A Personal Encounter with Deception

Delving into the world of online trading can be an exciting prospect, but it’s crucial to navigate cautiously. My heart raced with exhilaration as I ventured into options trading, enthralled by the potential for quick returns. However, my hopes were shattered when I stumbled upon a website that promised extraordinary profits with minimal effort. Little did I know, it would turn out to be a scam that left me reeling from financial and emotional turmoil.

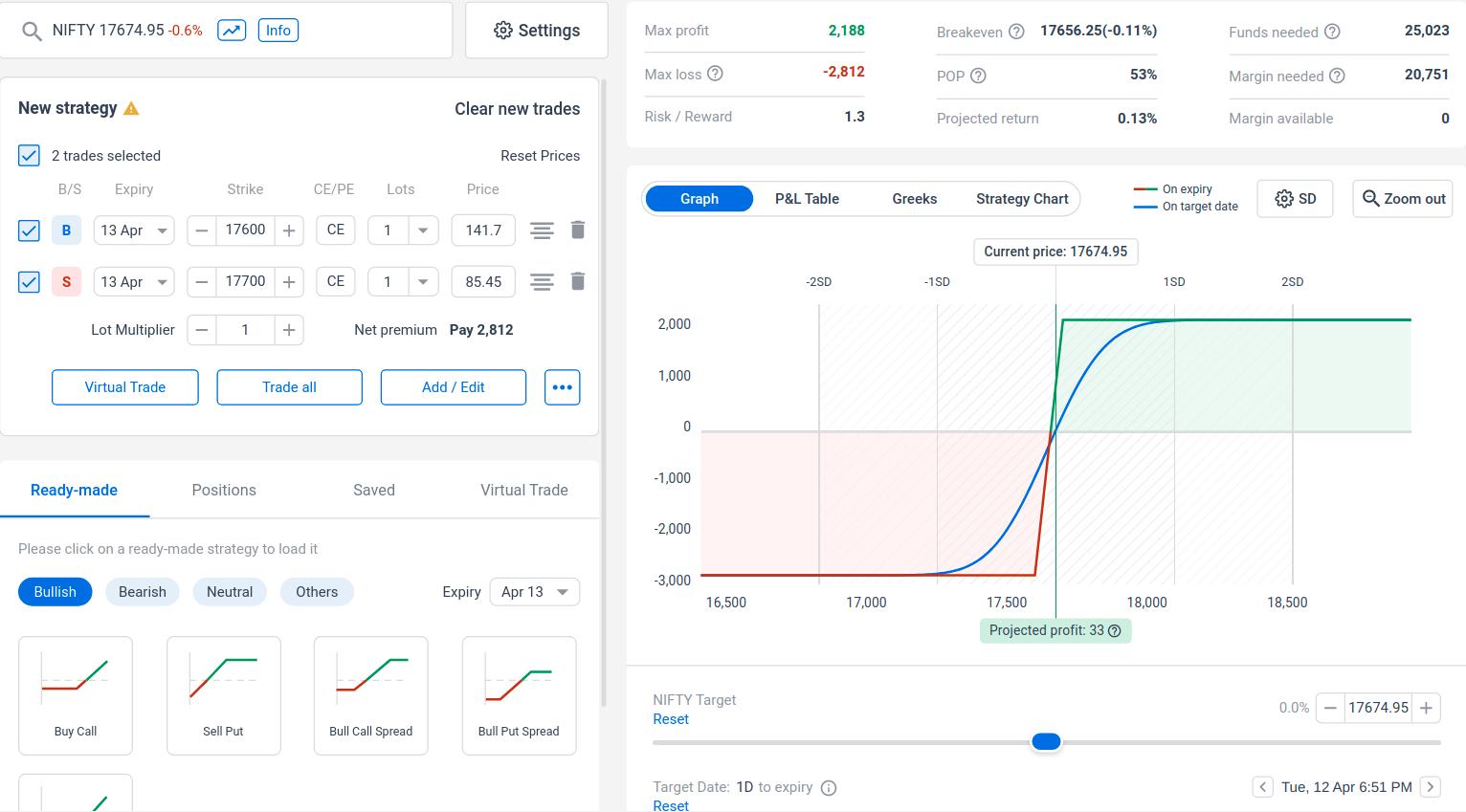

Image: www.youtube.com

The website’s sleek design and persuasive marketing tactics lured me in, painting a picture of easy riches. The allure of duplicating the dazzling returns showcased by their alleged expert traders proved irresistible. As I eagerly funded my account, a gnawing unease crept into the forefront of my mind. My instincts screamed for caution, but greed clouded my judgment.

