In the ever-evolving world of finance, options trading presents a dynamic and potentially lucrative opportunity for investors. Delving into the realm of weekly options offers unique benefits that can enhance your trading strategies. This comprehensive guide will unveil the intricacies of dynamic trading with weekly options, providing a roadmap to navigate this exciting market.

Image: kumeyuroj.web.fc2.com

Understanding Weekly Options: The Building Blocks of Success

Weekly options are short-term options contracts that expire every Friday, offering traders more frequent trading opportunities compared to traditional monthly options. Their shorter lifespan demands a nimble and agile approach, empowering traders to capitalize on short-term market movements. Understanding the key characteristics of weekly options is essential:

- Shorter duration: Expire every Friday, providing traders with greater flexibility and potential for profit.

- Higher liquidity: Due to their shorter duration, weekly options tend to have higher liquidity than monthly options.

- Increased volatility: Weekly options are more susceptible to market fluctuations, making them potentially more volatile.

Executing Dynamic Trading Strategies: Unleashing Your Potential

Dynamic trading with weekly options requires a combination of technical analysis, market understanding, and strategic execution. By mastering these elements, traders can harness the full potential of this dynamic market:

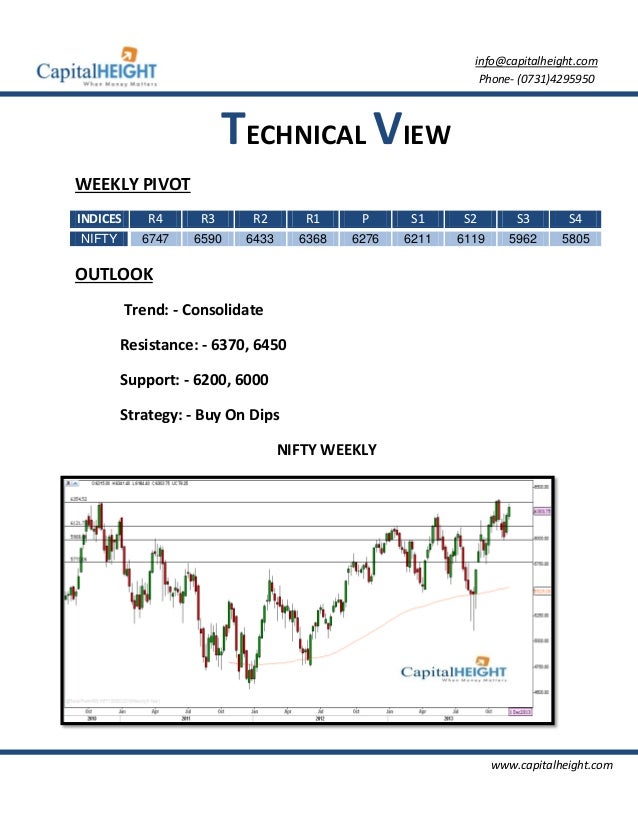

- Technical Indicators: Employ technical indicators such as moving averages, oscillators, and support/resistance levels to analyze market trends and identify trading opportunities.

- Market Analysis: Pay close attention to news, economic data, and market sentiment, as these factors can significantly impact option prices during their shorter lifespan.

- Strategic Execution: Implement diversified trading strategies that incorporate both bullish and bearish positions, allowing you to adapt to market fluctuations.

Perfecting Your Execution: Tips and Expert Advice

Sharpen your trading skills by incorporating these tips and expert advice:

