to costly mistakes.

- Seek Professional Guidance: Consider consulting with a financial advisor or broker who specializes in options trading for personalized advice and guidance.

**FAQs on Option Trading**

Q: What is the difference between a call option and a put option?

A: A call option grants the buyer the right to buy an asset at a specified price (strike price), while a put option grants the right to sell an asset at a specified price.

Q: Can you explain the concept of premium in options trading?

A: Premium is the price paid by the buyer of an option to the seller in exchange for the rights granted by the option contract.

Q: What factors influence the value of an option?

A: The value of an option is influenced by factors such as the strike price, time to expiration, volatility of the underlying asset, and interest rates.

Q: Can you lose money in options trading?

A: Yes, it is possible to lose money in options trading, as the value of options can fluctuate significantly.

Q: Is option trading suitable for all investors?

A: Option trading is not suitable for all investors due to its complexity and inherent risks. It requires an understanding of options terminology, trading strategies, and risk management techniques.

How Do You Make Money Option Trading

**Call to Action**

Embark on your options trading journey with confidence by familiarizing yourself with the fundamentals, strategies, and tips outlined in this comprehensive guide. Whether you are an aspiring trader seeking to enhance your knowledge or an experienced investor looking for new opportunities, this article provides valuable insights to help you navigate the dynamic landscape of option trading. Join the growing community of savvy investors who have harnessed the power of options to achieve their financial goals.