Every investor’s journey is unique, and so are their aspirations. As you navigate the ever-changing landscape of financial markets, adaptability and innovation become crucial. Fidelity recognizes this and has taken a revolutionary step forward by enabling options trading, empowering you to make informed decisions and tailor your investment strategy precisely to your goals.

Image: brokerchooser.com

Fidelity has consistently been at the forefront of financial innovation. Their options trading enablement is a testament to their commitment to providing investors with cutting-edge tools and educational resources. With this enhancement, Fidelity caters to both seasoned traders and individuals seeking to venture into the realm of options trading, ensuring a seamless and rewarding experience.

Options Trading: A Strategic Tool for Diversified Portfolios

Options trading presents a versatile instrument that enables investors to enhance their investment strategies and manage risks effectively. One of the primary benefits of options trading lies in its ability to speculate on the direction of a specific asset’s price, without necessarily purchasing or selling the underlying security itself.

By employing options, investors can potentially amplify their returns while managing their exposure to volatility. Options provide a wide range of strategies, empowering traders to craft tailored approaches that align with their individual risk tolerance and profit potential. Moreover, options can enhance portfolio diversification, reducing reliance on a single asset class and mitigating the impact of market downturns.

Understanding the World of Options

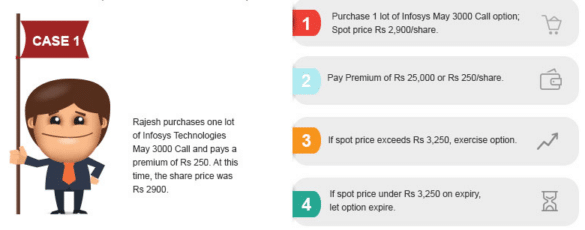

Before embarking on an options trading journey, it’s crucial to establish a solid understanding of the underlying concepts. Options can be broadly classified into two primary types – calls and puts. Call options grant the holder the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

On the other hand, put options provide the right, but not the obligation, to sell an underlying asset at a strike price on or before the expiration date. By utilizing these financial instruments, investors can speculate on potential price movements, manage risks, and customize their investment portfolios to match their strategic objectives.

Expert Guidance for Navigating the Options Market

Fidelity’s commitment to investor education extends to the realm of options trading. Through comprehensive resources, tailored guidance, and hands-on practice opportunities, they equip traders with the knowledge and skills they need to navigate the nuances of options trading confidently.

Aspiring traders can leverage Fidelity’s intuitive trading platforms, which provide real-time market data, advanced charting capabilities, and comprehensive analytics, empowering them to make well-informed decisions. These platforms seamlessly integrate with Fidelity’s educational offerings, ensuring that traders can continually enhance their understanding of options trading while refining their strategies.

Image: investgrail.com

Frequently Asked Questions on Options Trading

Q: What is the minimum investment required to start options trading?

A: Although different brokerages may impose varying requirements, options trades generally require a higher level of capital compared to traditional stock or bond investments. It’s advisable to consult with your broker to determine the minimum investment threshold.

Q: Can I trade options on any underlying asset?

A: The availability of options contracts varies depending on the underlying asset. While options on major indices, stocks, and exchange-traded funds are widely accessible, the availability of options on specific underlying assets may be subject to certain conditions or may not be offered at all.

Q: How can I mitigate the risks associated with options trading?

A: Careful portfolio construction, proper position sizing, and a thorough understanding of risk management strategies are key to minimizing risks in options trading. Regularly monitoring market conditions, hedging techniques, and seeking guidance from experienced traders can contribute to informed decision-making.

Fidelity Options Trading Enable

Image: www.youtube.com

Join the Financial Frontier with Fidelity Options Trading

Embrace the transformative power of Fidelity’s options trading enablement today. Join the ranks of investors who are reshaping their financial futures through strategic options trading. Take advantage of Fidelity’s educational resources, practice opportunities, and expert guidance to navigate the options market confidently and effectively.

Are you ready to explore the exhilarating world of options trading? Unlock the gateway to financial flexibility with Fidelity and seize the opportunities that await you.