The Anatomy of a Scam

Empty Promises and Sophisticated Deception

The first options trading website scam employs a cunning strategy, creating an illusion of legitimacy. They often establish a sophisticated online presence, complete with glossy testimonials, fake trading platforms, and fabricated success stories. Their sales pitches are meticulously crafted to prey on the hopes and aspirations of unsuspecting individuals.

The scammers hook their victims with promises of exceptional returns and automated trading systems that require minimal effort. They leverage persuasive language and social proof to instill a false sense of security, convincing individuals to invest their hard-earned money with abandon.

How to Spot the Red Flags

- Unrealistic Promises: Beware of websites that guarantee exorbitant returns with little to no risk. Legitimate investment opportunities involve inherent risks that should not be downplayed.

- Automated Trading Systems: While automated trading systems exist, they are not foolproof and require careful monitoring and management. Scammers often use these systems as a decoy to mask their fraudulent practices.

- Fake Reviews and Testimonials: Positive reviews and testimonials can be easily fabricated and should not be taken at face value. Verify the authenticity of such feedback by seeking unbiased sources or conducting a thorough background check.

- Lack of Transparency: Scammers often operate behind a veil of secrecy, refusing to disclose key information about their company, trading strategies, or risk management measures. Transparency is paramount in legitimate investment practices.

- Offshore Registration: Many scam websites are registered offshore to evade regulation and make it more challenging to hold them accountable.

Pressure to Invest: Legitimate investment opportunities do not involve aggressive sales tactics or pressure to make a quick decision. If you feel pressured to invest, it’s a strong indication of a scam.

Image: stewdiostix.blogspot.com

Tips for Avoiding Scams

Navigating the world of online trading requires vigilance and a keen eye for detail. To safeguard your investments, consider the following tips:

- Do Your Research: Diligently research any investment opportunity before committing your funds. Read reviews, consult reputable sources, and verify the legitimacy of the company and its trading platform.

- Beware of Emotional Appeals: Scammers capitalize on emotions like greed and fear to manipulate potential victims. Stay calm and avoid making rash decisions based on emotional triggers.

- Involve Financial Professionals: Consulting a certified financial advisor or other financial professional can provide invaluable insights and help you make informed investment decisions.

- Start Small and Gradually Increase Exposure: Once you identify a credible investment opportunity, start with a small investment and gradually increase your exposure as you gain confidence and experience.

- Monitor Your Investments: Regularly review your investment performance and stay informed about market trends. If you notice any unusual activity or discrepancies, promptly seek professional guidance.

Frequently Asked Questions

Q: How can I recover funds lost to an options trading scam?

A: Recovering lost funds can be challenging, but some steps can increase the chances of success. File a complaint with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). You can also contact your bank or credit card company to report the fraud and request a chargeback.

Q: What are the signs that an options trading website may be a scam?

A: Red flags include unrealistic promises of high returns, automated trading systems, fake reviews, pressure to invest, lack of transparency, and offshore registration.

Q: How do I protect myself from options trading scams?

A: Stay vigilant, research thoroughly, avoid emotional appeals, consult financial professionals, start small and gradually increase exposure, and monitor your investments closely.

First Options Trading Website Scam

Image: bank2home.com

Conclusion

Falling prey to a first options trading website scam can be a devastating experience, leading to financial losses and emotional distress. However, by arming yourself with knowledge and exercising caution, you can safeguard your investments and steer clear of malicious actors. Remember, if an investment opportunity seems too good to be true, it likely is. Conduct thorough due diligence, prioritize risk management, and seek professional guidance when navigating the complexities of financial markets.

Are you interested in learning more about options trading?