In the realm of financial markets, risk management is paramount. Options trading offers investors a unique opportunity to manage risk effectively and capture market returns, and the equal risk options strategy stands out as a powerful tool for this purpose. This comprehensive guide will delve into the intricacies of equal risk options, empowering you with the knowledge to navigate this sophisticated strategy and potentially enhance your trading outcomes.

Image: dotnettutorials.net

What is Equal Risk Options Trading?

Equal risk options trading is an advanced options trading strategy that aims to create a portfolio of options with an equal level of risk exposure. By carefully selecting options with different underlying assets, expiration dates, and strike prices, investors can diversify their portfolio and limit their potential losses while maximizing their chances of profit. This strategy is particularly suited for risk-averse investors seeking consistent returns over time.

How Equal Risk Options Trading Works

The equal risk options strategy involves following a specific methodology to construct a portfolio of options with equal risk exposure. Here’s a simplified breakdown of the steps involved:

-

Determine the desired level of risk: This decision depends on your risk appetite and investment goals. Higher risk tolerance allows for higher potential returns but also exposes you to more significant potential losses.

-

Identify potential underlying assets: Select a range of underlying assets that align with your market outlook and investment objectives. Consider factors such as industry trends, economic conditions, and potential volatility.

-

Choose options with different expiration dates: Diversifying expiration dates helps manage risk in changing market conditions. Select a mix of short-term, medium-term, and long-term options to capture different market movements.

-

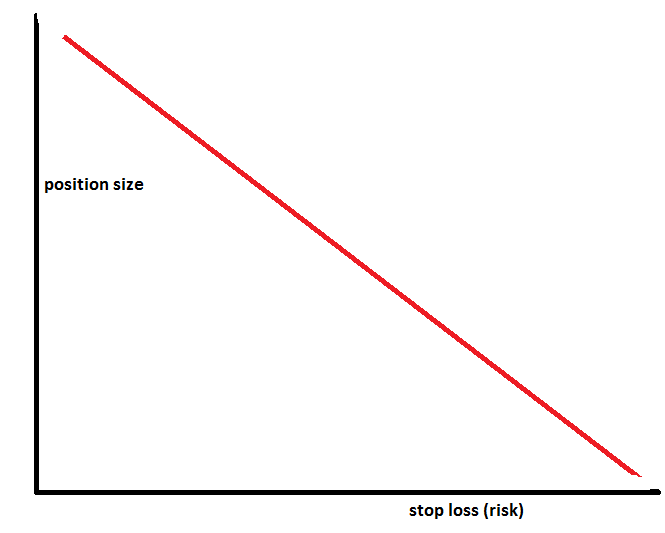

Select options with different strike prices: Strike prices represent the price at which the underlying asset can be bought or sold. Choose a range of strike prices to enhance the probability of capturing price fluctuations.

-

Calculate the value of each option: Determine the monetary value of each option based on its characteristics (e.g., type, strike price, time to expiration) using an options pricing model.

-

Adjust the number of contracts: Based on the desired level of risk, adjust the number of contracts purchased for each option so that the overall portfolio value is equal to your desired investment amount.

Benefits of Equal Risk Options Trading

The equal risk options strategy offers several advantages for investors:

-

Risk Management: By equalizing the risk across options, investors can effectively mitigate their exposure to market volatility.

-

Diversification: Combining a range of options with different characteristics helps diversify the portfolio and reduce concentration risk.

-

Consistency: This strategy aims to generate consistent returns regardless of market direction. It targets steady income rather than explosive gains.

-

Flexibility: Equal risk options trading can be customized to suit varying risk appetites and investment goals.

Image: brandfuge.com

Limitations of Equal Risk Options Trading

While the equal risk options strategy offers benefits, it also has some limitations:

-

Transaction Costs: Several transactions are required to implement this strategy, resulting in potentially higher brokerage fees.

-

Time Consuming: Constructing and adjusting the portfolio can be time-consuming, requiring ongoing monitoring to maintain equal risk exposure.

-

Potential for Limited Returns: The objective of equal risk options trading is to manage risk and generate consistent returns. It may not yield exponential gains that more aggressive strategies could provide.

Equal Risk Options Trading

Image: michealschuler.blogspot.com

Conclusion

Equal risk options trading is a sophisticated strategy that enables investors to manage risk effectively while seeking market returns. By understanding the principles and elements of this strategy, investors can harness its potential to enhance their trading outcomes. However, it’s essential to thoroughly assess your risk tolerance, investment goals, and the potential limitations before implementing equal risk options trading in your portfolio. As with any investment strategy, consulting with a financial advisor is highly recommended to make informed decisions.