Unlocking the Potential of Options Trading

In today’s dynamic financial landscape, traditional savings and investment avenues may fall short of providing the desired returns. Options trading emerges as a dynamic alternative, offering the potential to supplement your income and navigate market volatility. This comprehensive guide will delve into the intricacies of options trading, equipping you with the knowledge and strategies to harness its income-generating abilities.

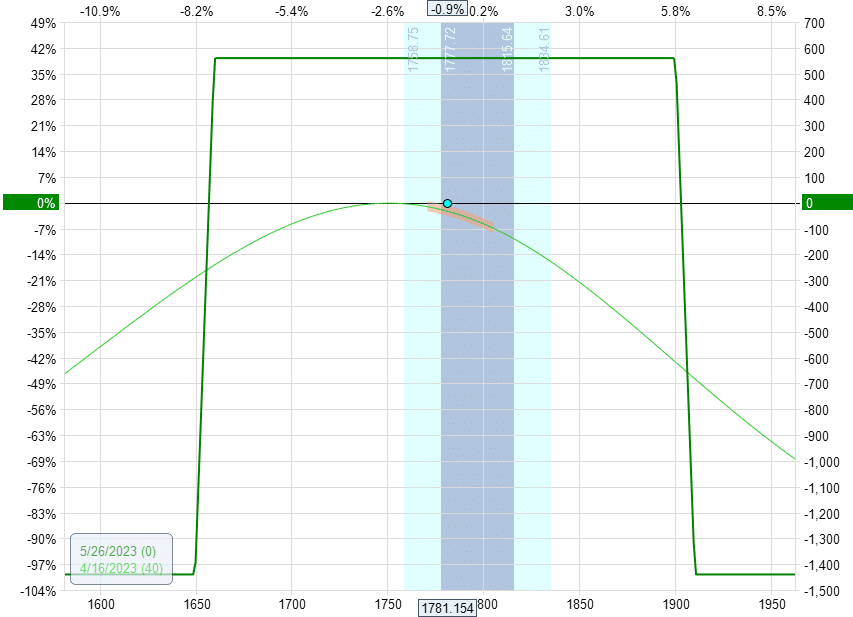

Image: optionstradingiq.com

Options Trading: A Deeper Dive

Options contracts, essentially financial instruments, provide holders the right but not the obligation to buy or sell an underlying asset (e.g., stocks, commodities) at a predetermined price on or before a specified date. This flexibility empowers traders to tailor their strategies to market conditions, seek returns, or manage risk.

To illustrate, let’s consider a call option that gives the holder the right to purchase a stock at a specified strike price. If the stock price rises above the strike price, the option can be exercised, yielding a profit. Conversely, put options grant holders the right to sell an underlying asset, allowing for potential gains when the asset value declines.

Types of Options Strategies

Options trading opens up a diverse range of strategies, each catering to specific risk appetites and market expectations. Here are some popular methods to enhance your income:

- Covered Calls: Ideal for generating income while owning the underlying asset, covered calls involve selling call options against your existing shares.

- Selling Cash-Secured Puts: This strategy entails selling put options backed by the cash to purchase the underlying asset if the option is exercised.

- Iron Condors: Combining a bull put spread with a bear call spread, iron condors seek to profit from a limited price range within which the asset is expected to trade.

- Bull Call Spreads: Buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price allows for profit when the underlying asset appreciates in value.

Benefits of Options Trading

Options trading offers numerous benefits that have attracted a growing number of traders:

- Income Generation: Options strategies can provide regular income through premiums received from selling options or profits from exercising options.

- Risk Mitigation: The right to but not the obligation of options contracts allows traders to manage downside risk in their portfolios.

- Flexibility: Options trading offers adaptability to varying market conditions, enabling traders to adjust strategies as the market evolves.

- Potential Leverage: Options contracts can provide leverage, amplifying potential returns but also magnifying risks.

Image: optionstradingiq.com

Risks Associated with Options Trading

While options trading holds the allure of enhanced income, it also carries inherent risks:

- Option Risk: Options contracts entail the risk that the underlying asset may not move in the desired direction, resulting in financial losses.

- Time Decay: The value of options contracts erodes over time, creating a time-sensitive aspect to trading strategies.

- Unlimited Risk: Selling uncovered call options or naked puts exposes traders to unlimited potential losses.

- Margin Requirements: Options trading often requires margin accounts, which carry margin calls and additional risks.

Generate Extra Income With Options Trading

Image: www.youtube.com

Conclusion

Embarking on options trading as a means of generating extra income requires a comprehensive understanding of market dynamics, trading strategies, and risk management. By embracing the concepts outlined in this guide, you can unlock the potential of options contracts and elevate your financial pursuits. Nevertheless, it is imperative to approach options trading with prudence, acknowledging and managing the inherent risks associated with this dynamic investment strategy.