As an aspiring trader, I had always been fascinated by the intricacies of financial markets. It was during a visit to the bustling trading floor of a major investment bank that I first encountered the enigmatic world of eurodollar futures options trading.

Image: paxforex.org

Witnessing the high-stakes decision-making and the adrenaline-fueled environment, I was instantly captivated. I embarked on an intense journey to unravel the complexities of this niche market, eager to unlock its potential for profit and limit risks.

Delving into Eurodollar Future Options

Definition and History

Eurodollar futures are financial contracts that provide a standardized agreement to buy or sell a fixed amount of eurodollars at a specified price on a particular date in the future. They are traded on futures exchanges like the CME Group and play a crucial role in interest rate management and hedging strategies.

Mechanism and Meaning

Eurodollar future options add another layer of flexibility to the equation, allowing holders to exercise the right, but not the obligation, to buy or sell the underlying futures contract at or before the expiration date. This optionality can be a powerful tool for speculating on market movements and managing risk.

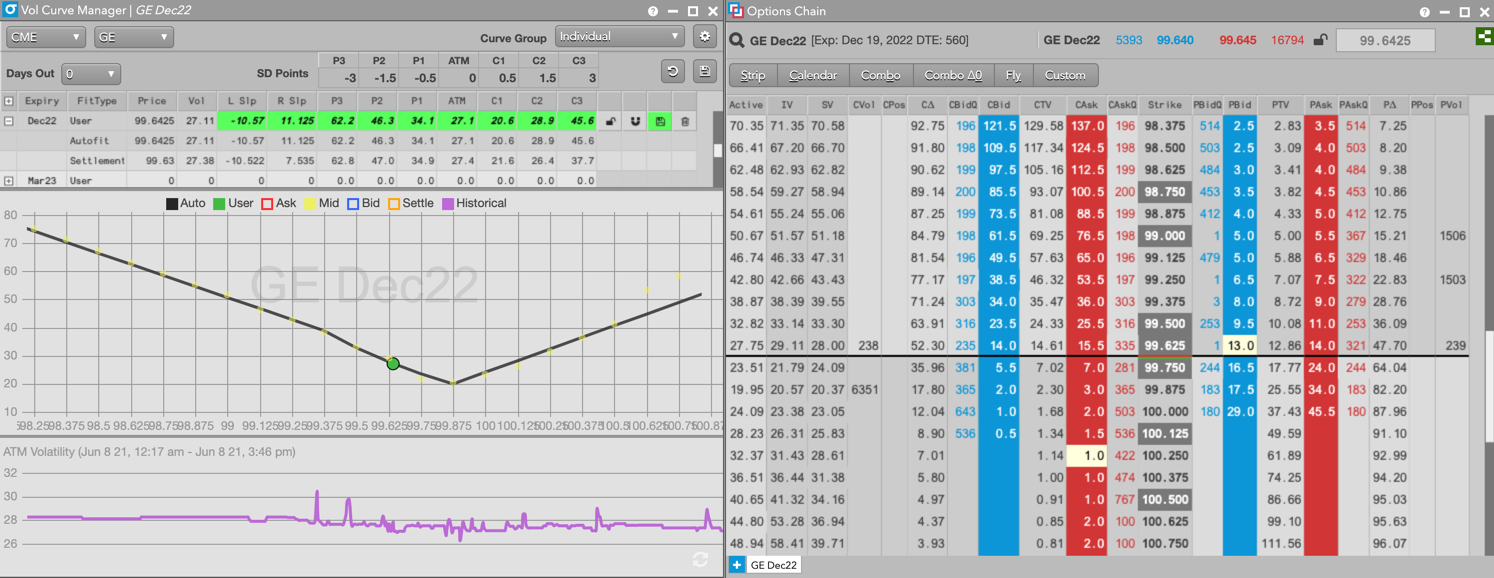

Image: www.tradingtechnologies.com

Navigating the Eurodollar Market Landscape

Understanding the Basics

The eurodollar market is primarily driven by expectations of future interest rate movements. Traders closely monitor economic data, central bank announcements, and global events that could influence interest rate policies. By analyzing these factors, they form opinions on the direction of future rates, which forms the basis for their trading strategies.

Eurodollar futures are quoted in points. Each point represents $25 in underlying value. Bid-offer spreads can vary depending on liquidity and market conditions. Understanding the market dynamics and trading terminology is essential for effective participation.

Mastering Trading Techniques

Eurodollar future options trading offers a wide range of trading opportunities and strategies. Scalping, day trading, and longer-term strategies can be employed depending on individual risk tolerance and trading style. Options strategies can enhance returns or provide downside protection, but they also involve complexities and additional risks.

Traders should carefully consider their entry and exit points, position sizing, and risk management techniques. A well-defined trading plan and disciplined execution are key to sustained success in this market.

Expert Guidance for Trading Success

Insights from the Trading Arena

Seasoned traders recommend a thorough understanding of the underlying fundamentals driving the market. They emphasize the need for constant market monitoring, timely analysis, and lightning-fast decision-making.

Developing a resilient mindset is crucial for handling the inevitable market fluctuations. Traders must be prepared to accept losses and learn from their mistakes while remaining focused on their long-term goals.

Frequently Asked Questions

Q: What is the minimum capital required for eurodollar future options trading?

A: The exact amount varies depending on the broker and trading strategy. However, a starting capital of $5,000-$10,000 is recommended for beginners.

Q: Are eurodollar future options suitable for all traders?

A: They cater to experienced traders with a strong understanding of futures and options markets and a tolerance for higher risk.

Q: What are the potential risks involved?

A: Eurodollar future options trading carries risks, including high volatility, margin calls, and the potential for significant losses.

Eurodollar Future Options Trading Class

Image: www.insidefutures.com

Embarking on Your Own Eurodollar Journey

Are you ready to dive into the exciting yet demanding world of eurodollar future options trading? Remember, success in this market requires a commitment to education, discipline, and a passion for learning. Immerse yourself in the intricacies of interest rate markets, refine your trading skills, and never cease to seek out new knowledge.

Join the ranks of savvy traders who have mastered the art of eurodollar future options trading. Embark on this enriching journey today and unlock the potential for financial success.