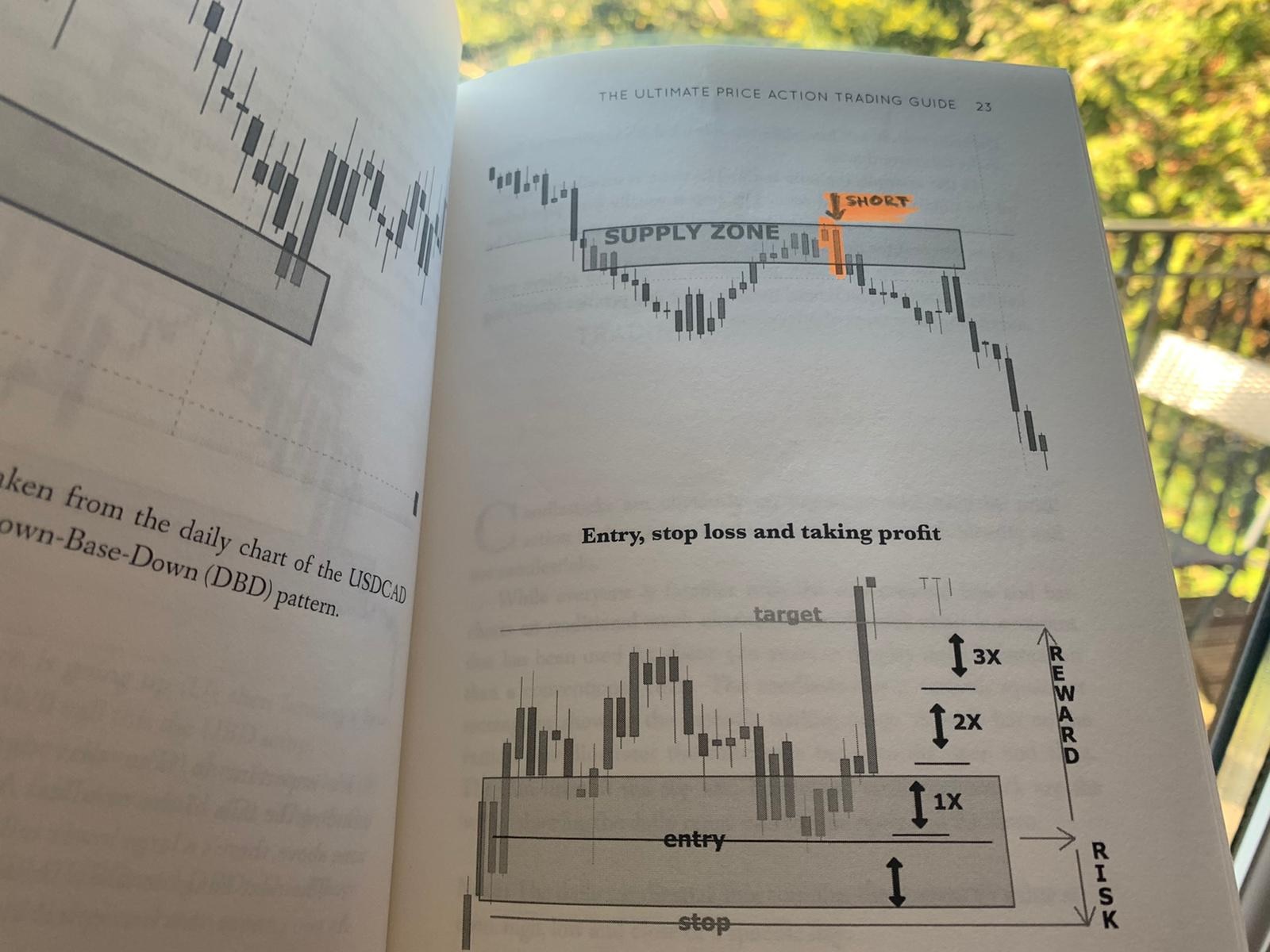

- Manage Your Risk: Establish clear risk management guidelines to mitigate potential losses. Utilize stop-loss orders or option spreads to limit downside risk.

- Monitor Your Trades Closely: The dynamic nature of weekly options demands constant monitoring. Adjust your positions and exit strategies as market conditions evolve.

- Seek Education: Stay abreast of the latest trading strategies and market trends through workshops, webinars, or online resources.

Image: www.bank2home.com

Dynamic Trading With Weekly Options Pdf

Image: unbrick.id

Frequently Asked Questions: Addressing Common Concerns

To address common questions about dynamic trading with weekly options:

- Q: Is weekly options trading suitable for beginners?

A: While it offers exciting opportunities, weekly options trading requires a higher level of market knowledge and experience. Beginners are advised to gain a thorough understanding of options trading before venturing into weekly options. - Q: How can I improve my dynamic trading performance?

A: Regular practice, continuous education, and a disciplined approach are key. Analyze past trades, seek feedback from experienced traders, and stay up-to-date with market trends.

Embark on the journey of dynamic trading with weekly options and unlock a world of exciting possibilities. Remember, success in this dynamic market requires a combination of skill, adaptability, and a commitment to continuous improvement. Are you ready to embrace the challenge and conquer the markets?