Image: blog.validea.com

Fractional options trading, a revolutionary concept in the world of financial markets, has captivated the attention of investors and traders alike. As a burgeoning investment strategy, fractional options trading enables investors to buy and sell options on their favorite underlying assets in precise increments, down to a single penny. This unprecedented precision opens up a myriad of new opportunities for savvy investors looking to maximize their returns.

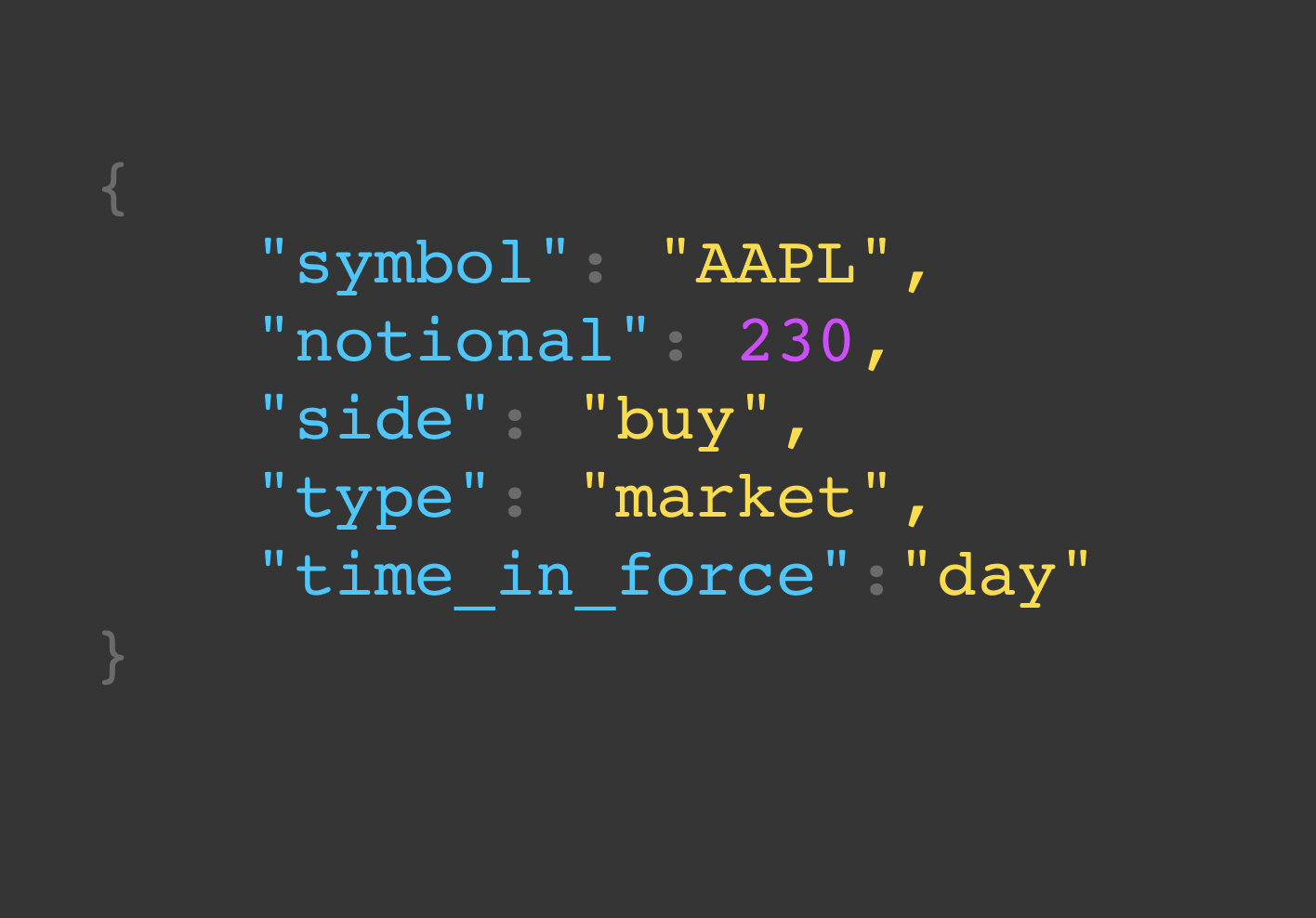

Unlike traditional options contracts that require the purchase or sale of 100 shares of an underlying asset per contract, fractional options allow traders to trade on even a single share. This flexibility grants investors access to markets that were previously inaccessible, empowering them to fine-tune their trading strategies and mitigate potential risks.

Unveiling the Intricate Nature of Fractional Options

Fractional options contracts are inherently identical to traditional options. They share similar core principles, including strike prices, expiration dates, and the rights and privileges associated with each type of option. However, fractional options possess a unique attribute that sets them apart – they can be traded in increments as small as 0.01 of a contract.

This distinctive characteristic empowers investors to scale their positions precisely, allowing them to participate in options markets with a far smaller capital outlay. Fractional options facilitate micro-hedging, enabling investors to offset specific risks without committing to full-sized contracts. Consequently, these contracts are particularly well-suited for individuals seeking to implement sophisticated trading strategies involving gamma scalping.

Embracing the Nuances of Gamma Scalping

Gamma scalping is an advanced trading technique that capitalizes on the volatility inherent in options markets. Options traders can harness the power of fractional options to implement this strategy by rapidly buying and selling options with different strikes and expirations. The goal of gamma scalping is to generate profits from fluctuations in the gamma of options, which is a measure of the rate of change in an option’s delta. Fractional options provide traders with the agility to adjust their positions swiftly in response to market dynamics.

The combination of fractional options trading and gamma scalping offers a highly effective approach for experienced traders to navigate complex market conditions. By leveraging the precision of fractional options, traders can optimize their strategies, capture profitable trading opportunities, and enhance their overall returns.

Incorporating Fractional Options into Your Trading Arsenal

Before embarking on the journey of fractional options trading, it is imperative to possess a solid understanding of options basics. The underlying principles, including leverage, time decay, and volatility, remain equally applicable to fractional options contracts. Additionally, traders should diligently research relevant trading platforms and familiarize themselves with their specific trading rules for fractional options.

With fractional options trading at your disposal, you are empowered to explore new investment horizons. Embrace the flexibility and precision that fractional options offer, elevate your trading capabilities, and unlock the potential for substantial returns in the dynamic world of financial markets.

Image: alpaca.markets

Fractional Options Trading

Image: devexperts.com